Billable hours are the backbone of profits for any service company. However, they are often unrealistically calculated. In this article, we will show you how to prevent that from happening.

In this article, you will find:

- The definition of billable hours and non-billable hours

- Billable hours calculations with examples

- Techniques for monitoring billable hours

Non-Billable vs Billable Hours: What’s the Difference?

Let’s start simple — first, any project manager should understand what’s hidden behind these terms.

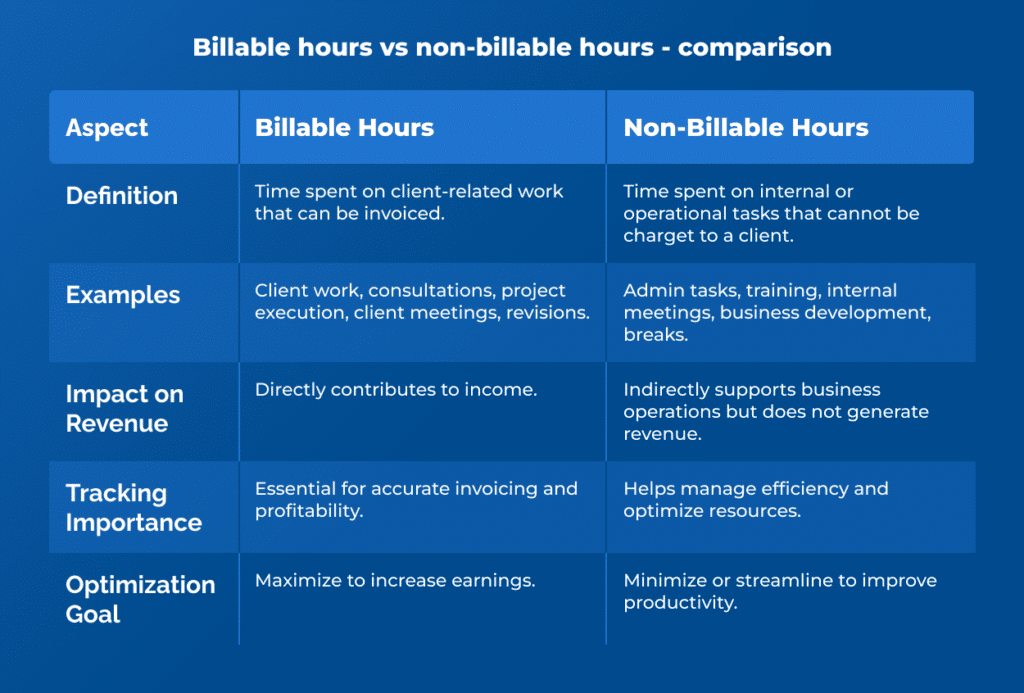

What Are Billable Hours? Definition

Billable hours are the hours an employee spends working on a customer’s projects. In other words, these are the hours the company can charge its customers for. In the case of a professional services company, that mostly includes tasks that contribute to a customer’s product or project.

For example, if 3 employees work on a time and material project for 160 hours a month, the customer that ordered the project will get an invoice for the 480 billable hours spent working.

What are Non-Billable Hours?

In short, non-billable hours are all the hours that a company cannot charge its customers for because the employees are not working on a given project at the time.

In most cases, non-billable hours include time spent in meetings, working on internal projects, or simply conducting any operations not defined in the project scope.

For service companies in general, non-billable hours also include the work of the marketing, sales, and other support departments, as they do not participate directly in the projects.

Billable vs Non-Billable Hours – Comparision

Billable Hours vs Billing Types: How do They Mix?

Speaking of finances, let’s now take a look at how billable hours affect the projects with different billing types.

Fixed-Price Projects

Fixed-price projects are the easiest to convert into invoices. That’s because the number of billable hours in the project is known from the beginning and stated in the contract.

For example, if the project is estimated to last a month, exactly 1,080 hours, the invoice will have this exact number at the end of the month. The difficulty for the company, in that case, is equipping the people available to work that long with the skills required to complete the project.

Time and Material Projects

Time and material projects are much more dependent on time tracking. That’s because, as the name suggests, their base for charging customers is the resources used to complete the projects in a given period.

For example, let’s assume that a customer outsources a project to a software development company that decides to charge the customer $150 per hour. The company assigns a team of 5 specialists to the project. They work on it every day, and by the end of the month, they have spent 1,240 hours working. This number will be multiplied by 150 and written down on the invoice.

