DCAA Approved Accounting System QuickBooks

BigTime integrates with QuickBooks and Sage to ensure that firms track their expenses and time to DCAA standards.

SHOW ME HOW

Track smarter, not harder

Easily log time and expenses with personalized data entry options for your team's individual timesheets.

Bill fast and friendly

Quickly pull together professional-looking custom invoices and send to your clients without the hassle.

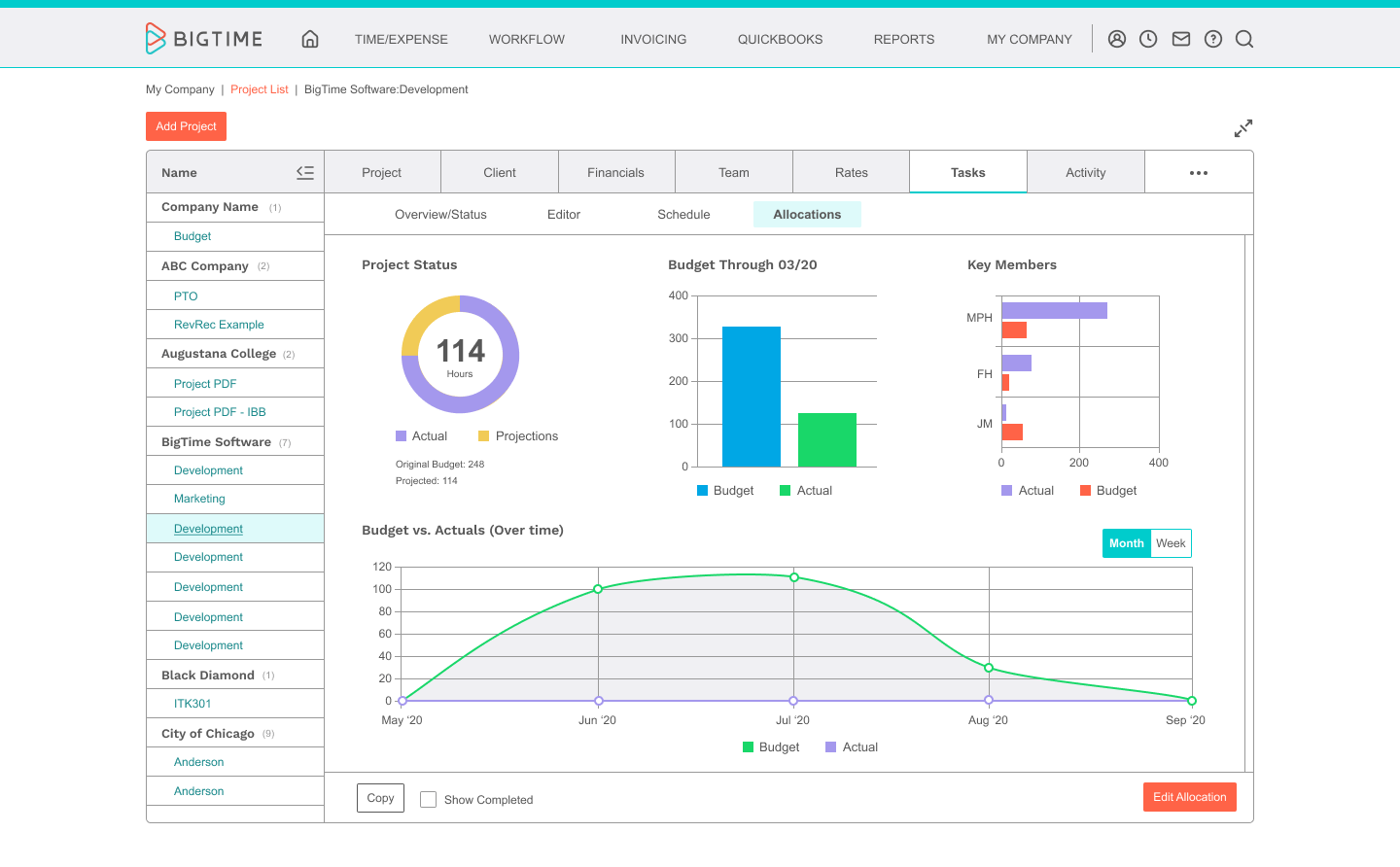

Avoid over/under scheduling

Always have an idea of you who working on what and reduce overall time on the bench.

