Every penny counts – and no one knows it better than accounting firms. Still, with many factors at play, even the best of them sometimes struggle with managing the entire billing process. Fortunately, that changes today with time and billing software for accountants.

With minimal overview from the managers, such solutions can automate task management, process payments, generate invoices, and more – all in a single source of truth for the entire business. But which time and billing software for accounting professionals is the best? Let’s find out!

In this article, you’ll find:

- The benefits of time and billing tools for certified public accountants.

- A complete list of the best time and billing software for CPA and accounting firms for 2025.

- The best choice for your company.

How CPA Firm Time and Billing Software Can Improve Your Processes?

Time and billing software is not just a quicker way to send invoices. The best systems on the market is an all in one solution that should become a backbone of your processes, automating repetitive actions and ensuring the accuracy of all the critical data. As a result, such solutions offer:

Automated Processes

Recurring invoices, client payments, time tracking… There are dozens of processes accounting firms need to manage on a daily basis. The right accounting software can turn those repetitive tasks into automated processes, saving your precious time and turning raw data into actionable insights in seconds.

Improved Resource Allocation

Workflow management in accounting firms is never easy, especially with dozens of customers and hundreds of requests at hand. With the right accounting practice management software, that changes.

The best time and billing software tailored to the needs of accounting firms can help their managers find the right specialists for every project in just a few clicks. With complete overview of people, their skills and certifications, making the right call in resource allocation is just a formality. Addtionally, some AI-powered time and billing software for accountants, such as BigTime, can also notify you about any errors in schedules and create reports summarizing your plans and forecasts.

Better Project Management and Tracking

Keeping track of multiple ongoing client engagements can be overwhelming without a centralized system and automated reminders. Time and billing software provides structured project views in one place, helping the interested parties with project tracking. Managers and staff gain visibility into progress, dependencies, and team assignments, making it easier to ensure every engagement stays on schedule and within scope.

Quick Payments and Invoicing

Generating accurate invoices and getting paid faster is critical for a firm’s cash flow. Still, without the right software, monitoring billable time is not a piece of cake.

CPA time and billing software simplifies invoicing with features like automated billing from approved time entries, custom invoice templates, and support for various billing models (hourly, fixed-fee, retainer). As a result, project managers can collect payments and monitor due invoices with minimum time spend in Excel spreadsheets.

