Are some projects doomed to be unprofitable?

In our experience, a large percentage of fixed-price projects are unprofitable after they end, even though they were expected to improve the company’s finances.

Why does this happen, and how can you prevent it?

Why are fixed-price projects a financial risk?

Nearly any project can go over budget. However, fixed-price projects are particularly prone to this problem. To solve this, we first need to understand why it happens.

The Scope Crawl

Fixed-price projects operate on a limited budget. However, just like any other project, they are prone to a scope crawl — a sudden change in the deliverables that is often the root of all the delays and problems with budgeting. In the case of fixed-price projects, this process is harmful as it can often lead to the operation being unprofitable.

Changes in Costs Over Time

As the name implies, fixed-price projects do not change in price, but their costs change over time. Things such as:

- Changes in salaries and wages

- Inflation

- Changes in the currency rates

- Scope crawl

have a huge impact on the project’s expenses — and they are often unavoidable, as they result from current economic conditions. They can quickly turn even the most profitable projects into failures.

Unexpected Expenses

Project scope and economic factors are not the only things that can change in a fixed-price project. Sometimes, completing such an operation requires additional unexpected expenses that were not a part of the financial forecast. Additional equipment, software, or simply a bit of help from another specialist may generate huge costs, contributing to a project’s failure.

How to Accurately Estimate the Costs of a Fixed-Price Project

As you can see from the examples above, fixed-price projects are mostly threatened by the changes they are particularly prone to. However, that doesn’t mean these changes cannot be considered while planning the project. Here’s how to do that.

Estimate the Cost of the Project for the Time Being

Before you decide to accept a project, make sure that the work cost won’t exceed your expectations. In other words, create a project schedule to see how much work you need and add some additional information to get a bigger picture of the project’s finances.

That includes:

- The wages and hourly rates of the employees who will be assigned to the projects (no estimates or average values here — just create a draft allocation and calculate its costs to avoid mistakes), as well as the typical changes in those wages over time.

- Historical data on the costs of similar projects in the past.

- Project overheads, both typical and project-specific.

- A percentage of organizational overhead.

In the end, add some money to reach your desired profit margin. That will be a base for your further calculations.

Include Change Over Time in Your Estimates

As we have stated before, the costs of your fixed-price project will probably change over time. However, you can take that into account, too, by calculating the net present value.

What is the net present value?

Net present value (NPV) is an indicator that can help you determine whether your investment (or, in this case, a fixed-price project) will be profitable over time. It sums all the expenses and incomes to tell the managers whether extra money will be left over after the project is completed.

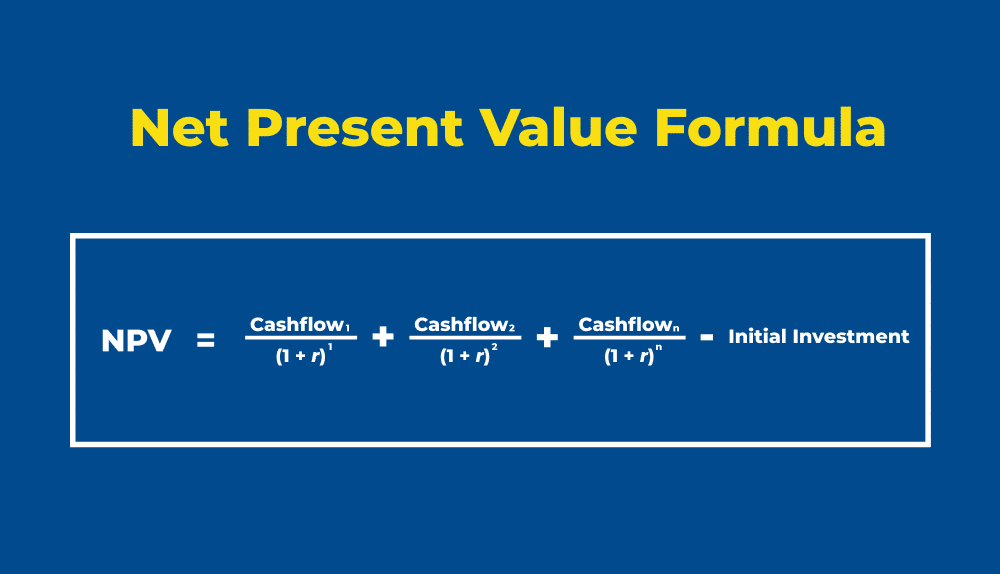

Net Present Value Formula

You can calculate the value of your project over time using the formula below:

In this formula:

- Cash flow is the sum of money spent and money earned on the investment or project for a given period of time.

- “n” is the number of periods of time.

- “r” is the discount rate.

How to Interpret Net Present Value

Net present value has three potential outcomes:

- Positive NPV: Your project is profitable. Congratulations!

- Negative NPV: Your project is losing some money and you need to fix that.

- Zero NPV: An NPV of zero means the project or investment is neither profitable nor costly. Maybe there’s something you can do to help it generate profits.

What types of fixed-price projects are likely to be profitable?

Not all fixed-price projects are doomed to fail financially. Some operations are destined for enormous profits — and you can use them to your company’s advantage.

Quick Fixes

Some projects simply require a short period of intense work, and therefore there is little chance their scope will change. Such projects are widely known as quick fixes and usually make a perfect candidate for a fixed-price project.

That’s because they:

- Have a very limited scope of work that is unlikely to change.

- Are resistant to inflation and financial adjustments over time, as they typically only last around 3 months.

- Typically address simple problems that can be solved with a ready-to-go product or a simple implementation.

Quick fixes have very predictable costs and profits.

Gray-Haired Projects

Gray-haired projects are those your company knows very well, as it has done them many times, over and over again. They are the safest project to sell for a fixed price as they:

- Can be very accurately estimated in terms of both budget and time.

- Do not require you to hire any additional specialists — having worked on similar projects in the past, you probably have very experienced employees already on board.

- Are likely to be completed before the scheduled time, generating additional profits

- Can be accelerated by using the same formula you used previously for similar projects.

In other words: gray-haired projects have a great chance of succeeding and generating profits.

What else can I do to keep my projects profitable?

Of course, sometimes going over budget is simply inevitable. Still, you can prevent the unpleasant consequences of such situations or even prevent it altogether.

First, you can limit the number of fixed-price projects you take on. This type of financing should only be chosen for gray-haired projects and quick fixes; other fixed-price projects are very unlikely to be profitable, especially if you have never worked on similar operations before.

The second option is to precisely describe the scope of work in a contract with a customer, then stating that any changes to the project will result in additional costs. This may not attract new customers, but it will prevent you from losing money.

The last option is to simply convince your customers to switch to (or to choose) time and material projects. This is an optimal solution for both the provider and customer, as it allows for flexible management of the scope of work without threatening both parties with unexpected charges.

What should I do if my fixed-price project is already unprofitable?

Unfortunately, if you have already begun working on a project that turns out unprofitable later on, you can’t do much. Of course, you can:

- Try to limit the costs of work by replacing more expensive employees with cheaper ones.

- Use the formula from previous projects to speed up or simplify the work.

- Keep project overhead to a minimum.

However, these methods may not be enough to turn the project’s profitability around. In that case, renegotiating the contract may be the best way to avoid losing money, even if that causes some organizational problems in the future.