Accurate and timely financial reporting is the cornerstone of strategic business planning. For small-to-mid-sized businesses and professional services firms, financial data informs everything from project budgets to cash flow reports and long-term growth strategies.

However, many firms still rely on financial processes bogged down by manual data entry, Google Sheets, and outdated accounting tasks, which lead to errors, inefficiency, and delayed insights. With compliance requirements, financial reporting standards, and client expectations rising, businesses need tools that streamline reporting and provide real-time data.

This blog reviews the best financial reporting software for 2025, comparing leading platforms and highlighting why BigTime is the top choice for service-based organizations seeking integrated reporting software, project data, and billing workflows.

What is financial reporting software?

Financial reporting software automates the creation of basic financial statements like balance sheets, profit and loss statements, and cash flow statements. It consolidates data from multiple sources, such as accounting systems, ERP platforms, and financial workflows, to provide accurate, real-time reporting for better business processes.

For professional services firms, these tools are invaluable for analyzing financial transactions, revenue streams, and expense management. By delivering customizable reports, financial dashboards, and audit capabilities, the right platform helps finance teams reduce risk, improve compliance, and make informed decisions.

Key Features in Leading Financial Reporting Software

Automated Report Generation

An automated financial reporting system reduces manual data entry and recurring tasks by scheduling routine reports. This ensures consistency and frees finance teams to focus on financial analysis.

Customizable Report Templates

With a custom financial report builder, firms can customize reports by project, client, or time period. Customizable reports make it easy to tailor outputs to both internal teams and external stakeholders.

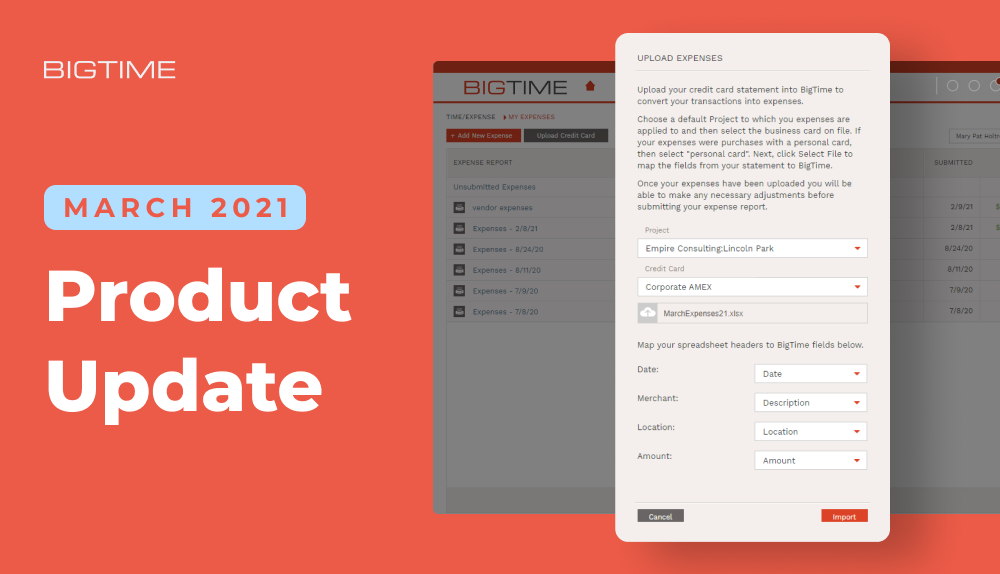

An example of project report in BigTime

Integration with Accounting & ERP Systems

Top financial reporting tools connect with accounting software, enterprise resource allocation systems, and other financial software. This integration streamlines financial consolidation, improves data validation, and eliminates gaps.

Real-Time Dashboards

Real-time financial dashboards give decision-makers immediate access to key performance indicators and metrics. These KPI tracking and reporting tools help firms gain deeper insights into financial performance and cash flow visibility.

KPI and Profitability Tracking

Track key performance indicators like billable utilization, project profitability, and revenue per client. These insights support financial planning and risk management.