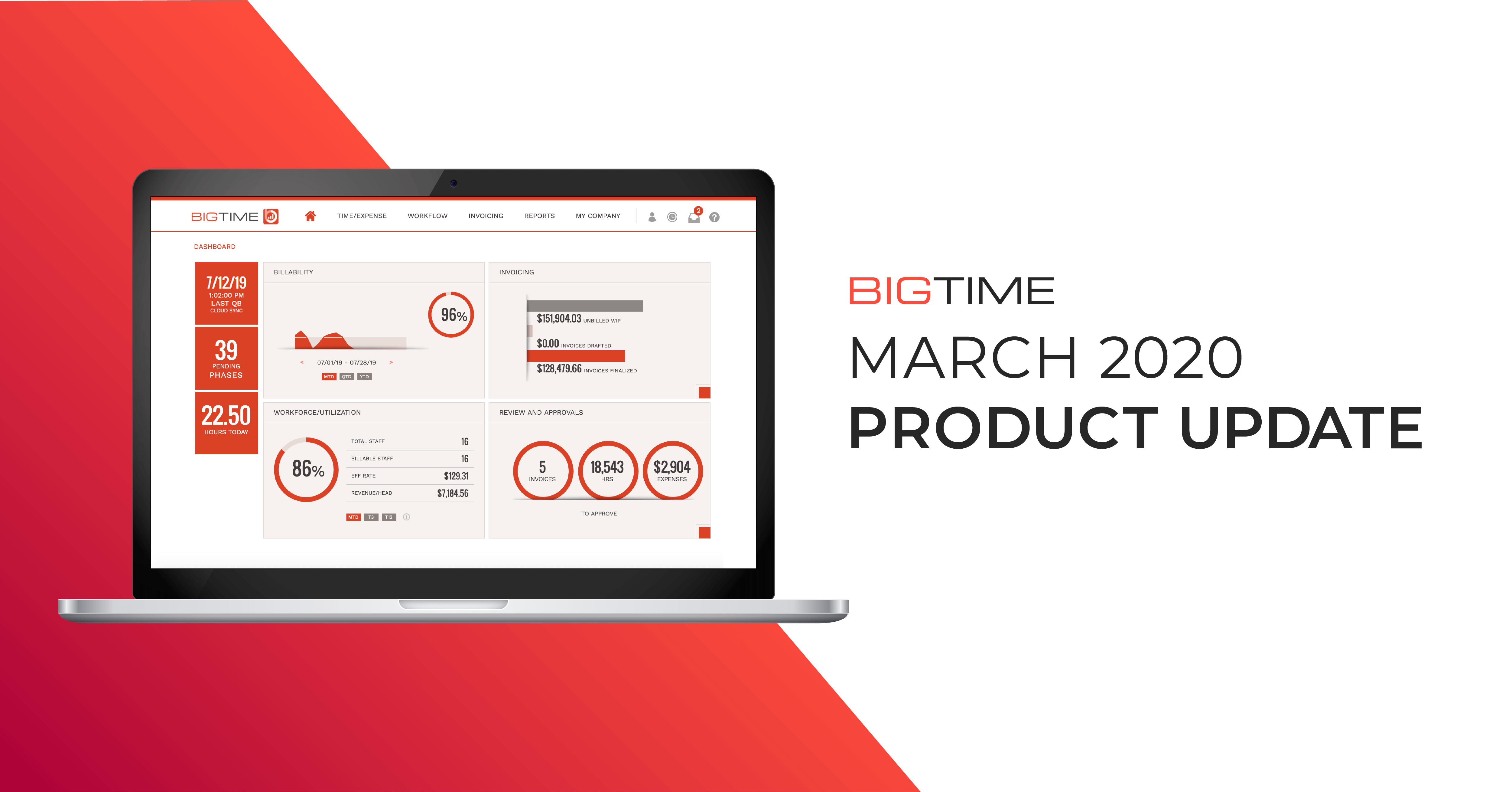

Advanced Analytics

Modern time and billing solutions go beyond reporting; they also offer real-time business intelligence. With dashboards and analytics tools built specifically for accounting firms, leaders gain a deeper understanding or key data and track utilization rates, project profitability, budget vs. actuals, and billing efficiency. These insights help firms identify their most valuable service lines, optimize pricing, and plan for long-term growth with confidence.

The Best Time and Billing Software for CPA and Accounting Firms

Looking for a perfect tool for time tracking and billing for accounting services? There are many choices available on the market, but only a few of them truly stand out. Here are the best of them.

BigTime

BigTime is purpose-built for CPA and accounting firms seeking a robust, all-in-one solution for managing time, billing, and project-based financial workflows. Designed with the complexities of accounting services in mind, BigTime streamlines everything from time entry and expense tracking to invoicing and financial reporting.

Whether you’re managing tax season, audit engagements, advisory services, or client retainers, BigTime empowers firms to operate more efficiently, bill more accurately, and scale with confidence. Its deep integration with accounting platforms and professional service tools makes it a top choice for modern firms aiming to improve utilization, compliance, and profitability.

Why BigTime Stands Out for CPA and Accounting Firms

Purpose-Built Time and Expense Tracking

BigTime helps CPA firms track time and align with accounting workflows. Users can log billable and non-billable hours from mobile or desktop, with timesheets that pull in calendar events, project assignments, or prior entries to reduce administrative work. This ensures precise timekeeping during busy periods like tax season or audit deadlines.

Flexible Billing Features and Invoicing

To ensure accurate billing, BigTime supports a variety of billing models used by accounting firms, including hourly, fixed-fee, milestone-based, and retainer structures. The system can also create invoices – the system pulls directly from approved time and expenses, reducing billing cycles and minimizing errors. Firms can customize invoice formats to align with client expectations and regulatory requirements, streamlining cash flow and improving collections.

Engagement and Project Management

With BigTime, project managers can track engagements across audit, tax, consulting, and bookkeeping service lines with configurable project templates, budget alerts, and phase tracking. Whether managing recurring monthly accounting work or complex year-end audits, BigTime provides visibility into project timelines, team assignments, and profitability at every stage.

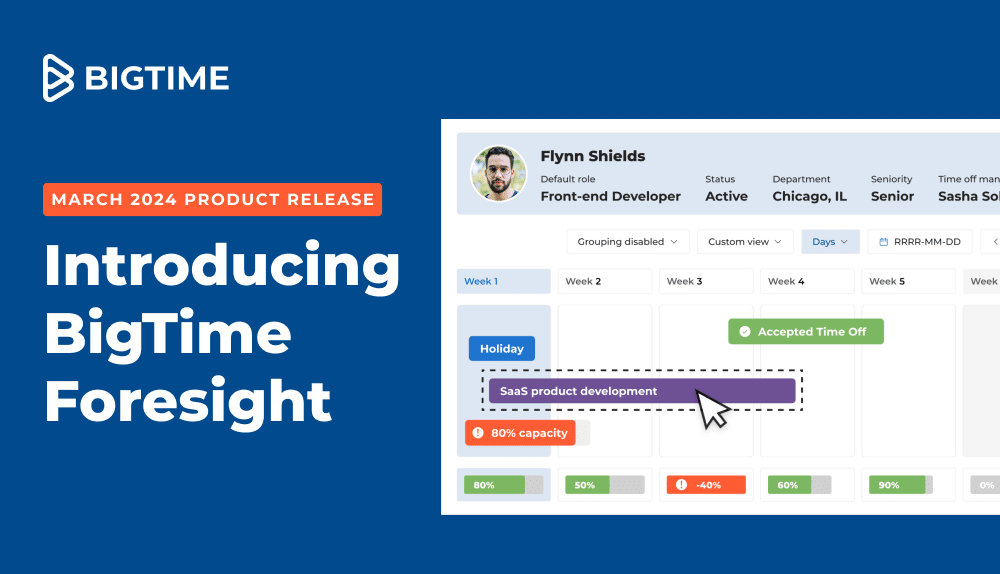

An example of capacity report in BigTime

Capacity and Utilization Planning

BigTime’s drag-and-drop resource planning tools can help you optimize your plans during peak seasons. Managers can view team workloads, allocate resources by skillset, and forecast future demand based on project pipelines. Real-time utilization rates help identify under- or over-staffed roles and balance workloads in both short- and long-term planning.

