In today’s dynamic and data-rich business landscape, CFO tools are no longer optional; they are mission-critical. Whether you’re overseeing a lean startup or managing a growing enterprise, the right tools empower you to forecast with accuracy, budget with confidence, and scale without financial blind spots.

Let’s explore the scope of modern CFO software, from features to use cases, and why scalable CFO tools for growing businesses are an investment in long-term success.

What Are CFO Tools?

CFO tools are software solutions that support the Chief Financial Officer’s strategic, operational, and compliance responsibilities. These tools provide capabilities such as real-time financial analysis, automated reporting, financial planning, cash flow forecasting, scenario modeling, and expense management. Some of today’s CFO tools even integrate with broader business systems to offer a 360-degree view of organizational health.

Why Are Scalable CFO Tools Important More Than Ever?

In today’s competitive landscape, finance leaders are expected to do more than maintain budgets; they’re tasked with driving growth, reducing risk, and optimizing project cost management. As their responsibilities change, so does the finance and accounting software that needs to accompany them every step of the way – and now it includes more financial data than ever before.

The right financial management tool enables CFOs to:

- Align financial strategy with business goals. With integrated data, CFOs can track financial KPIs in real time and adjust strategy on the fly without worrying about making mistakes in key financial processes.

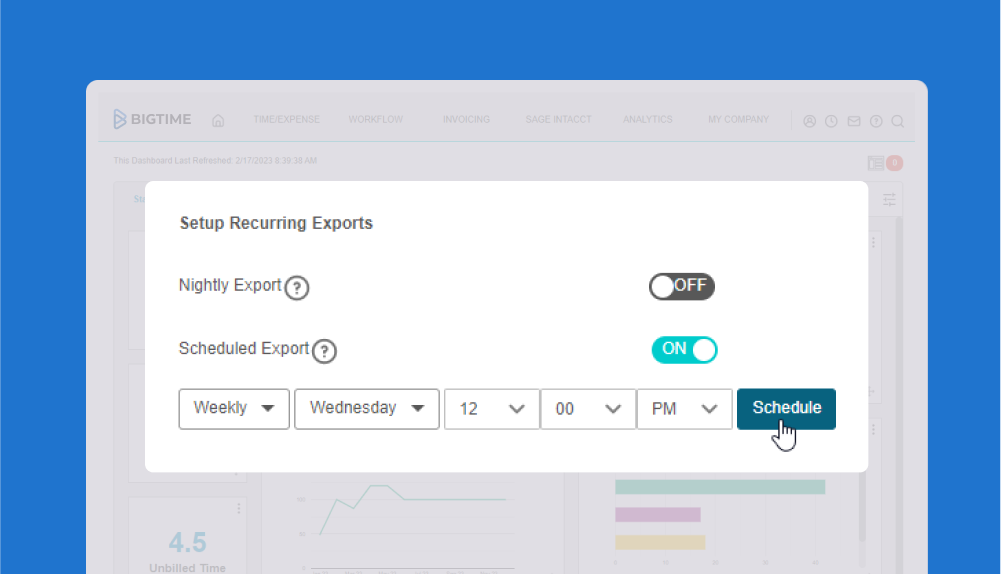

- Improve operational efficiency. Automations offered by CFO software tools reduce manual work in finance teams, cut costs, and improve accuracy. Some of them – including BigTime – can also integrate with other invoicing and payroll management tools, such as Quickbooks, providing managers with even more valuable data and improving their decision making processes.

- Support data-driven decisions. Advanced analytics and dashboards combined with AI-powered financial reporting and other business intelligence tools empower proactive, evidence-based budget management, resource allocation and project monitoring, helping managers navigate obstacles and improve profitability.

Core Capabilities of CFO Software Tools

Investing in CFO software tools is not just about tracking numbers—it’s about turning financial management into a strategic powerhouse that drives business performance. When armed with the right toolkit, CFOs can proactively steer organizations toward growth and deliver financial clarity that inspires confident decision-making instead of hiding behind reactive Excel spreasheets.

But what defines “the right CFO tool”? Let’s explore the essential features that transform financial operations into a centralized hub for strategic finance.

Financial Planning & Analysis

At the heart all effective finance tools is its ability to facilitate all the finance-related processes: from data analytics, to financial planning and forecasting – and that’s exactly what the right CFO software stack can provide you with.

FP&A tools combine all the financial information in a single source of truth about business operations. As a result, they help finance teams build rolling revenue forecasts, perform variance analysis, and evaluate scenarios in real time, without creating repetitive expense reports manually over and over. What is more, modern FP&A functionality also act as a team collaboration software to allow different project managers to see updates instantly and let them exchange information between teams.

Cash Flow Management

Liquidity is the lifeblood of any organization, especially businesses that are still aiming to expand. Still, without a complete overview of cash flow, making the best decisions for the company’s growth might be a challenge. Fortunately, the right CFO software can change that.

Scalable CFO tools for growing businesses must offer clear, real-time cash flow visibility to facilitate strategic decision making and empower business leaders to choose the right course of action every time. For that reason, such tools should cover short-term cash forecasts, working capital dashboards, and alerts for anomalies in incoming or outgoing payments on top of basic financial transactions and budget management. Sophisticated tools even use AI project management software to predict future cash gaps and suggest strategies to bridge them.

