Accounting Practice Management Software

Streamline your practice, boost productivity, and increase profitability with accounting practice management software built for accountants, CPA firms, and financial advisors.

Why Choose BigTime Accounting Practice Management Software?

Accounting firms face unique challenges: managing multiple clients, tracking billable hours, juggling project deadlines, and maintaining accurate billing. BigTime offers a modern, scalable solution that replaces disconnected systems and manual processes with one powerful accounting practice management software platform.

BigTime accounting management system is purpose-built to meet the demands of accountants, CPA firms, and financial advisory teams by eliminating inefficiencies and improving visibility across your firm’s processes.

Streamline operations

Centralize workflows into one unified platform.

Automate time tracking

Save time with smart timesheets and expense logs.

Get paid faster

Reduce billing errors and automate invoicing.

Enhance visibility

Monitor progress with real-time dashboards.

Make better decisions

Use reporting tools that deliver performance metrics.

Sync seamlessly

Integrate with your existing tools for a one-stop solution.

Streamline Your Practice

BigTime’s accounting practice management software helps eliminate manual processes and fragmented systems by consolidating your firm’s operations into one centralized platform. Accounting firms can manage time tracking, billing, project workflows, and client data in a seamless, efficient workflow, saving hours every week and improving accuracy across your practice.

Automate Time and Expense Tracking

Say goodbye to spreadsheets and time-consuming manual entry. BigTime’s intelligent timesheets and expense-tracking tools are purpose-built for accountants and CPA firms, enabling team collaboration to log billable hours, track reimbursable expenses, and maintain accurate records with ease.

Improve Accuracy

With BigTime’s customizable billing features, you can generate branded, error-free invoices directly from logged time and expenses. This accounting practice management solution helps firms get paid faster, reduce disputes, improve client relationships, and ensure financial accuracy on every engagement.

