Time and Expense Tracking software

Time and Expense Tracking software simplifies logging time and expenses.

Ensure prompt and accurate tracking of time and expenses

- Speed up the entry process with auto-fill repetitive data, auto-save and smart lookups with user-specific presets

- Give managers specific user rights for reviews and approvals

- Reduce errors and control access to sensitive information

- Set required fields that employees must complete before saving

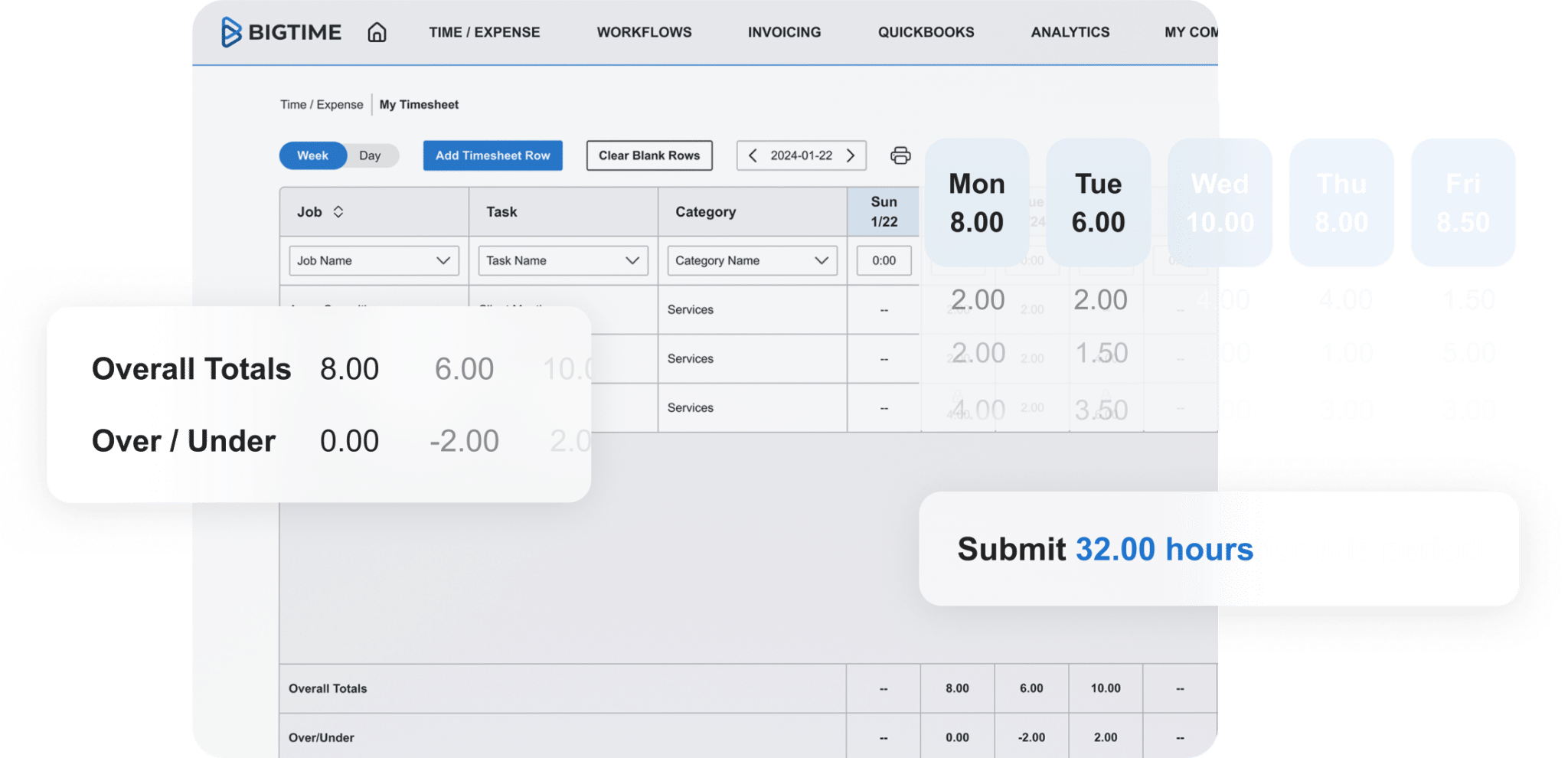

Real-time visibility keeps projects on track

- Set up timesheets in daily or weekly views with user-defined workweek

- Add, remove, or rename columns and mark fields as required (including the option to follow FAR & DCAA compliance)

- Make submission times flexible with optional lockout periods for approvals

Link expense to projects for accurate billing

- Mark expenses as reimbursable, non-reimbursable, billable, non-billable, or service fees

