Managing finances has become increasingly complex for small businesses. From tracking income, monitoring cash flow, and categorizing expenses to preparing for tax season and issuing professional invoices, manual bookkeeping simply can’t keep up. Without the right financial tools, small business owners risk errors, delays, and blind spots in their business’s financial health.

This blog compares the best financial software for small businesses in 2025, highlighting features, limitations, and use cases. While general-purpose accounting software has its place, service-based businesses need financial management tools that also support time tracking, billing, and project financial visibility. That’s where BigTime leads the way.

What is financial software for a small business?

Financial software for small businesses includes solutions that streamline invoicing, expense tracking, cash flow monitoring, budgeting, and reporting. Unlike basic small business accounting software, which focuses mainly on financial transactions and compliance, financial management platforms are designed to give owners real-time visibility into their business’s financial health.

The best small business financial software combines advanced reporting, payment gateways, and accounting apps to automate tasks like tracking expenses, generating balance sheets, and managing accounts receivable. For service-based firms, the ability to link billable hours, invoices, and expense tracking in one convenient platform is critical.

Key Features in Leading Financial Software for Small Business

Integrated Billing and Invoicing

Create and send invoices with just a few clicks. The best financial software for small business allow firms to generate recurring invoices, accept online payments, and automate payment reminders to improve cash flow.

Expense Tracking and Categorization

Small businesses need to track expenses, capture receipts, and categorize financial transactions for accurate reporting and compliance. This replaces manual bookkeeping and reduces errors. The best financial tools can help assign costs to projects and people, turning raw data into actionable insights.

Budgeting and Forecasting Tools

With built-in budgeting tools and financial reporting, small business owners and managers can monitor spending, predict revenue, and plan for growth. As a result, they get an overview of every penny spent and earned.

Time Tracking Integration

By linking time tracking and billable hours to client invoices, service-based businesses can ensure accurate billing and improve productivity. In the best financial software, time tracking is also a base for measuring KPIs and optimizing utilization rates, leading to higher profits.

Cash Flow Monitoring

Stay on top of bank transactions, upcoming bills, and accounts receivable to keep your business’s financial health in check. Monitor project budgets and react to cost overruns before they affect your profits.

Custom Reporting Dashboards

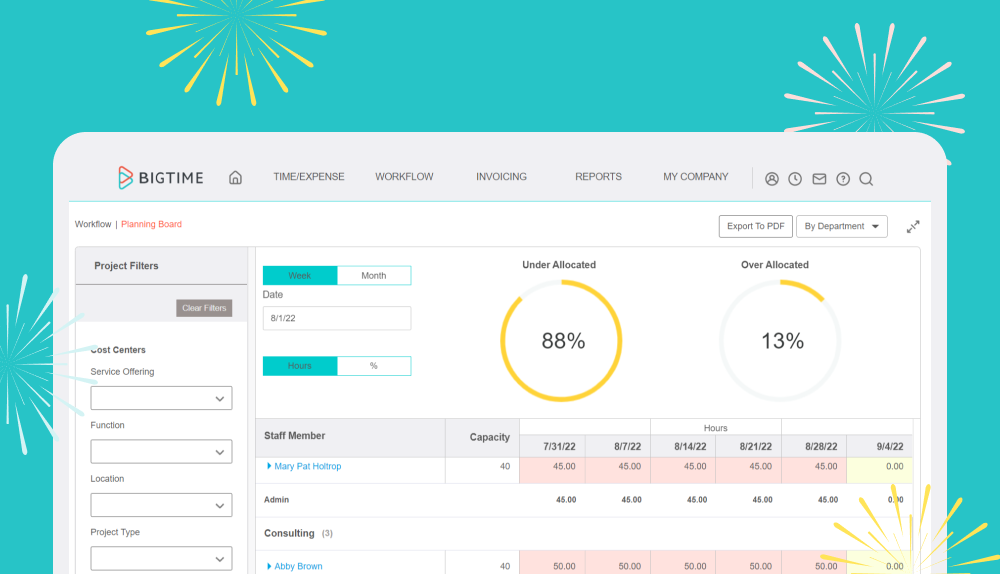

Gain actionable insights into profitability, sales tax, expense trends, and balance sheets through configurable reports and dashboards. Use AI-powered reporting tools to

