Taking on new government contracting work can be daunting if you don’t feel up to date on DCAA knowledge. Whether you’re just getting started or need a light refresher, we’ve answered the top questions around DCAA compliance to make sure your firms on the right track.

Taking on new government contracting work can be daunting if you don’t feel up to date on DCAA knowledge. Whether you’re just getting started or need a light refresher, we’ve answered the top questions around DCAA compliance to make sure your firms on the right track.

Who is the DCAA?

The Defense Contract Audit Agency (DCAA) performs all contract audits for the United States Department of Defense. Although it’s a member of the Department of Defense, the DCAA also assists other government agencies with accounting and financial advisory services. The goal of the DCAA is to make sure taxpayers and military dollars are being spent accurately, with audits in place to check on the processes.

What is DCAA compliant timekeeping?

DCAA compliant timekeeping follows regulations set in place to ensure government contractors follow the rules of the Federal Acquisition Regulations (FAR). The FAR system makes certain every process in which the government purchases goods or a service is the same. For contracted services, the money spent associated with hours worked requires a specific set of rules meant to prevent any inaccurate tracking of time. For a breakdown of the specific actions needed to be DCAA compliant, check out our blog on steps to DCAA compliant timekeeping.

Why is it important to be compliant?

Failure to follow DCAA regulations will lead to a poor audit trail with the consequence of excluding your firm from further government contracting work. The DCAA can also recommend that the current project stop payments on the work in progress. Therefore, the procedures are critical to running successful engagements involving a government group.

What are they looking for during an audit?

The primary purpose of an audit is to check in on the cost of a project. Money spent by the government must be classified in different ways than a standard business may go about the payment for contracted work. Common things for the DCAA to inspect include: allowable costs, unallowable costs, direct costs, indirect costs, cost pools and pooling of indirect costs. Compliant timekeeping plays into compliant accounting by providing the accurate time spent to bill. Each step of the compliance process is important for the audit so there isn’t a domino effect of errors. For further details on the items inspected during an audit, visit the FAR website.

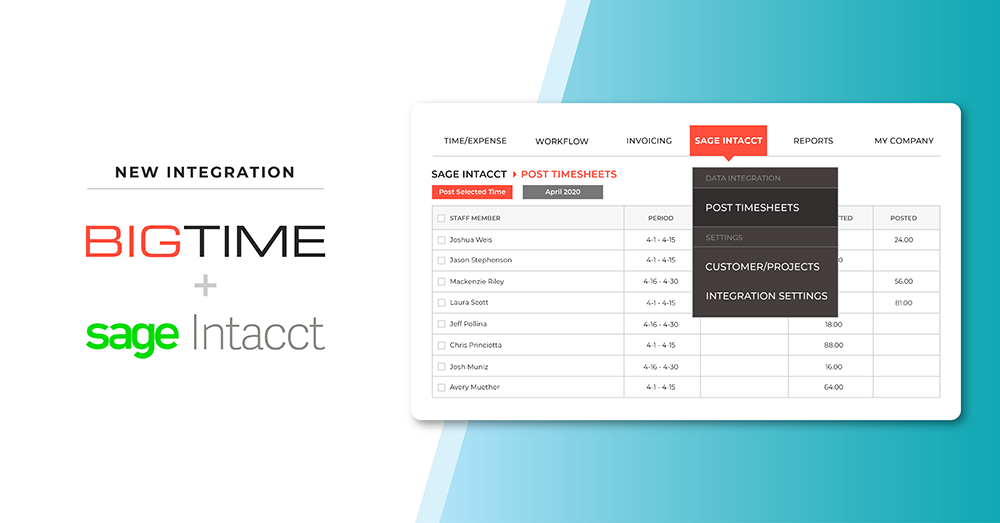

What should I look for in a DCAA compliant timekeeping software?

Using a timekeeping software, as opposed to manual tracking, helps prevent staff from going off policy. Look for a time and billing software that can be configured to follow DCAA regulations automatically, such as blocking late entry of time or prevent timesheets with errors from being submitted. Having a system with set review and approval processes also makes staying compliant seamless. Lastly, make sure the timekeeping system you choose can integrate into the accounting tool of your choice, as the main importance of DCAA compliant time tracking software is to guarantee accurate accounting and billing.

What resources do the DCAA provide to help with an audit?

The official guide for the audit process is called the DCAA Information for Contractors. This document provides an overview of the audit process, checklists to ensure you’re compliant, and what to expect when taking on a government contracting engagement. Specific DCAA consultants are also a good resource to help your team get organized with a set process and ways to ensure compliance.

What if I need to edit time that’s already submitted? Is this possible?

No, unfortunately, once you sign and submit your timesheets, the submitted entries are locked for approval and unavailable to edit. Only system administrators can update and make changes after that.

Can I add time for a day other than today?

Whether you are using a timekeeping software or a manual process, you can edit your timesheet to include an entry for a prior day—but not a future date. With every time entry and update, you will be asked to explain the reason for this change in your audit log notes. The notes must be visible to your manager after you sign and submit your timesheet as well.

To learn more about BigTime’s DCAA compliant time and billing software, request a demo to see it in action and get your questions answered.