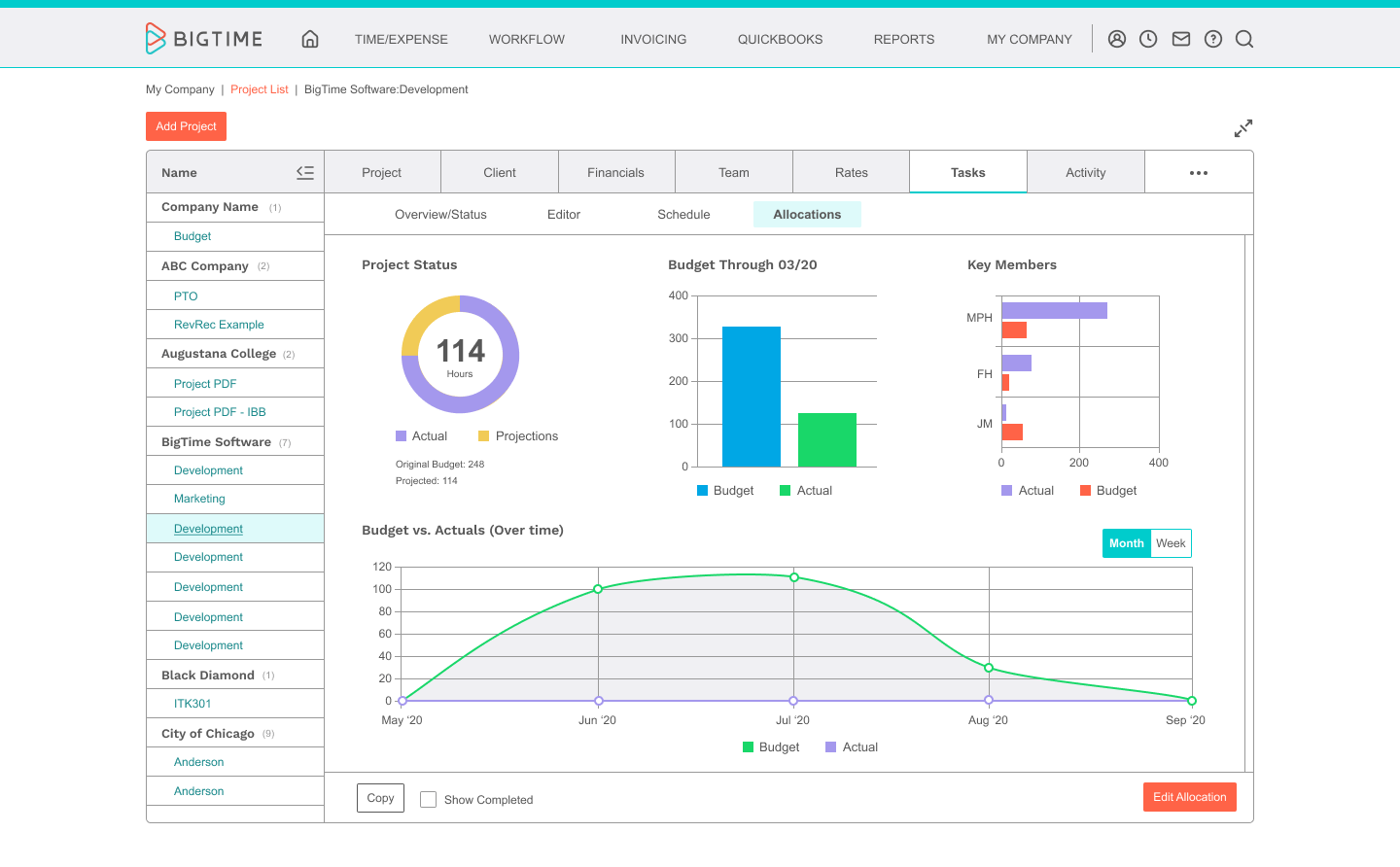

Enhance Project Management Visibility

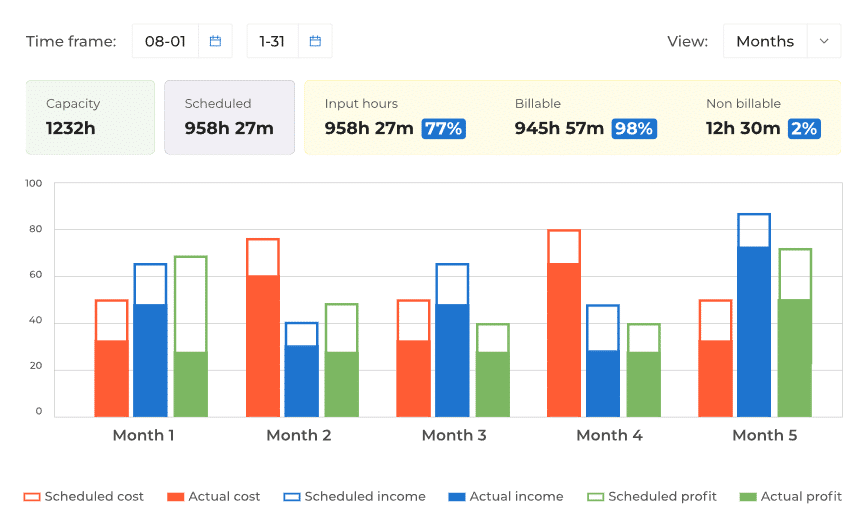

Monitor every client engagement with real-time project dashboards that display progress, budgets, deadlines, and resource allocation. Designed as a project management software for accounting firms, BigTime gives your workers the visibility to stay on schedule and deliver exceptional client work.