An example of capacity report in BigTime

The Best Financial Software for Small Business in 2025 Reviewed

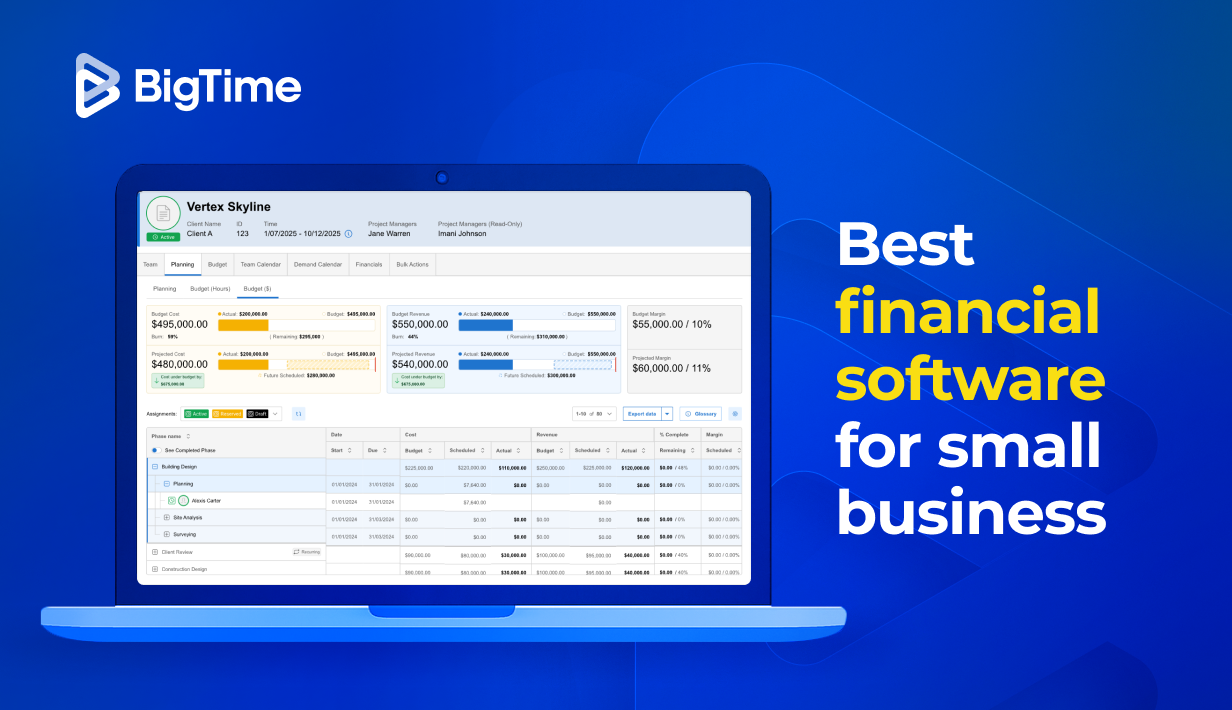

BigTime: Comprehensive Financial Management for Service-Based Firms

BigTime is a financial management software solution designed for small businesses in professional services industries like consulting, engineering, IT, and accounting. With a variety of tools and modules bridging the gap between finances, resources and projects, BigTime can provide managers with what they need most: a complete overview of all the critical data.

By integrating time tracking, invoicing, and resource planning, BigTime helps firms reduce administrative overhead while improving visibility into project profitability. Its focus on the needs of smaller professional services firms makes it a practical alternative to more complex enterprise systems, though some users may find its breadth of features requires an initial learning curve.

Why BigTime Stands Out

All-in-One Platform

BigTime integrates project, billing, and financial workflows in one convenient platform, reducing the need for multiple third-party apps. This helps firms stay organized and save time by centralizing all financial data.

Flexible Billing Models

Whether your firm works on hourly billing, fixed-fee projects, or retainers, BigTime supports flexible models to match your client agreements. This ensures accurate, client-specific billing for every engagement.