Enterprise Resource Planning

While resource management might seem to fall far from CFO’s responsibilities, in professional services companies, the majority of the costs starts with the employee workload. Therefore, any cash management solutions should account for expenses related to the cost of work. More comprehensive financial platforms, such as BigTime, automatically convert the information on planned and executed work based on pre-defined employee data, updating project budgets and progress in the real time.

Expense and Cost Control

Cost management is a daily challenge for any CFO. Still, while basic, with dozens of projects and hundreds of employees, this remains a very challenging task – unless you have the right tools at hand.

Strong CFO platform can provide granular expense tracking, automated approvals, and policy enforcement features that protect margins. From recurring overheads to variable project costs, these tools ensure you know where every dollar is going, and why.

Revenue and Billing Management

Especially in service-based and subscription models, CFO tools for small businesses and large organizations alike must handle billing complexity with precision, regardless of the circumstances – and, in the modern competitive business landscape, can change almost overnight.

To prepare finance teams for all the possible scenarios, business tools should support not only payment and payroll processing, but also invoicing and advanced reporting, complete with detailed financial statements. Advanced platforms should also automate revenue forecasting based on pipeline data or project progress—connecting finance directly to operational workflows.

Invoicing and Accounting Tools

Having the raw data from the financial tool is one thing; using them in practice is a whole different story. Fortunately, the best tools for CFO can overcome this obstacle by offering built-in invoicing and accounting platforms capable of generating customized, branded invoices in just seconds based on pre-defined hourly rates and project costs. With such payment processing tools, managing bills becomes just a formality.

Integrations

Finance doesn’t operate in isolation—and neither should your CFO tool. Seamless integrations with accounting systems (like QuickBooks or NetSuite), CRMs (like Salesforce), payroll, and project management platforms create a unified source of truth.

Choosing the Right CFO Tool for Your Business

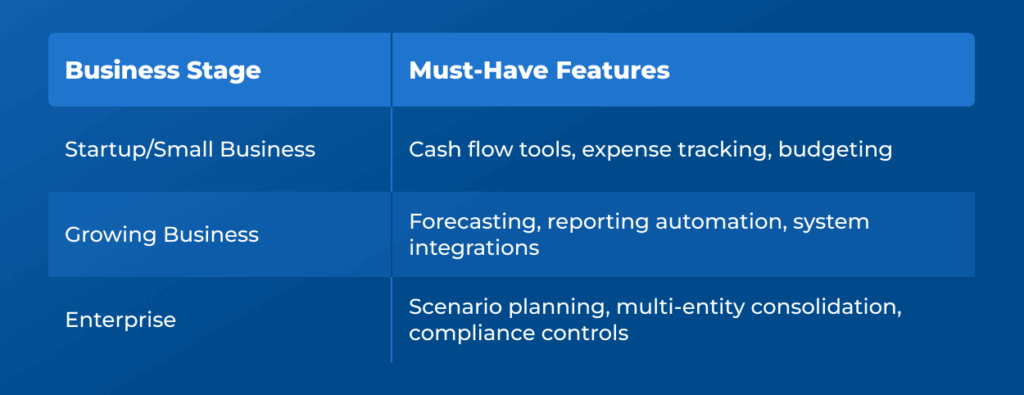

Whether you’re a founder managing your first budget or a finance leader scaling a global enterprise, selecting the right CFO software depends on your business stage and goals.

Here’s what to look for depending on the size of your company:

Of course, regardless of your company size, there are also some universal factors any tools for analysis, financial planning and budget monitoring should have. Those mainly include:

- Robust, responsive support eager to solve customers’ problems and provide updates on any steps they take to do so without days of waiting.

- Scalable system with multiple additional modules that can be expanded as needed.

- Seamless integrations with other tools – after all, combining the data on company spending from different tools is the key to accuracy in any payroll operations.

BigTime: A CFO Tool Built for Strategic Growth

BigTime is not just a project management platform—it’s also a comprehensive CFO tool that supports strategic financial operations from planning to execution. With robust time tracking, expense management, budgeting, and real-time reporting, BigTime ensures every dollar is accounted for and every decision is grounded in data.

BigTime enables CFOs to:

- Generate financial forecasts based on historical data and plans for future operations.

- Allocate resources based on hourly rates utilization and profitability, and analyze the costs of all working hours. You can also use the tools to test different scenatios and choose the most profitable one – every time.

- Track billable hours and translate the time logs into the use of project budget without a single click – it all happens automatically.

- Create project-level budgets and monitor financial performance as the project progresses. All the overheads, both for the project and the company as a whole, will be included in the final results.

- Generate advanced reports in seconds and see the company finances from a bird’s eye view without filling in a single Excel spreadsheet.

Its seamless integration with leading accounting systems makes it a strong contender for both small teams and fast-growing organizations looking to scale intelligently.

Power Your Financial Strategy with CFO Tools That Deliver

The CFO role has never been more critical or more complex. In a world where growth is data-driven and precision is non-negotiable, investing in the right CFO tools is a strategic imperative.

Whether you’re seeking CFO tools for small businesses, scalable CFO tools for growing businesses, or a unified CFO software tool for enterprises, your tech stack should empower, not hinder your ability to lead with confidence.

Ready to unlock strategic finance? Book a demo today and see how CFO tools can transform your operations from reactive to proactive—one smart decision at a time.