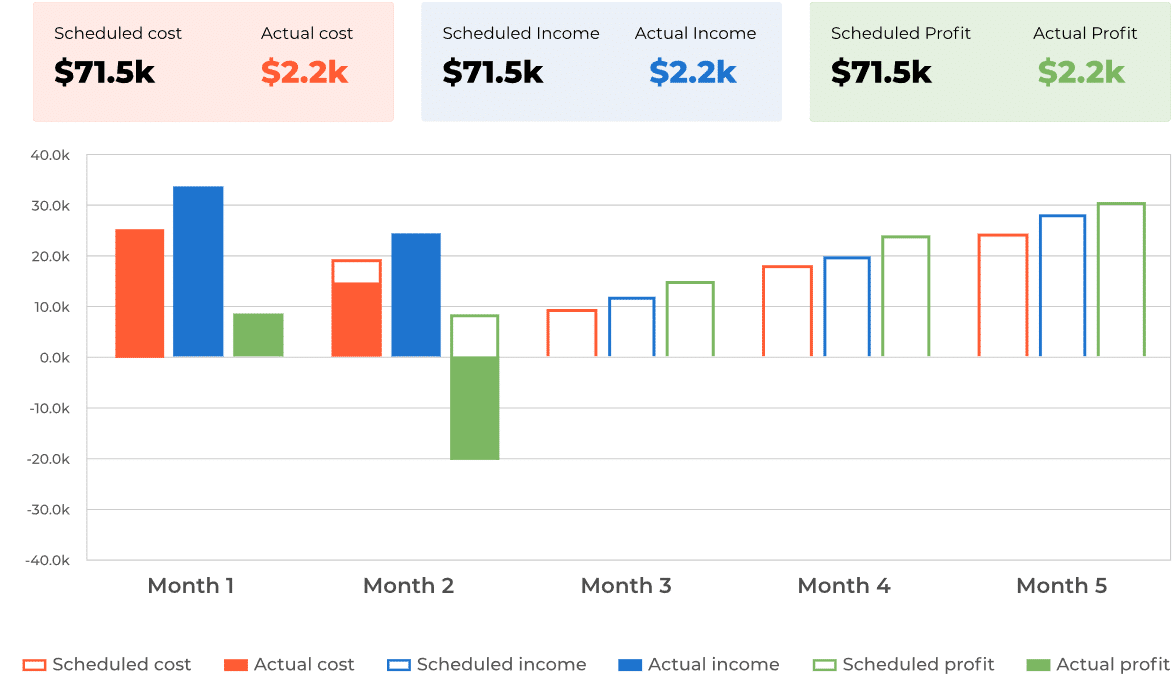

Gain Real-Time Insights into Performance

Make smarter business decisions with real-time reporting and performance analytics. BigTime’s CPA practice management software offers insights into utilization rates, billable hours, profitability, and team productivity, empowering leaders to fine-tune their practice and drive growth.

Integrate Seamlessly with Leading Accounting Platforms

BigTime integrates with the tools accountants already use, including QuickBooks, Sage Intacct, and Salesforce. This deep integration ensures your data flows smoothly across platforms, enabling an end-to-end accounting practice management solution that reduces redundancy and increases productivity.

Better accounting starts here.

free trial

Key Features of BigTime’s Accounting Practice Management Software

Explore the powerful features that make BigTime the best accounting practice management software for firms looking to boost efficiency, improve accuracy, and scale smarter.