- Apply credit card charges to a project, then easily post to QuickBooks

- Reconcile your bank statement using QuickBooks

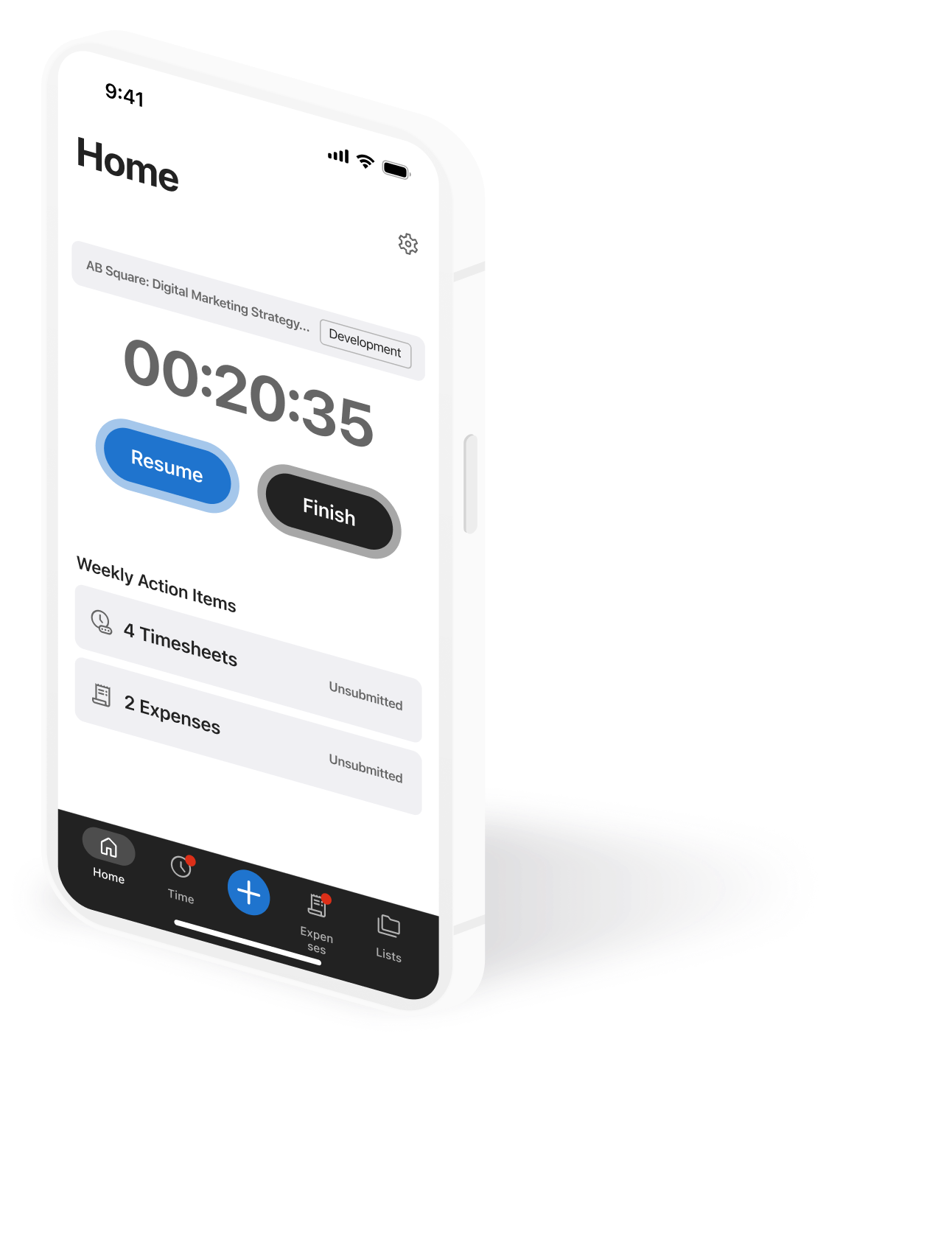

Hassle-free time and expense tracking - anywhere, anytime!

- Simple, user-friendly mobile app to track your project work

- Create, save, and submit timesheets from the palm of your hand

- Easily and accurately track expenses by uploading receipt photos and PDFs

- Capture every billable minute with one-tap timers for start, pause, and finish

download the app now

Streamline your time and expense tracking software with integrations

Explore our shared learnings

Love at first sight?

Real BigTime customers and their initial reactions to our software.

Frequently Asked Questions

What is a time and expense system?

A time and expense system helps professional services firms log the billable hours worked and expenses for a client project. In the system, team members can track time and expenses against a project budget.

Which is the best software to track billable hours?

Professional Services Automation (PSA) software is best for tracking billable hours and project expenses. The time and expense capabilities are integrated with budget tracking, project management, invoicing, and business intelligence for a seamless operational workflow. Professional services firms that track billable hours, such as engineering, architecture, consulting, IT services, and accounting benefit the most from PSA software.

What is time and expense capture?

Time and expense capture is the recording of hours and costs associated with a project. The employee time and expenses tracked are typically billable to a client, and capturing the information allows for an invoice to be generated.

Does Sage have time tracking?

Yes, Sage Intacct offers a basic time-tracking and expense-tracking solution. In the software, you can enter project costs and employee hours.

What is time and expense entry?

Time and expense entry is the tracking and recording of time and expenses related to a project or service provided to a client. Staff enter their billable hours and expenses into a Professional Services Automation (PSA) software where an invoice can then be generated for the project costs and time.

What is the simplest time-tracking app?

There are many simple time-tracking apps, including keeping track of hours in an Excel spreadsheet. Professional Services Automation (PSA) software is easy to use for time and expense reporting, while offering additional features like resource allocation, invoicing, and real-time reporting to keep firms operating at peak efficiency.

How do you automate an expense report?

Expense reports are automated through expense management software. Employees enter their expenses associated with a project by expense type into the software, and from there, an expense report is generated for approval. Once approved by management an invoice can be generated automatically pulling in the time and expenses tracked to bill the client.

How does expense management work?

To properly manage expenses, professional services firms use PSA software to keep track of the costs associated with a client project. Employees enter their billable time calculated by their hourly rate, and the expenses logged for a project. Managers then approve the time and expense reports so an invoice can be generated to bill the client and reconcile the expenses.

Why is expense management software important?

Expense management software is valuable for keeping track of the expenses associated with a billable client project. Utilizing software for the recording of expenses reduces the chances of human error, prevents double data entry, and expedites the speed at which a firm gets paid.

How do I track time spent on tasks?

The easiest way to track time spent on tasks is in Professional Services Automation (PSA) software. Employees use smart timesheets to enter their billable hours associated with a project task on a daily or weekly basis. Managers can limit timesheet information to reduce errors and speed up time entry for staffers.