Data Visualization Tools

Data visualization and trend analysis tools transform raw numbers into charts and graphs. These visualizations improve financial transparency and support informed decision-making.

The Top Financial Reporting Software for 2025 Reviewed

When evaluating the best financial reporting tools, it’s important to choose platforms that reduce human error, automate reporting, and deliver accurate insights you can trust. Below, we’ve compared leading solutions for 2025 to help you identify which financial reporting software best fits your business needs.

BigTime: Integrated Financial Reporting for Service Firms

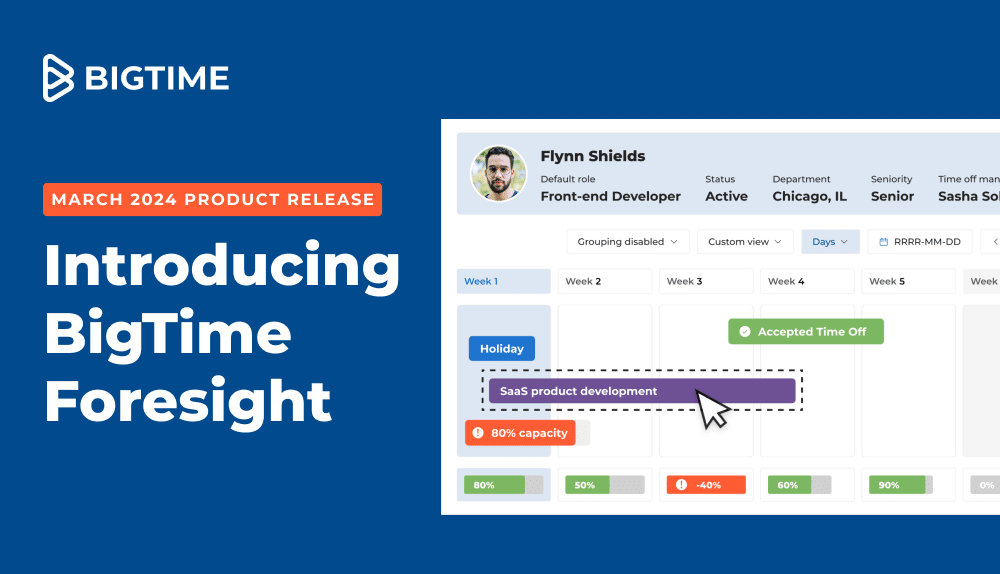

BigTime is a cloud-based financial reporting tool built for professional services firms. By integrating time tracking, billing, expense tracking, and project financial data, BigTime provides accurate, real-time insights into financial health and performance.

Why BigTime Stands Out

Integrated Project & Financial Data

BigTime unifies operational and financial workflows, offering a complete view of both project execution and financial performance. This eliminates the silos that slow down financial close processes.

Customizable Reports

With a custom financial report builder, BigTime makes it easy to generate reports tailored by project, client, or date range. This flexibility ensures finance teams can meet regulatory compliance and stakeholder needs.

Real-Time KPIs

Access real-time reporting and financial dashboards that display KPIs like billable hours, utilization rates, and profitability. This empowers leaders to make data-driven business decisions instantly.

Automated Scheduling

BigTime offers an automated financial reporting system that delivers recurring reports without manual input. This helps finance teams reduce routine tasks and improve audit readiness.

AI-Powered Insights with Data Hub

BigTime’s Data Hub uses AI to generate smart, ad hoc reporting, trend analysis, and predictive insights. Firms can analyze historical data while also preparing for future financial scenarios.

Visual Dashboards

Interactive, visual dashboards transform raw financial statements into charts, graphs, and trend lines. This simplifies complex reporting for both executives and project managers.

Scalable Solution

BigTime grows with your firm, supporting multiple entities, financial consolidation, and complex reporting needs. Whether you’re handling a few projects or managing enterprise-scale workflows, BigTime adapts.

