Government Accounting Software

Seamlessly manage compliance, invoicing, and reporting with government accounting software built to meet public sector demands.

Why Choose BigTime Government Accounting Software?

Government contractors face complex challenges in maintaining compliance with rules and regulations set by the Defense Contract Audit Agency (DCAA). From tracking time to contract billing and financial reporting, every process must align with stringent local, state, or federal standards. BigTime’s Government Accounting Software provides a powerful, intuitive solution built for government contractors, financial officers, and project managers working with the public sector—offering automation, insight, and full compliance.

Ensure compliance and security

Get secure encryption and DCAA-compliant workflows to protect your information.

Streamline processes

Save time and improve productivity with a unified platform.

Enhance accuracy

Eliminate redundant data entry and get real-time visibility to ensure accuracy.

Gain real-time insights

Use customizable dashboards to generate audit-ready reports.

Improve efficiency

Implement user-friendly workflows and automation that reduces admin work.

Scale with ease

Get flexible features that adapt to your needs without overhauling your systems.

Ensure Compliance and Security

BigTime’s government accounting software is built with DCAA-compliant workflows and robust security features. Whether you're preparing for an audit or maintaining compliance with the Governmental Accounting Standards Board (GASB), BigTime helps ensure your processes are aligned. Role-based access, secure encryption, and audit-ready reports protect your sensitive data and government contracts in the public sector.