Real-Time Budgeting and Profitability Insights

Gain full visibility into your firm’s financial performance with built-in budgeting tools and real-time profitability tracking. Compare estimated versus actual hours, monitor engagement margins, and analyze profitability by client, service line, or partner and take project cost management to a whole new level.

Seamless Integration with Your Tech Stack

Document management in ten different tools is burdensome, to say the least? BigTime integrates with key accounting platforms like QuickBooks, Sage Intacct, and Xero, along with CRM and workflow tools such as Salesforce, Lacerte, and Slack. These integrations eliminate redundant data entry, ensure accuracy across systems, and create a streamlined tech environment that supports the entire accounting lifecycle.

Clockify

Clockify is a basic time tracking solution that offering While it delivers solid value, it lacks some of the more advanced billing, resource planning, and compliance features needed by mid-sized or growing CPA firms. Clockify works best for small accounting teams or solo practitioners who need a basic way to log hours.

Clockify Key Features:

- Time tracking. Basic functionality works well, but lacks automation or context-based time entry (like pre-filled timesheets or project-specific reminders) that save time during tax season or audit crunches.

- Basic reporting. Reports are available, but lack real-time budget tracking, profitability analysis by service line, or multi-dimensional filters that most accounting firms would expect.

- Integrations with accounting tools. Integration is available, but somewhat limited in scope—mainly for syncing time logs rather than enabling full billing workflows or syncing financial data.

- No native billing automation. Invoicing requires connecting to third-party tools. There is no support for recurring retainers, complex billing structures, or WIP tracking—common needs for CPA firms.

Harvest

Harvest is a straightforward time and expense tracking tool with lightweight invoicing capabilities. Though it’s often praised for its user-friendly interface, Harvest’s limited depth makes it better suited for freelancers or very small firms rather than complex accounting practices. It lacks native resource planning, audit trail management, and multi-level engagement tracking—features essential to CPA firms handling multiple client accounts, recurring tax engagements, or multi-phase audit projects.

Harvest Key Features:

- Time and expense tracking. Offers clean, intuitive entry for time and expenses. However, lacks features like bulk time approvals, project task dependencies, or industry-specific tracking categories (e.g., tax prep, audits).

- Basic invoicing and payments. Invoices can be generated from time entries, but there’s little flexibility for more complex billing needs—like tiered pricing, consolidated client statements, or tax-specific billing codes.

- Reporting tools. Includes basic time and cost reports. No support for granular profitability tracking, engagement forecasting, or dashboards tailored to partners or firm admins. 0

- No resource or capacity planning. A major drawback for CPA firms during peak periods. You can’t easily plan staff workloads or optimize based on utilization rates—essential functions for firms managing dozens of client files.

Canopy

Canopy positions itself as an all-in-one practice management solution for tax and accounting professionals, offering modules for client management, document storage, and workflow automation. However, its time and billing capabilities are relatively underdeveloped compared to dedicated tools. CPA firms may find Canopy’s billing and invoicing features rigid, with limited flexibility in customizing billing structures for different client needs.

Canopy Key Features

- Client management. One of Canopy’s stronger points, providing centralized client data, task assignments, and communication logs. However, data entry can be clunky and requires frequent manual updates.

- Document management. Offers secure document storage and sharing, useful for client collaboration. But the system lacks advanced tagging or automation workflows that firms handling high-volume document flows often need.

- Workflow automation. Provides basic task templates and status tracking, but lacks built-in logic for deadlines based on filing calendars or compliance deadlines—important for tax firms managing regulatory timelines.

- Time tracking and billing. The weakest link in the platform. Lacks billing model flexibility, automation of recurring fees, and detailed WIP reports. Invoices are overly simplistic and lack the customization needed for firms with diverse clients and service types.

- Modular pricing model. Canopy requires firms to purchase features in separate modules. This drives up total cost of ownership quickly and limits flexibility, especially for firms who only want time and billing functionality without being locked into the full ecosystem.

Choose The Best Time and Billing Accounting Software Right Away…

…and don’t do this while blindfolded. Book a demo with BigTime right now or start a trial to see how BigTime:

- Streamlines communication between team mebmers with live updates to every type of data.

- Improves resource allocation – with our notifications, no overbooking will slip through the cracks!

- Helps managers supervise project budgets for both time and material and fixed fee projects.

- Seamlessly turns billable hours into customizable, branded invoices.

- Increases your recovered revenue and speeds up cash flow with quick payment processing – just like we did for Priority Designs. Works for recurring invoices, too!