Expense Management

Capture and categorize business expenses in real time, helping your team stay organized and ready for tax time. By automating expense entry, BigTime reduces manual bookkeeping errors.

Cash Flow Insights

Monitor WIP, accounts receivable, and revenue forecasts to stay ahead of cash flow challenges. Real-time insights allow small business owners to make proactive financial decisions.

Custom Reports

Generate custom financial reports to drill into profitability by client, project, or employee. These reports give business leaders clarity on financial performance and project health.

Scalable Solution

As your business grows, BigTime scales with you, offering pro plans, integrations with accounting software like QuickBooks Online, and advanced reporting features. It’s a platform designed to grow with small business owners, not outpace them.

Summary

BigTime is the best financial software for small business owners in professional services who need financial visibility, invoicing efficiency, and operational control in one solution. With its all-in-one platform, flexible billing, and real-time financial visibility, BigTime is purpose-built for service-based small businesses. But to make an informed decision, it’s important to compare BigTime against other leading small business financial software options in 2025.

Paymo

Overview

Paymo is a project management and business accounting software tool that combines time tracking, invoicing, and expense management to help small firms streamline daily operations. Its all-in-one approach makes it appealing for teams that want to manage both projects and finances without juggling multiple tools. However, its breadth of features can feel less specialized compared to dedicated accounting platforms, which may limit its appeal for firms with more complex financial needs.

Key Features

- Time Tracking: Capture billable hours and add them to invoices seamlessly.

- Invoicing: Create invoices with templates and accept online payments.

- Expense Tracking: Keep financial records up to date for client billing and tax purposes.

Summary

Paymo is affordable and user-friendly, and it offers basic accounting features. Firms that require more detailed financial reporting and cash flow monitoring may outgrow it quickly.

Productive.io

Overview

Productive.io is a management platform built for agencies that want to unify projects, finances, and profitability tracking in one system. Still, some users note that its wide scope can feel overwhelming at first, and smaller teams may not fully leverage its more advanced capabilities.

Key Features

- Budgeting Tools: Monitor project budgets and the overall business’s financial health.

- Invoicing: Automate the invoicing process and send professional invoices.

- Custom Reports: Create detailed reports on margins and utilization.

Summary

Productive.io is well-suited for agencies, but its pricing plans may be too steep for smaller firms or self-employed owners.

Avaza

Overview

Avaza is a small business accounting software solution that combines project management, invoicing, and payments in a single platform. Its simple interface and affordability make it attractive for startups and growing firms looking for an accessible all-in-one tool. However, its lightweight design means it may lack the depth and scalability needed by larger or more complex organizations.

Key Features

- Recurring Invoices: Schedule and send invoices automatically for repeat clients.

- Expense Tracking: Categorize expenses and prepare for tax season with organized data.

- Online Payments: Accept payments via credit cards, bank transfers, or third-party apps.

Summary

Avaza is flexible and affordable, but it provides more general business accounting software features rather than service-specific financial tools.

Everhour

Overview

Everhour is primarily a time tracking and invoicing app designed to integrate seamlessly with popular project management tools like Asana, Trello, and ClickUp. Its strength lies in adding precise time and cost visibility to platforms that lack built-in financial features. Still, its reliance on integrations can limit standalone functionality, making it less appealing for firms that prefer an all-in-one solution.

Key Features

- Time Tracking: Log hours across multiple projects and sync with invoices.

- Expense Tracking: Record project-related expenses and link them to client bills.

- Integrations: Works with other business tools like Asana, Trello, and ClickUp.

Summary

Everhour is excellent for tracking income from billable hours, but it lacks deeper financial features like budgeting tools and balance sheets.

Scoro

Overview

Scoro is a full-service financial management software solution that combines project planning, CRM, and invoicing into one platform. Its breadth makes it attractive for firms that want to unify client management with financial oversight and project delivery. However, this all-in-one approach can feel complex to implement, and some smaller firms may find they use only a fraction of its capabilities.

Key Features

- Budgeting and Forecasting: Plan ahead with forecasting tools and cash flow reports.

- Automated Invoicing: Streamline billing with recurring and scheduled invoices.