Streamline Processes

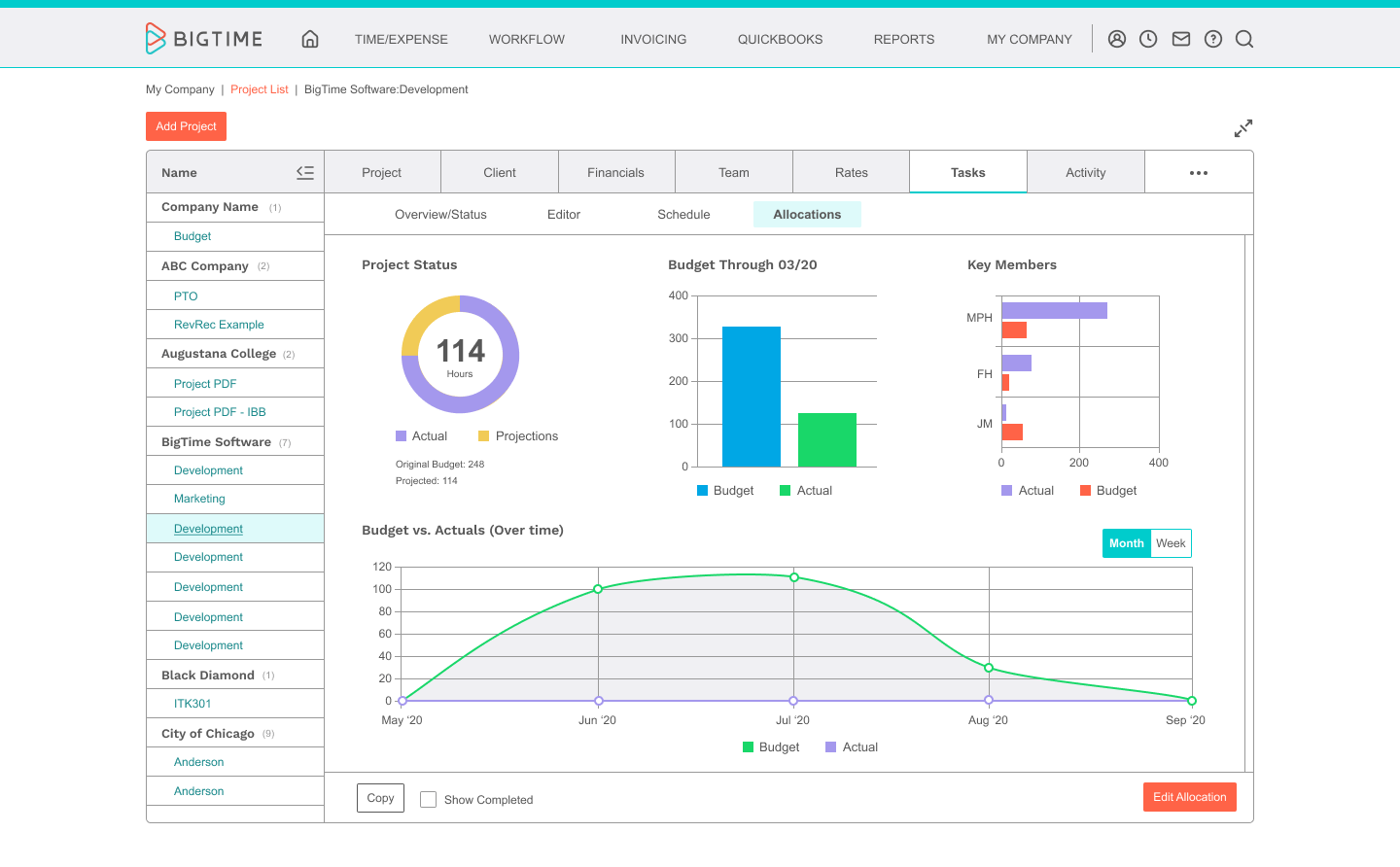

Manage everything from time tracking and resource management to billing and invoicing in one unified system. BigTime automates tasks and time-consuming manual processes, reducing errors and administrative overhead so your team can focus on delivering value to government clients.

Enhance Accuracy

Manual errors are costly, especially under strict compliance requirements. BigTime’s integrated modules eliminate redundant data entry and sync your project accounting, invoicing, and timekeeping in real time, ensuring financial accuracy and audit readiness for local government and public sector contracts.