Keep projects moving

Smoothly handoff work between teams and approval levels with custom workflows so you can manage your projects you way.

Plan ahead and on the fly

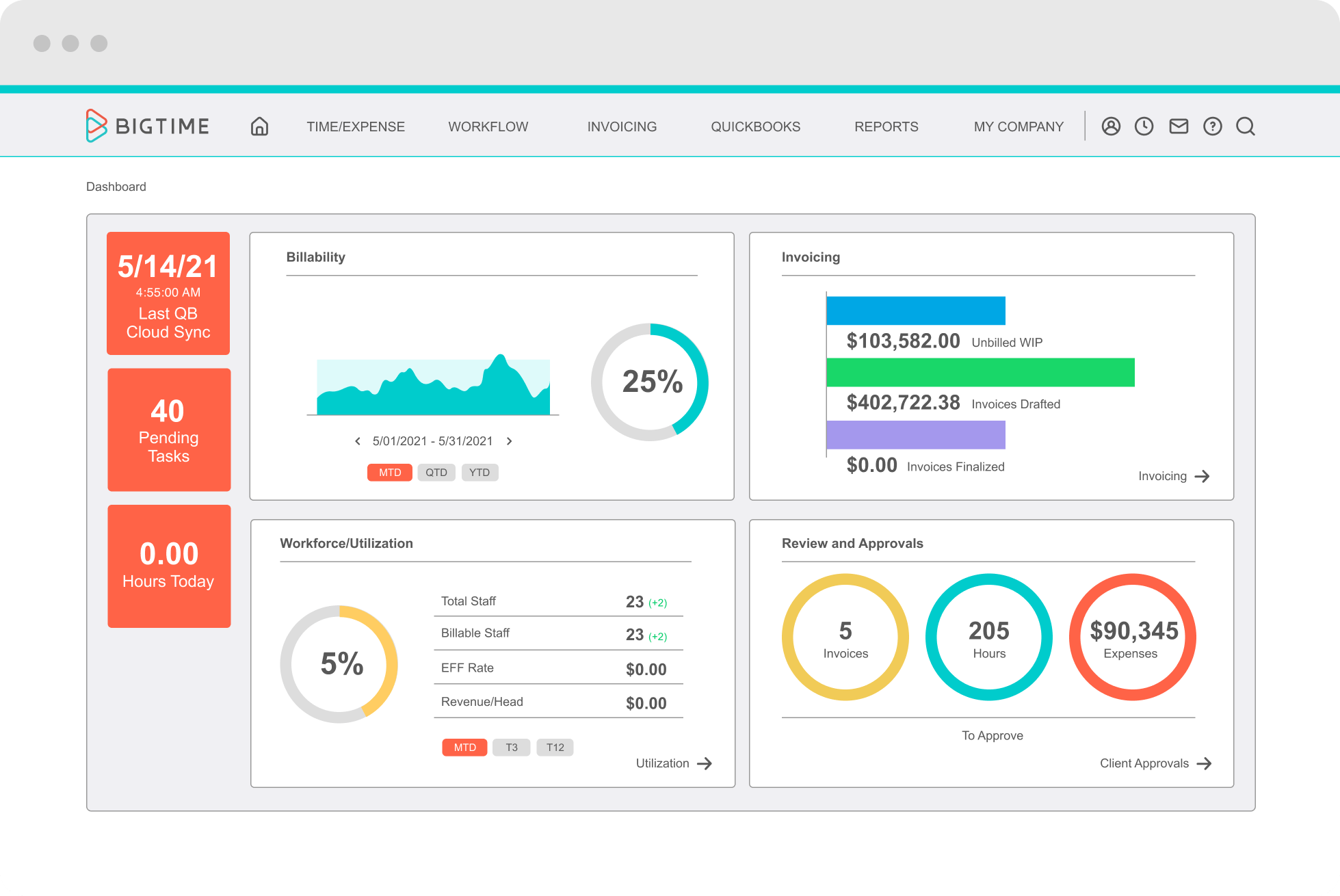

See your plans and analyze progress at a glance with dashboards, analytics, and reporting.