- Custom Dashboards: Access business data and project management KPIs in real time.

Summary

Scoro is feature-rich but may be too complex for small businesses looking for a streamlined, easy-to-use tool.

Accelo

Overview

Accelo is a client work management tool that integrates project management, CRM, and billing to serve the needs of service-based firms. Its automation features help teams streamline workflows and connect client relationships directly with financial performance. Still, its broad functionality can make the platform feel heavy for smaller firms, and mastering its full potential often requires a significant setup effort.

Key Features

- Accounts Receivable Management: Monitor overdue invoices and streamline collections.

- Automated Workflows: Automate accounting tasks like reminders and invoice creation.

- Integrations: Syncs with QuickBooks Online and other accounting apps.

Summary

Accelo is powerful but requires more setup and training, making it less accessible for small business owners with limited resources.

ClickUp

Overview

ClickUp is an all-in-one productivity tool that now includes basic invoicing and financial tracking features alongside its project management and collaboration tools. This makes it appealing for teams that want to manage tasks and simple billing in one place without adopting multiple platforms. However, its financial features are relatively limited compared to dedicated accounting software, so firms with complex needs may find it insufficient.

Key Features

- Time Tracking: Log and report hours for invoicing purposes.

- Custom Fields: Track financial records alongside project tasks.

- Integrations: Connect with third-party apps for invoicing and payments.

Summary

ClickUp is versatile but offers only basic accounting features. It works best as a productivity suite rather than dedicated small business accounting software.

Clockify

Overview

Clockify is a free time tracking and invoicing tool that appeals to freelancers and small teams looking for a straightforward solution. Its ease of use and accessibility make it ideal for basic project and billing needs without added overhead. That said, its lightweight financial capabilities can feel restrictive, and larger firms may find themselves needing a more robust platform as they scale.

Key Features

- Free Plan: Create invoices and manage up to five clients with no monthly fees.

- Time Tracking: Track hours for billing periods and recurring invoices.

- Expense Tracking: Record mileage and expenses for reimbursement.

Summary

Clockify is great for self-employed professionals who need a starter plan, but it lacks the advanced financial reporting and cash flow insights that growing firms need.

Discover How BigTime Can Streamline Your Small Business Finances

BigTime gives small business owners a single, convenient platform to manage invoicing, expense tracking, cash flow monitoring, and custom reporting. With integrations to QuickBooks Online and other accounting software, BigTime ensures all your data stays connected and well-organized. Start your free trial today.

Frequently Asked Questions

What is the best financial software for a small business?

BigTime is the best financial software for a small business because it combines billing, project management, time tracking, and cash flow monitoring in one solution. It’s built for service-based firms that need more than just accounting.

How does financial software help manage cash flow?

By tracking bank transactions, accounts receivable, and upcoming payments, financial software helps small businesses stay ahead of expenses and maintain visibility into their financial health.

Can financial software integrate with accounting platforms like QuickBooks?

Yes. BigTime integrates seamlessly with QuickBooks Online, Xero, and other business accounting software, ensuring your financial records are always accurate.

What features should small businesses look for in financial software?

Key features include invoicing, expense tracking, cash flow monitoring, budgeting tools, custom reports, and integrations with accounting apps.

Is cloud-based financial software secure for sensitive data?

Yes. Trusted providers like BigTime use bank-level encryption and secure hosting to protect your financial records and business data.

Can financial software handle multiple currencies?

Yes. Platforms like BigTime and Avaza support multi-currency invoicing and payments, making them ideal for businesses with global clients.

How does time tracking integration benefit financial management?

By connecting billable hours and project tasks directly to invoices, time tracking ensures accurate billing and improves the invoicing process.

Which financial software is best for project-based businesses?

BigTime is the best choice for service-based businesses because it combines project tracking, expense management, and billing in one platform.

Can financial software generate custom financial reports?

Yes. BigTime provides custom reports that highlight profitability, project margins, and your business’s financial health, helping owners make informed decisions.

How can financial software improve billing and invoicing efficiency?

Financial software streamlines the invoicing process with recurring invoices, online payments, automatic payment reminders, and professional invoices. This reduces errors and improves cash flow for small business owners.