Time and Expense Tracking

Customizable Invoices

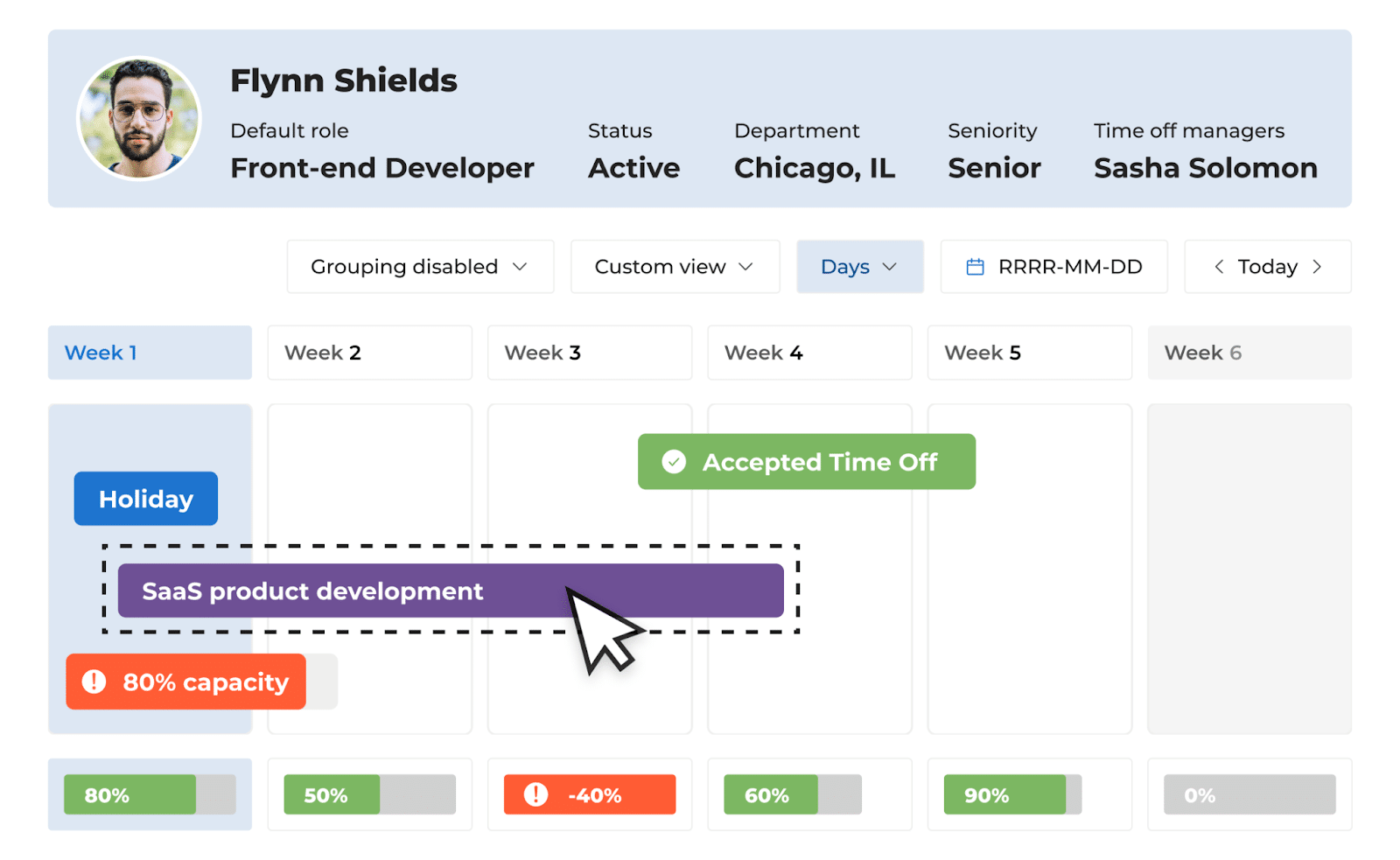

Resource Allocation Tools

Project Tracking Dashboards

Advanced Reporting and Analytics

Mobile Accessibility

How BigTime Accounting Practice Management Software Works

See how BigTime simplifies accounting firm management from day one.

Step 1: Onboarding and Integration

Step 2: Log Time and Expenses

Step 3: Manage Projects and Resources

Step 4: Automate billing

Step 5: Analyze and Optimize

Why Professional Services Firms Choose BigTime

Success Stories: Real Results for Real Firms

Wacek and Associates, a mid-sized accounting firm, turned to BigTime to improve billing and streamline operations. Before BigTime, the firm struggled with inefficiencies in project tracking and missed revenue due to inaccurate time logs. With BigTime, the firm has significantly improved its billing process, leading to faster payments and greater client satisfaction. Read the full story.

What Our Customers Say

Jay Shewan

FAQ

What is accounting practice management software?

Accounting practice management software is a digital solution that helps accounting firms and CPA practices manage time tracking, billing, client communication, task management, and project workflows in one centralized platform. The right practice management software replaces manual processes and disconnected tools to improve accuracy, boost efficiency, and support firm growth.