What if Estimating Billable Hours Goes Wrong?

The results of miscalculating billable hours can, unfortunately, cause numerous problems both for the manager and his accountant. That’s because mishaps may be the root of issues such as:

- Charging the customer too much money for too many billable hours. Customers usually do not react positively to being overcharged, some may even consider them a fraud attempt.

- Underestimating the number of billable hours. Fixed-price projects suffer the most from this mistake. Their price is based on the estimated number of billable hours required to complete the project. If the estimate is wrong, there might be no profit margin left.

- Lack of sufficient resources. Billable hours should also be estimated for particular specializations. When estimated wrong, some specialists may be overworked, while some resources can be missing altogether.

How to Calculate Billable Hours

Let’s cut straight to the point — if we know what billable hours are, how do we calculate them?

How Many Billable Hours Are Available Each Year?

Calculating billable hours in a year is fairly simple. For the equation, we simply need the number of working days in a year and the length of a working day.

For the sake of simplicity, we will assume that the company we calculate this example for works Monday to Friday, 8 hours a day, 260 days a year.

260 days x 8 hours = 2,080 billable hours in a year

However, remember that the value may vary depending on your company’s local public holidays and working days. If your business operates on the weekends and holidays, too, you may add some working days to the equation.

How Many Billable Hours Are Available Each Month?

Let’s consider a similar case — how many billable hours are in a month?

Like in the previous example, we will calculate the value for a typical company working 8 hours a day from Monday to Friday. This time, however, we will choose a random month for a calculation, as the equation will differ depending on the period of choice. In our case, we will analyze the billable hours for September 2023.

September 2022 started on a Thursday and ended on a Friday, and it has exactly 30 days. However, only 22 of them are working days. Therefore, our calculation for September 2023 will look like this:

22 days x 8 hours = 176 billable hours

This calculation must be repeated each month, as the number of working days will inevitably differ.

Calculating Billable Hours: Examples

Calculating billable hours does not end here. That’s because several other factors also affect the number of billable hours, including time off, public holidays, and other duties. Let’s see how these factors change things in our equations.

How does time off affect billable hours?

Imagine that Jane, one of your employees, wishes to go on a 5-day vacation in September 2023. How does her absence affect her billable hours?

As we calculated in the previous example, September 2023 has 22 working days. Jane will miss 5 days of work. Therefore, the number of her billable hours will be:

17 days x 8 hours = 136 hours

Remember that Jane’s decision to take some time off does not affect her peers (unless one of them is going to travel with her, of course).

How do public holidays affect billable hours?

What if there was a one-day public holiday in September?

The situation is even simpler then — we just need to deduct 8 hours from the maximum amount of billable hours in September 2023. That results in the following equation:

176 maximum billable hours – 8 hours for a public holiday = 168 billable hours

However, in this case, the public holiday affects the capacity of all the company’s employees. You also need to add in the absences of those who, just like Jane from the previous example, decide to take more time off. The 8 hours spent on public holidays must also be deducted from their billable hours.

How do other duties affect billable hours?

Another full-time employee, Brad, is scheduled to work on an internal project for exactly half of his time. How many billable hours does he have left?

Provided that we are calculating his capacity for September 2023 only, the calculation is very simple — we just need to divide the number of all the hours in the month by 2.

176 working hours in September 2023 ÷ 2 = 88 billable hours Brad can spend working on a paid project.

Increasing Billable Hours: How Can Professional Services Companies Do That?

Monitoring client work is just a tip of the iceberg. One firm’s billable hours are calculated, project managers can now focus their attention on an even more important process: understanding billable hours and improving their values in the long-term perspective. Here’s how to do that.

1. Improve Time Management and Minimize Non-Billable Work

If you already started tracking hours, you can now see that more non billable hours equals smaller income. Improved time management can change that.

Based on the time tracked in your legal services, IT projects or any other operations, set clear priorities and deadlines to minimize wasted time. Use time-tracking tools to monitor and optimize daily activities and avoid waste – for example, during lenghty meetings. Then, reduce time spent on administrative tasks by automating invoicing, scheduling, and documentation.

2. Enhance Client Engagement & Project Scope

Managing billable hours starts even before the project does. To make sure it is a success, clearly define the scope of work to prevent unpaid revisions. Set client expectations on billable vs. non-billable activities. Regularly review contracts to ensure all chargeable work is properly billed.