Connect your favorite tools

Seamlessly sync your current software with our deep integrations and full tech support from our team.

Better growth starts here.

LEARN MORE

For many business owners, accounting is intimidating and time-consuming — but it doesn't have to be. With the help of BigTime's cutting-edge software, your business’s accounting becomes less stressful and more organized. BigTime’s software is a DCAA compliant accounting system with both a QuickBooks and Sage integration. The system undergoes stringent regulations and auditing requirements overseen by the Defense Contract Audit Agency, the DCAA.

The program must also undergo an in-depth checklist known as the FAR compliance checklist. This serves as a guidebook for government contractors and outlines the rules, regulations, and processes contractors must use. This mainly applies to contract formation, contract administration processes, and the acquisition planning phase for the government to obtain goods and services.

BigTime integrates with QuickBooks and Sage and compiles all of a business's DCAA-compliant data into one view for audit log reports. The program is easy to use and offers advanced filtering capabilities that let companies view weekly timesheet report details, configure existing accounts with time audit log details and simplify the payroll process quickly with billable timesheet reports.

Some other useful features that BigTime offers are time and expense tracking, project management and workflows, resource management, billing and invoice, payment processing, integrations, reporting, and analytics. Users even have access to a mobile app to keep track of all of the system's elements. This service is suitable for a government accounting service because of its credentials. Whatever your business needs, BigTime is sure to have the necessary tools. Here are a few things to consider when looking for a system that offers DCAA compliance with QuickBooks.

DCAA Compliance

DCAA compliance is complex, to say the least. Offering DCAA compliant accounting means checking off multiple boxes, especially when working on government projects. When looking for a DCAA approved accounting system, here is a DCAA compliance checklist to consider:

- Cloud-based and mobile time entry options to utilize when working remotely

- Automated review and approval processes

- Integration options for your accounting system

- Ability to set up different permission levels and rights for staff

- Efficient workflows for necessary timesheet edits

- Required note field for timesheets

- Labor category and CLIN, also known as contract line item number, budget tracking

- Prevention of time submission for early dates.

- Notifications to alert project managers when a budget is at risk

These elements ensure that your accounting system meets the needs of your business and gives you the security of having the tools you really need. BigTime's DCAA certification cuts down on time spent in these processes and helps them run smoothly. BigTime’s software features timesheet fields, eliminating the odds of timesheet submission errors.

Many processes are also automated, like reviews and approvals. This is a significant component of compliance concerns, and automation makes compliance more accessible rather than an obstacle to overcome. BigTime also allows you to track budgeting in real-time. This is attributed to the government's main goal to keep spending within their budget, following DCAA compliant accounting guidelines.

Other features, such as simplifying the workflow and integrating a business's accounting system, help keep BigTime's software under DCAA compliance rules. These tools automate and narrow the process to focus on best practices rather than timesheets and budgets.

DCAA Compliance Time Tracking

The goal of the DCAA is to prevent waste and fraud. It’s important to remember that government timesheet regulations are different compared to other businesses. Timekeeping for government contractors comes with its own set of rules. DCAA compliant timekeeping requires companies to be organized with their recordkeeping. BigTime's software is configured to streamline your business's existing workflow and maintain timesheet compliance.

One of the software’s first rules is that it requires a one-of-a-kind password for each user to access and control their timesheets. These passwords are updated every six months, and users are notified of changes. Audit trails should be clear and record all transactions across the software, including transactions and the accounting system.

Effective software should also feature a policy or procedure document which details the steps for accurate timekeeping. This information should be given to all employees, including those not directly working on the government project. This DCAA compliant time tracking software training should be conducted annually to stay up to date.

Timesheets are submitted daily to verify the accuracy, and no hours can be left behind. This includes vacation time, holidays, and sick days. Any submitted time must be looked over and approved by the employee’s assigned supervisor.