Is BigTime built specifically for accounting firms?

Yes, BigTime is purpose-built for accountants, CPA firms, and financial advisory firms. Unlike generic project management or time tracking tools, our accounting practice management software includes industry-specific features like time and billing software, project tracking dashboards, and customizable billing designed to meet the needs of accounting professionals.

Can I integrate BigTime with QuickBooks or other accounting tools?

Absolutely. BigTime integrates seamlessly with popular accounting platforms, including QuickBooks, Sage Intacct, and Salesforce. These deep integrations ensure your accounting firm’s financial data is synced across systems, reducing duplicate data entry and enhancing workflow automation.

How does BigTime help accounting professionals manage their business during busy tax seasons

BigTime gives accounting professionals the tools they need to manage their business more efficiently, especially during high-pressure times like tax season. With the ability to create streamlined workflows, automate time and expense tracking, and manage invoices, your firm can stay focused on delivering exceptional service to clients without sacrificing accuracy or speed. Whether you're a solo practitioner or running a growing business, BigTime supports your profession with features created to handle the demands of tax preparation and client communication.

Does BigTime support remote workers?

Yes. BigTime is a cloud-based accounting practice management solution that supports remote and hybrid teams. Whether working from the office or on the go, your accountants can log time, manage projects, and collaborate with clients using the web or mobile app.

How do invoices work in BigTime?

BigTime’s tools pull data directly from timesheets and expense reports to generate branded, customizable invoices. Accounting firms can automate the billing process, reduce delays, and ensure that invoices reflect accurate, real-time project and time data. This improves your firm's productivity and strengthens client relationships in the process.

Does BigTime offer reporting tools?

Yes. BigTime includes robust reporting and analytics tools that provide insight into your accounting practice’s most important metrics, such as billable utilization, employee productivity, project profitability, and overall business performance. You can also customize dashboards to monitor KPIs that matter most to your firm.

Is there a mobile app for BigTime?

Yes. BigTime offers a mobile app that gives employees in the accounting profession the ability to monitor time, submit expenses, view projects, and communicate with their employees—all from their smartphone or tablet. This mobile accessibility supports flexibility and work-life balance for busy accounting firms.

How long does it take to implement BigTime?

Most firms have the ability to implement BigTime in just a few weeks. Our onboarding specialists guide you through setup, tool integration, and employee training to ensure your accounting practice management software is fully optimized from day one.

Can I customize workflows in BigTime?

Yes. BigTime supports customized workflows to align your firm’s processes with the software. From approval paths to task templates, you can create a system that mirrors how your accounting firm operates, improving adoption and productivity.

How does BigTime support client management and improve work-life balance for small firms?

BigTime streamlines client management by centralizing all client work, communications, and data collection in one platform, making it easier for accounting professionals to stay organized and responsive. Small firms can manage more accounts without sacrificing accuracy or service quality with features that monitor client responses, automate workflows, and improve visibility into deliverables. BigTime helps firms maintain better work-life balance by reducing administrative burdens and enhancing collaboration while delivering exceptional client experiences.

How does BigTime’s practice management and time and billing software help firms stay focused on high-priority client work?

BigTime’s comprehensive practice management solution combines powerful time and billing software with tools that help your firm prioritize what matters most—client work and business growth. With time tracking, resource allocation, and automated billing, your employees can spend less time on administrative tasks and more time delivering value to clients. By aligning workflows with your firm’s priorities, BigTime empowers accountants to operate more efficiently and make smarter, more strategic business decisions.

Does BigTime include a client portal for improved communication and document sharing?

BigTime includes a secure client portal allowing clients to access project updates, view and pay invoices, and upload important tax or business documents. It enhances transparency, reduces client response time, and helps accountants create a more professional, efficient client experience.

Is support included with the software?

Yes. BigTime provides extensive support for your practice management software, including onboarding assistance, ongoing customer service, and access to a robust knowledge base. Our team is here to help your accounting firm succeed every step of the way.