3. Optimize Employee Utilization

Low utilization rates are one of the main reason why there’s not enough billable hours in your company. To change that, assign projects based on skills and workload to maximize efficiency. Encourage proactive time tracking to reduce unrecorded billable hours. Provide training to improve speed and effectiveness in client work.

How to Monitor Billable Hours in a Project Environment

After analyzing all the examples above, you are probably left with the question, “How do I calculate billable hours for a company that employs, let’s say, 100 or 200 people?”

The answer to this question is simple: you don’t.

In small companies, managing billable hours may be done on paper or in Excel spreadsheets. However, this process is not scalable at all. That’s why the majority of businesses use automated time and expense tracking software for this purpose.

Billable Hours Chart – The Basic Way to Track Billable Hours

A billable hours chart is a structured document or visual representation that tracks the time an individual or team spends on work that can be charged to a client. It is commonly used in industries like law, consulting, accounting, and freelancing, where professionals bill clients based on time worked.

Key Components of a Billable Hours Chart

- Date – The day the work was performed.

- Client Name/Project – Identifies the client or project associated with the work.

- Task Description – A brief explanation of the work completed.

- Start and End Time – Records when the work session began and ended.

- Total Hours Worked – The sum of time spent on the task.

- Billable or Non-Billable Status – Indicates whether the work is chargeable to the client.

- Hourly Rate (Optional) – The rate at which hours are billed.

- Total Amount (Optional) – A calculation of hours worked multiplied by the hourly rate.

Time Tracking Software – The Advanced Way to Track Billable Hours

But how to track billable hours without writing down the actual hours in an Excel spreatsheet? The answer is simple: use a time tracking tool.

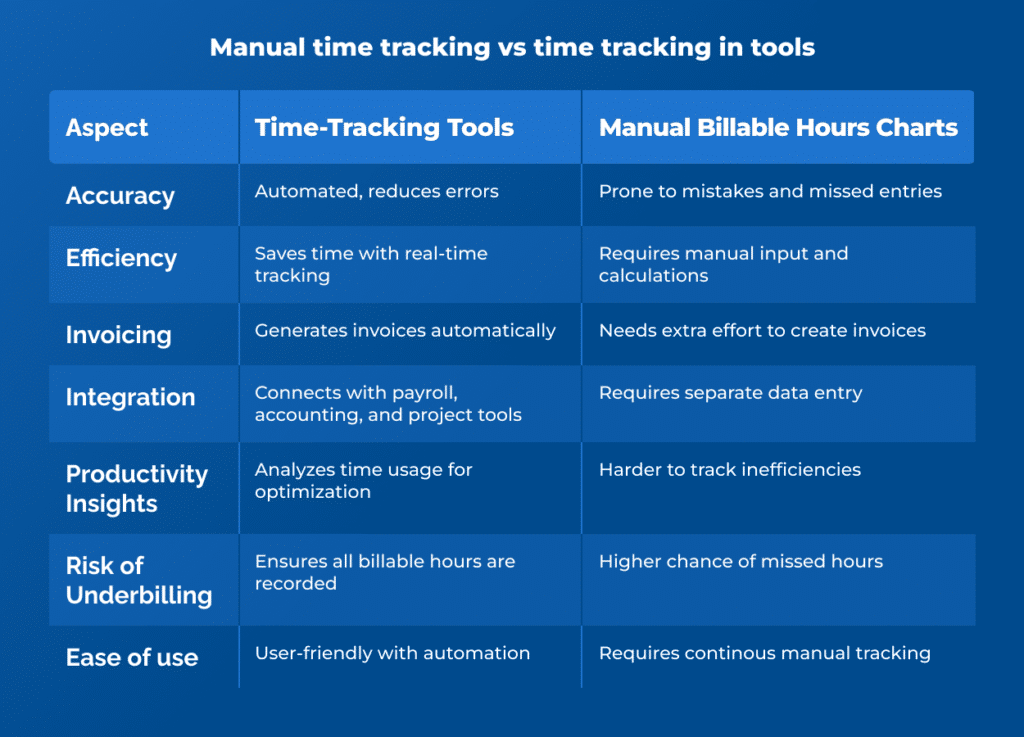

Using time-tracking tools improves accuracy, saves time, and automates invoicing compared to manual billable hours charts. These tools, such as BigTime Foresight, record work in real-time, reducing errors and ensuring no billable hours are missed. They also generate reports instantly, integrate with accounting systems, and provide insights into productivity.