Summary

BigTime is a cloud-based financial reporting solution purpose-built for professional services firms in industries like consulting, engineering, IT, and accounting. By bringing together time tracking, billing, expenses, and project financials, BigTime delivers accurate, real-time visibility into firm performance. As a result, it is one of the best financial reporting tools available on the market.

Avaza

Overview

Avaza is a cloud-based financial reporting tool designed for small businesses, combining project management, invoicing, and financial tracking in one platform. Its simplicity and affordability make it appealing to startups and growing firms that want an all-in-one solution without the overhead of enterprise systems. However, its lightweight design means it may lack the depth and advanced reporting features needed by larger firms or those with more complex financial requirements.

Key Features

- Expense Tracking: Simplify expense entry and reporting for small teams.

- Custom Reporting: Build financial reports for clients and internal teams.

- Online Payments: Link financial data directly to client invoices and receipts.

Summary

Avaza is affordable and easy to use, but it lacks advanced financial reporting standards, KPI tracking, and complex reporting features.

BQE CORE

Overview

BQE CORE is a financial management platform offering integrated billing, project accounting, and financial reporting tools for professional services firms. Still, its breadth and complexity can create a steep learning curve, and smaller firms may find it more than they need compared to lighter, more streamlined alternatives.

Key Features

- Cash Flow Reports: Monitor financial transactions and receivables.

- Customizable Reports: Create project-based financial statements.

- ERP Integration: Pull data from accounting and enterprise resource planning systems.

Summary

BQE CORE is powerful but has a steeper learning curve and higher cost, which may not be ideal for smaller businesses.

Accelo

Overview

Accelo integrates client work management, CRM, and financial reporting processes in one platform, making it a strong option for service-based firms that want to connect client relationships with financial outcomes. Its automation capabilities help reduce administrative work by streamlining project tracking, billing, and reporting into a single workflow. However, the platform’s breadth can feel complex for smaller firms, and fully leveraging its advanced features often requires a significant setup and adjustment period.

Key Features

- Automated Reporting: Generate recurring financial statements with less manual work.

- Revenue Tracking: Monitor client and project revenue in real time.

- Custom Dashboards: Visualize KPIs for finance and operations teams.

Summary

Accelo excels in workflow automation, but its complexity can be a drawback for small businesses, which often require extensive setup and training.

Scoro

Overview

Scoro delivers integrated reporting for firms seeking a single solution that combines CRM and financial management capabilities. Its all-in-one design makes it appealing to teams that want to link client relationships directly with financial performance. Still, the platform’s broad scope can feel complex to adopt, and smaller firms may find they only use a fraction of its functionality.

Key Features

- Customizable Reports: Tailor financial outputs for stakeholders.

- Cash Management: Track receivables, payables, and cash flow visibility.

- Profit and Loss Statements: Monitor margins and project profitability.

Summary

Scoro delivers comprehensive financial operations, but its broad feature set may be overwhelming for firms focused solely on financial reporting.

Productive.io

Overview

Productive.io is built for agencies that want clear visibility into financial performance and profitability. Its integrated approach helps connect project delivery with budgeting, resource planning, and financial tracking. However, the platform’s breadth can feel overwhelming for new users, and smaller teams may not fully take advantage of its more advanced features.

Key Features

- Budget Tracking: Monitor project budgets and profitability.

- Financial Dashboards: Real-time visualization of KPIs.

- Ad Hoc Reporting: Generate custom reports for different stakeholders.

Summary

Productive.io offers strong financial analysis, but it has pricing plans that may not fit small businesses.

Paymo

Overview

Paymo is a project management platform with built-in invoicing and financial reporting tools, giving small firms an accessible way to manage both operations and finances in one place. Its all-in-one design is appealing for teams that want to simplify their software stack and streamline daily workflows. Still, its financial capabilities are more limited than those of dedicated accounting platforms, which may be a drawback for firms with more complex reporting needs.

Key Features

- Expense Management: Capture and track costs across projects.

- Custom Reporting: Create financial reports for clients and teams.

