DCAA-Compliant Timekeeping Software

Effortless, audit-ready timekeeping software built to help government contractors achieve compliance and focus on what matters most.

Why Choose BigTime Software for DCAA-Compliant Timekeeping?

For government contractors, DCAA compliance means meeting the strict timekeeping and accounting requirements of the Defense Contract Audit Agency. Staying compliant is essential to avoid audit risks, win government contracts, and maintain credibility.

BigTime delivers DCAA-compliant timekeeping software that’s purpose-built for firms that need easy-to-use, audit-ready solutions. Whether you’re a small consultancy or a large-scale contractor, BigTime helps you easily track time with confidence and pass DCAA audits.

Ensure compliance

Track time with built-in DCAA rules to stay compliant without added complexity.

Streamline time tracking

Track and approve time quickly and accurately with intuitive workflows.

Enhance accuracy

Avoid errors with daily time reminders, required notes, and detailed audit trails.

Integrate seamlessly

Sync with your existing accounting platforms like QuickBooks and more.

Gain real-time insights

View project time data and compliance status in real time.

Scale with ease

Grow confidently with a platform built for small to large firms.

Ensure DCAA Compliance

BigTime software includes built-in DCAA timekeeping requirements that automate compliance so your team doesn’t have to second-guess regulations. With features designed to align with DCAA guidelines out of the box, you can track time and employee timesheets confidently, knowing they meet audit standards.

Streamline Time Tracking

BigTime makes government contractor timekeeping procedures easy with intuitive workflows that simplify daily time entry and approvals. Whether you're managing remote teams or multiple projects, your firm can log, review, and approve time efficiently while staying compliant.

Enhance Accuracy

Avoid costly errors and failed audits with features that support DCAA-compliant timekeeping requirements, like required notes, automatic time reminders, and accurate audit trails. BigTime helps ensure your team enters time correctly and consistently, every day.

Integrate Seamlessly

BigTime DCAA-compliant timekeeping software seamlessly connects with popular accounting platforms, including QuickBooks, Sage Intacct, and more. These accounting system integrations eliminate the need for duplicate data entry and ensure consistency across your finance operations.