Manual tracking, on the other hand, requires extra effort, is prone to mistakes, and lacks automation. It can lead to underbilling and inefficiencies in workflow management. Time-tracking tools streamline the process, helping businesses maximize revenue and optimize resource allocation.

Why Are Time-Tracking Tools Essential for Managing Billable Hours?

Time trackers fill in three gaps that traditional, Excel or paper-based processes are missing. These are:

- Productivity

- A summary of worked time

- Billing

First, time trackers show exactly who is working on what, and when. They can help project managers discover problems before they become more pressing and verify whether specialists are working as planned on the task they were assigned to.

Then, the data from time trackers can be used for broader calculations as a summary of work time. At the end of a billing cycle, they gather the information on hours as a whole, as well as billable hours, and create a list of costs that can later be used to charge the customer.

Last but not least, time trackers also solve problems with billing, as the amount of time spent on the task can easily be translated into costs.

How Advanced Time Tracking Software Can Help You Avoid This Scenario?

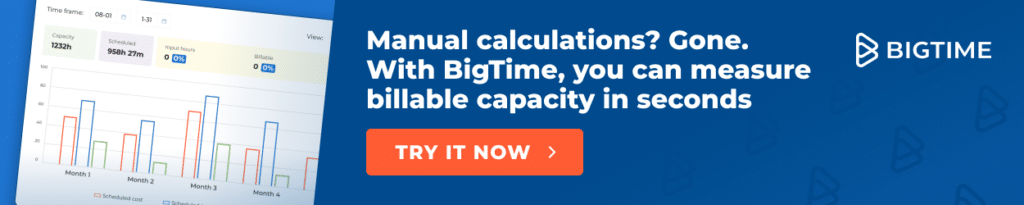

In professional services, billing process is the backbone of profitability – but, whithout the right tools, billable tasks might turn into problems instead of accurate invoicing. Time tracking software, such as BigTime, can change that.

Whether you’re looking for a legal practice management software, or a time tracker for any other profession depending on the time tracking process to create invoices, BigTime got your back. In this tool, you can:

- Let your employees track billable hours in numerous projects and once

- Monitor billable work and non-billable time and see their costs – BigTime can calculate them based on the pre-defined hourly rate!

- Create advanced reports in seconds, reducing the time of administrative tasks and monitoring billable hours targets in the real time,

- Maximize billable hours and minimize non-billable hours in a long-term perspective with AI, advanced analytics and notifications.

- Automatically create a billable hours chart for team mambers and turn them into branded invoices in just a few clicks – billing clients has just become easier.

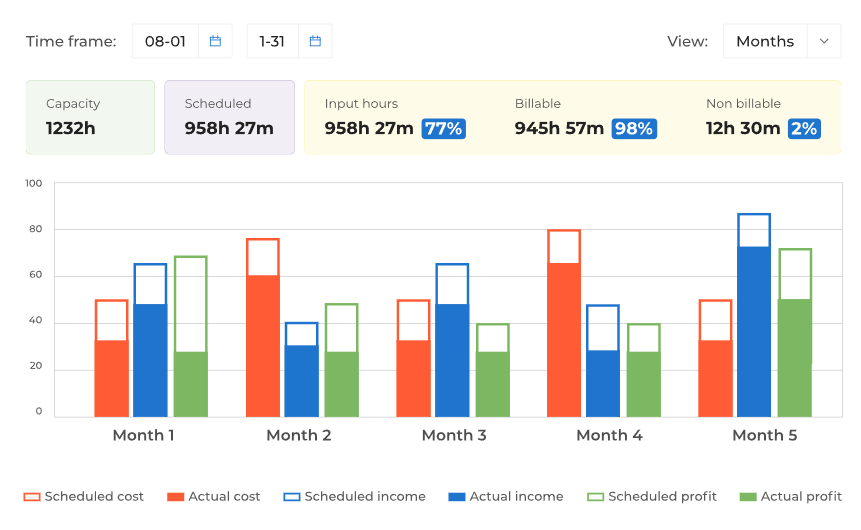

An example of a capacity report for total billable hours vs capacity in BigTime Foresight.

In short, with BigTime, your project managers will know exactly how much time is spend on billable and non billable tasks – and they can use that information to enhance their billable hours model to maximize profits. Book a demo and see what else we can do for you!