Corrections submitted can only be made by the employee and must be approved once again by the supervisor. The employee's adjustments cannot be edited by the accounting team or administrator without the employee's consent. Timesheets and corrections must be kept for at least two years, while government contract projects must be kept for three years for audit purposes after the final payment. DCAA has daily timekeeping requirements that must be strictly followed to ensure your business runs smoothly, and these rules help with that.

DCAA Accounting System Audit

Governments contracting firms encounter several types of audits. So, you might ask yourself, “When is a DCAA audit required?” Audits are only performed upon request or needed from a federal entity, not by a contractor.

The DCAA accounting system audit asks for specific details from requests to ensure DCAA certification. Requests usually ask for detailed information such as period of performance, the cost of an action, copy of the contractor’s submission, requested steps or specific regulatory criteria that might apply to the requested audit. DCAA offers this information for contractors to secure a proper audit process for businesses.

BigTime’s DCAA-certified software ensures that any records for time and expense tracking that a business has have been kept within DCAA-compliant standards. That way, when the DCAA reviews it, there will be no issues. BigTime’s DCAA accounting system audit allows for a proper paper trail so businesses can keep track of their records and provide them when needed. This guarantees that companies stay organized and ready for their next DCAA accounting system audit.

DCAA Bookkeeping

What does DCAA bookkeeping look like? DCAA bookkeeping uses the DCAA checklist to safeguard information and make sure that it is submitted on time. This includes invoices, sales taxes, deposit reports, and payroll. Many of these elements happen on a monthly basis, so regular recording is crucial.

As a part of DCAA bookkeeping, especially as it is performed by GovCon accountants, DCAA requires that businesses follow generally accepted accounting principles, also known as GAAP. These are standards that summarize the details, legalities, and complexities of business and corporate accounting. GAAP includes ten principles:

- Principle of Regularity

- Principle of Consistency

- Principle of Sincerity

- Principle of Permanence Methods

- Principle of Non-Compensation

- Principle of Prudence

- Principle of Continuity

- Principle of Periodicity

- Principle of Materiality

- Principle of Utmost Good Faith

These ten principles make the DCAA bookkeeping process transparent while standardizing definitions, assumptions and methods. GAAP is the foundation of best practices in accounting, which is why the DCAA requires it when it comes to bookkeeping. BigTime has the tools to simplify DCAA consulting and bookkeeping and utilizes QuickBooks to make the process smoother.

How To Make QuickBooks DCAA Compliant

What makes BigTime an even more efficient tool is that it is an official Intuit-Integrated Application, which syncs with QuickBooks Online and Desktop to support your business’s accounting process. You might wonder if QuickBooks Online is DCAA compliant, and it can be – just not by itself.

QuickBooks can be DCAA compliant by setting up to meet the DCAA regulations and requirements. For QuickBooks, this includes daily automated reminders that verify team members submit their timesheets at the end of every workday, a full audit trail, and real-time reporting. The audit trail archives when team members have updated or edited their timesheets, who makes those changes, and why they were made.

Once QuickBooks is approved and moved over as a DCAA compliant accounting software, QuickBooks will install the DCAA compliance add-on. Daily time submission reminders will be engaged, and click-in via text message and dial-in will be disabled. Company-wide permission that allows team members to access total hours worked on their manual time card will be turned on, and employees will be unable to clock in and out on their mobile device or the web.

BigTime uses QuickBooks to enter project data once and integrates the rest of your data for whatever your company needs. The two work together to keep an organized environment by doing tasks such as sending invoices out and paying employees faster by automatically calculating hours, rates, and expenses.

Enhance Your Business Operations With BigTime’s DCAA Compliant Accounting System

DCAA is hard to navigate, but BigTime has you covered, whether you’re sending out invoices or looking for ways to streamline your business’s workflows. Based in Chicago, BigTime’s experienced team is committed to helping clients manage professional services firms in the most efficient way possible. With our DCAA-certified program and partnership with QuickBooks, we guarantee that your business will stay organized and get the job done.