Gain Real-Time Insights

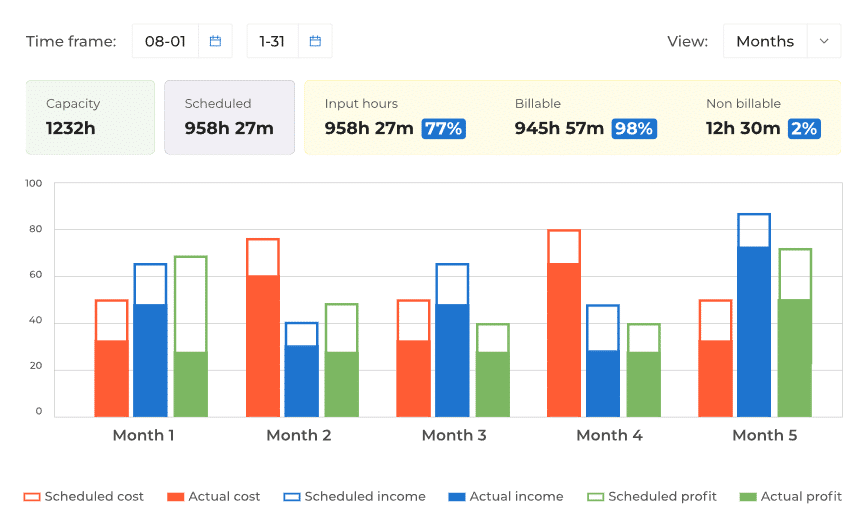

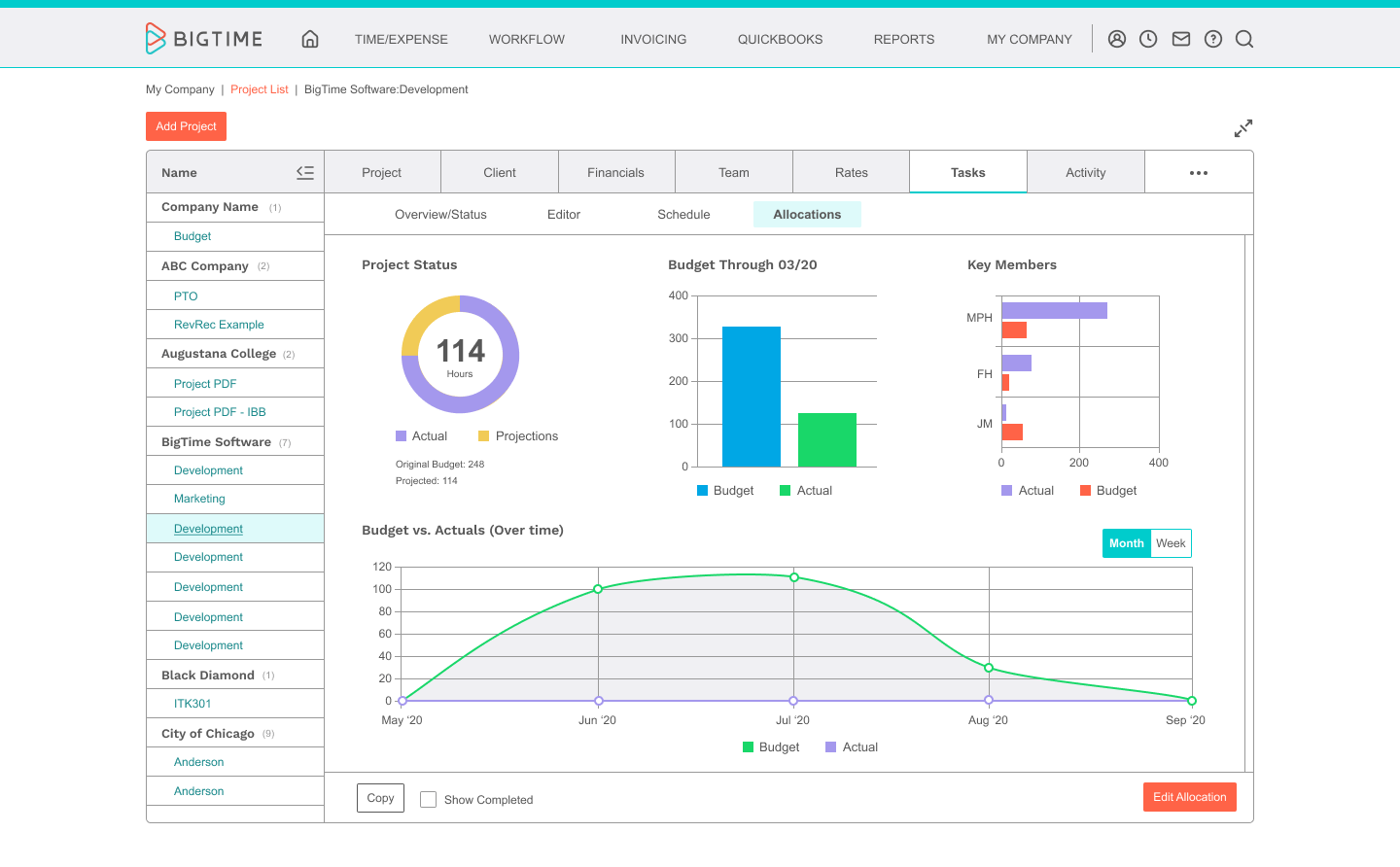

Access real-time project data and compliance status to make informed decisions faster. With time tracking for government contracts, BigTime DCAA-compliant time tracking tool delivers dashboards and reports that show where your time and budget are going—at a glance.

Scale with Ease

Whether you’re a small consultancy or a large federal contractor, BigTime grows with you. The platform is purpose-built to handle DCAA timekeeping procedures for firms of any size and help you calculate labor costs based on all the data.