Gain Insights

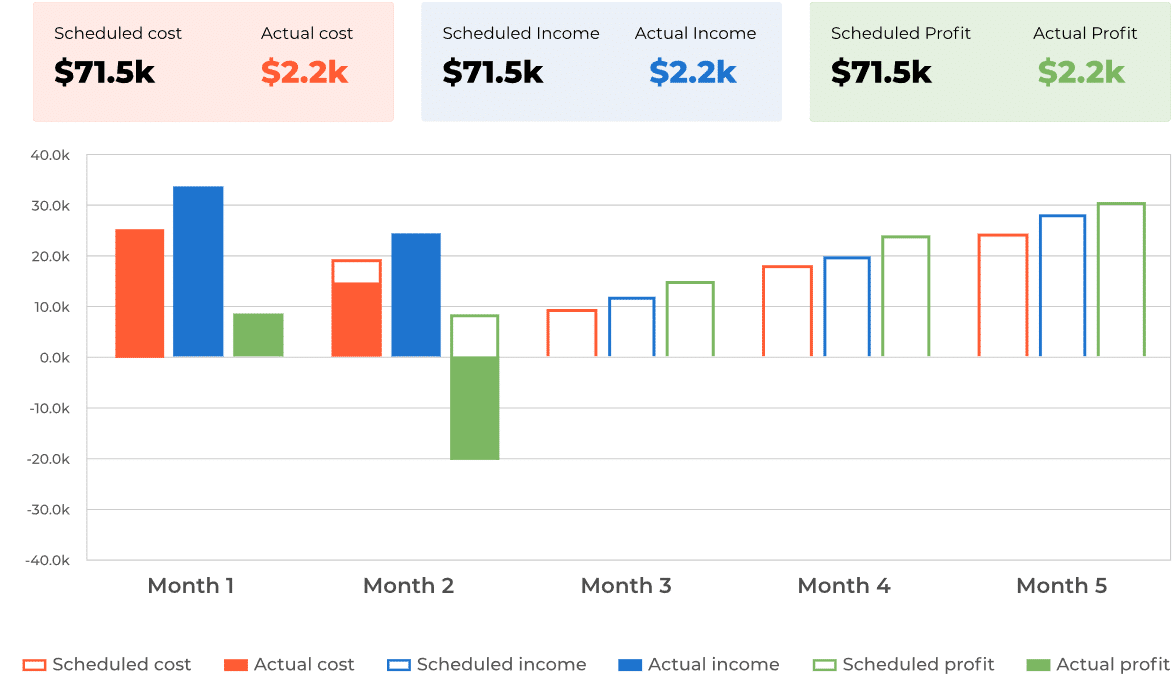

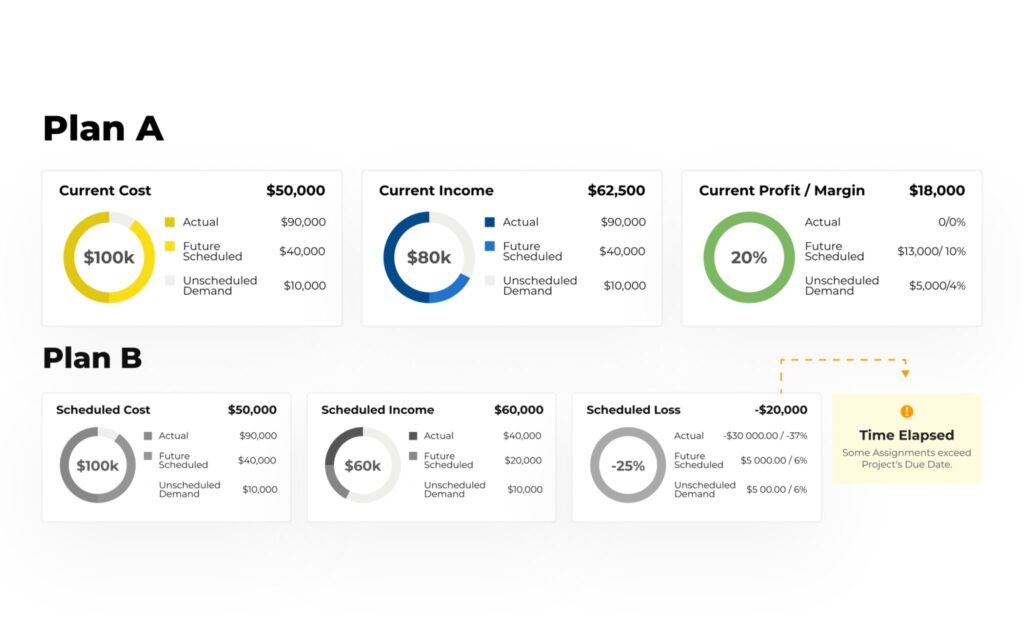

Use real-time reporting tools to track project performance, budgets, labor costs, and cash flow. BigTime’s customizable dashboards make it easy to generate detailed, audit-ready reports that inform better decisions and support financial management across departments.

Improve Efficiency

Boost efficiency across your organization with user-friendly workflows, intuitive interfaces, and automation that reduces administrative work. BigTime enables quick approvals, accurate invoicing, and smarter time tracking to streamline your business processes.

Scale Easily

Whether you’re a small contractor or an enterprise serving multiple agencies, BigTime adapts to your needs. With features built for flexibility and enterprise resource planning (ERP), it’s easy to scale without overhauling your financial management systems.

Better accounting starts here.

free trial

Key Features of BigTime’s Government Accounting Software

Discover the powerful tools and functionality that make BigTime the go-to accounting software for government entities looking for compliance, efficiency, and real-time insights.

DCAA Compliance Tools

Time and Expense Tracking

Invoicing and Billing

Integration Capabilities

Resource Management

Mobile Accessibility

How BigTime Works for Government Contractors

Step 1: Setup and Integration

Step 2: Time Entry

Step 3: Approval Workflow

Step 4: Invoicing

Step 5: Reporting and Compliance

Why Professional Services Firms Choose BigTime

Succcess Story: Real Results from Real Firms

Ardalyst, a professional services firm, needed a DCAA-compliant accounting software solution. BigTime enabled the company to enforce time entry policies and streamline invoicing, reducing the billing cycle from 60 days to just 20. That efficiency gave the Ardalyst team more time to focus on clients instead of administration. Read the full story.

What Our Customers Say

Ingrid Jansen

FAQ

Can BigTime integrate with my current accounting software?

Yes! BigTime integrates with QuickBooks, Sage Intacct, and other major accounting platforms to synchronize financials, eliminate duplicate data entry, and support seamless procurement, accounts payable, and cash flow management.

Is BigTime suitable for firms of all sizes?

Yes, BigTime is designed for scalability. From startups serving a single agency to enterprises managing multiple state and local government projects, our software grows with your business and supports evolving contract management and budgeting needs.

How can I get started with BigTime?

Request a personalized demo today. We’ll walk you through setup, integrations, and how BigTime can be customized to meet your unique government accounting and ERP requirements.

Does BigTime support multiple contract types and billing methods?

Yes. BigTime is built to support time & materials, cost-plus, and fixed-price contracts, allowing your team to bill according to contract terms with precision and compliance and handle contract management easily.

Is BigTime cloud-based?

Yes, BigTime is a fully cloud-based platform. Your team can securely access the system from anywhere, making it ideal for hybrid or remote work across various departments or geographic locations.

How secure is my data with BigTime?

We follow strict data protection protocols, including encryption, user authentication, and role-based permissions, to ensure your information stays safe and compliant with federal guidelines.

Can BigTime generate audit-ready reports?

Absolutely. From time logs to cost summaries, labor distribution, and budget compliance reports, BigTime provides customizable, exportable reports that are DCAA audit-ready.

What kind of support does BigTime offer?

BigTime provides comprehensive support including live chat, email and phone support, a robust knowledge base, and hands-on onboarding tailored for firms in the government contractor accounting space.

How does BigTime support functionality and real-time data across my organization?

BigTime offers robust functionality to support every aspect of your organization’s project and financial workflows. With built-in tools for time tracking, budgeting, invoicing, and procurement, the platform ensures all departments operate in sync. Its cloud-based architecture provides real-time data access, so decision-makers always have up-to-date insights into project status, resource allocation, and spending. Whether you're managing internal approvals or coordinating with external agencies, BigTime centralizes information to improve transparency, efficiency, and overall performance.