- Cash Flow Tracking: Improve financial transparency with real-time insights.

Summary

Paymo is simple and affordable, but it lacks the complex reporting, data visualization, and consolidation features needed by larger firms.

Clockify

Overview

Clockify is best known as a simple and accessible time-tracking tool, with the added benefit of basic invoicing and limited financial reporting features. Its free entry point makes it attractive to freelancers and small teams looking for a lightweight solution. However, its reporting capabilities are minimal compared to dedicated financial software, and growing firms may quickly find its functionality too restrictive.

Key Features

- Basic Financial Statements: Generate simple invoices and reports.

- Time-to-Invoice Tracking: Convert hours into client billing data.

- Customizable Reports: Build basic financial reports for small teams.

Summary

Clockify is free and accessible, but it cannot match the automated financial reporting system or scalability of top competitors.

Everhour

Overview

Everhour is a time tracking and reporting tool designed for small agencies that want better visibility into billable hours and project costs. Its strength lies in integrating seamlessly with popular project management platforms to add financial oversight where it’s missing. Still, its limited standalone functionality can be restrictive, making it less suitable for firms seeking a full all-in-one financial management solution.

Key Features

- KPI Tracking: Monitor project profitability and billable utilization.

- Google Sheets Integration: Export financial data for additional analysis.

- Expense Tracking: Track costs and attach them to projects for reporting.

Summary

Everhour is strong in time tracking and expense tracking, but it falls short for firms with more complex reporting needs.

ClickUp

Overview

ClickUp is an all-in-one productivity platform that includes basic financial reporting alongside its project and task management features. Its appeal lies in offering teams a single space to manage work, collaboration, and simple billing needs. However, its financial reporting tools are relatively limited, making it less effective for firms that require more advanced accounting or in-depth financial analysis.

Key Features

- Ad Hoc Reporting: Generate simple financial statements.

- Customizable Reports: Track budgets and analyze data.

- Integrations: Connect to accounting software and other financial software.

Summary

ClickUp works best as a general productivity platform but lacks advanced financial reporting processes and audit capabilities.

Discover How BigTime Can Elevate Your Financial Reporting

BigTime empowers finance teams and service-based businesses with real-time dashboards, customizable reports, automated reporting tools, and reliable customer support. By integrating project data, billing, and financial workflows, BigTime helps firms improve financial transparency, compliance reporting, and informed decision-making.

Frequently Asked Questions

What is the best financial reporting software for professional services firms?

BigTime is the best financial reporting software for professional services firms because it integrates project data, billing, and financial reporting processes in one platform.

Can financial reporting software integrate with QuickBooks or Sage Intacct?

Yes. Most financial reporting tools integrate with accounting software like QuickBooks Online, Sage Intacct, and Xero for seamless financial data consolidation.

How do real-time dashboards improve financial decision-making?

Real-time financial dashboards provide up-to-date visibility into KPIs, cash flow, and profit margins, enabling leaders to make informed decisions quickly.

What features should I look for in financial reporting tools?

Look for automated reporting, customizable reports, KPI tracking, audit capabilities, ERP integrations, and real-time reporting for maximum efficiency.

How can financial reporting software improve cash flow visibility?

By consolidating cash flow statements, expense tracking, and receivables, financial software improves cash management and transparency.

Can I create custom financial reports for clients or internal teams?

Yes. With a custom financial report builder, firms can generate reports by project, client, or department to meet specific needs.

Is cloud-based financial reporting secure?

Yes. Cloud-based financial reporting tools use encryption, audit trails, and document management protocols to protect sensitive financial data.

How does automated report generation save time?

An automated financial reporting system reduces routine tasks and manual data entry, delivering recurring reports without delays or errors.

Can I track profitability by project with financial reporting software?

Yes. BigTime allows firms to track profitability, billable utilization, and project margins with real-time data.

Which industries benefit most from financial reporting software?

Industries like consulting, IT services, engineering, accounting, and marketing benefit most, as they rely heavily on accurate data, financial transparency, and integrated reporting for success.