Better accounting starts here.

free trial

Key Features of BigTime’s Government Accounting Software

These powerful features are purpose-built to help government contractors and project managers meet DCAA requirements, improve accuracy, and stay audit-ready without slowing down the workflow.

DCAA-Compliant Workflow Automation

Daily Time Entry Reminders

Required Notes for Time Entries

Audit-Ready Change Logs and Reports

Supervisor Approval Processes

Flexible Integrations with Accounting Systems

How BigTime’s Timekeeping System Works for Government Contractors

Getting started with BigTime’s time tracking solution is simple. Here’s how your team can implement, use, and maintain compliance every step of the way.

Step 1: Configure the System

Step 2: Train Your Team

Step 3: Enter Time Daily

Step 4: Approve and Lock Time

Step 5: Generate Reports

Why Professional Services Firms Choose BigTime’s Timekeeping System

Success Story: Real Results from Real Firms

Ardalyst, a professional services firm, needed a DCAA-compliant timekeeping system. BigTime enabled the company to enforce time entry policies and streamline invoicing, reducing the billing cycle from 60 days to just 20. That efficiency gave the Ardalyst team more time to focus on clients instead of administration. Read the full story.

What Our Customers Say

Ingrid Jansen

FAQ

What is DCAA compliance?

DCAA compliance refers to adhering to the timekeeping and financial regulations outlined by the Defense Contract Audit Agency. For government contractors, this means maintaining accurate, auditable records using systems like DCAA-compliant timekeeping software to ensure eligibility for government contracts.

Why is DCAA-compliant timekeeping important?

Maintaining timekeeping requirements is crucial for eligibility, accountability, and audit success. A DCAA-compliant timekeeping software ensures your firm can pass audits, minimize risk, and secure more government contracts while keeping project costs in sight.

How does BigTime help with DCAA compliance?

BigTime enforces daily time entry, requires detailed notes, and logs all changes for full transparency, easily meeting DCAA timekeeping standards. Built-in automation ensures your team stays compliant without manual tracking or constant oversight.

Does BigTime integrate with accounting platforms?

Yes. BigTime supports seamless integrations with leading platforms like QuickBooks and Sage Intacct, creating a fully DCAA-compliant accounting system. These integrations streamline workflows, improve data accuracy, and save your team time maintaining accurate records and audit logs..

Can I use BigTime’s timekeeping system on mobile devices?

Absolutely. BigTime’s mobile app allows employees to log time, add notes, and approve entries on the go. This mobile functionality supports real-time government contractor time tracking, whether you're at the office or in the field.

Is BigTime suitable for small businesses?

Yes. BigTime is built to scale with you. From startups to large firms, the platform provides DCAA-compliant timekeeping software that adapts to your firm’s unique structure and needs and reduces time spent on repetitive time tracking tasks.

How long does implementation take?

Implementation is fast and supported by BigTime’s expert onboarding team. Most firms are up and running quickly, with custom time-tracking setups that reflect your DCAA timekeeping requirements and project workflows.

What happens if we're audited?

BigTime’s audit-ready change logs and reports give you everything you need to navigate a DCAA audit. You'll have clear, traceable documentation of time entries, approvals, and compliance history at your fingertips.

Do employees get reminders to enter time in BigTime’s timekeeping system?

Yes. BigTime includes automatic daily reminders to ensure timely and accurate time entry. This core feature supports DCAA timekeeping requirements and reinforces consistent, compliant behavior across your team.

How customizable is the platform?

BigTime is highly configurable to suit your operational and compliance needs. Whether you need to efficiently manage a DCAA-compliant timekeeping system, integrate with custom systems, or adapt workflows by role, BigTime makes it easy.

How does BigTime help with billing and managing employee time?

BigTime simplifies billing by turning accurate employee time entries into client-ready invoices in just a few clicks. With detailed time records that capture hours worked each day, your team can reduce errors, speed up approvals, and ensure compliance. Plus, real-time insights into time and project data empower you to make smarter, data-driven decisions about staffing, budgeting, and resource allocation.