Managing finances in professional services firms is inherently complex. With multiple projects, recurring bills, and ever-changing client needs, it’s easy for costs, monthly spending, and cash flow to spiral out of control without the right financial software. From project-based budgeting and expense tracking to invoicing and forecasting, the best financial management software empowers firms to make smarter financial decisions, improve profitability, and gain full visibility into financial data.

Here, we review the top financial management tools for services firms and explore how BigTime’s functionality stands out in providing real-time insights, customizable reports, and seamless integration with your existing systems.

What is financial management software?

Financial management software is a digital solution that helps businesses organize, track, and optimize their finances. For consulting, engineering, IT services, and accounting firms, this includes tracking time and transactions, managing expenses, forecasting income, and automating billing processes. Similar to some of the best personal finance software, the best business software allows firms to monitor cash flow, understand net worth, and manage project budgets with accuracy and ease, all from one app that works across desktop and mobile devices. Unlike personal finance software, however, the best financial management software is designed with robust features to support businesses of all sizes.

Professional services firms benefit from financial software that simplifies complexity by integrating budgeting, invoicing, revenue recognition, and time/expense tracking, helping leadership teams save time, cut costs, and drive innovation.

Key features in leading financial management software

Budgeting and forecasting

Robust budgeting tools allow services firms to control project finances and compare planned budgets against actual performance. Forecasting features help predict future income, spending, and profitability using historical and real-time data, ensuring you’re always one step ahead of your financial future.

Time and expense tracking

Accurate time and expense tracking is critical to managing billable work and controlling monthly bills. Leading software enables users to log time from anywhere, categorize transactions, and tag expenses to specific clients or projects. This ensures firms don’t miss a dollar in reimbursable costs or unbilled hours.

Invoicing and revenue recognition

Financial software for services firms must streamline billing processes and ensure accurate revenue recognition. Whether billing hourly, by milestone, or using fixed fees, top tools tie directly into tracked time and project data to generate professional, compliant invoices, which reduces errors and delays.

Project-based profitability tracking

Robust financial management software offers project portfolio views that let you assess profitability by client, team, or engagement. Customizable dashboards help monitor income, expenses, and investments to help you make data-driven decisions that boost margins and reduce overhead.

Custom financial reports and dashboards

Customizable reports help finance managers generate meaningful insights into monthly spending, budgeting trends, and account balances. Dashboards can be configured to highlight key financial KPIs—like cash flow, billable utilization, and savings—tailored to specific users or roles.

Integrations with accounting systems

Integrating seamlessly with platforms like QuickBooks, Sage Intacct, and Xero allows firms to sync data in real time. These integrations eliminate manual data entry, reduce errors, and improve collaboration between project accounting and project teams, making it easier to manage taxes, loans, and overall financial life.

The best financial management software for 2026 reviewed

With dozens of platforms promising smarter money management, we’ve narrowed down the best financial software options based on their ability to meet the unique needs of services-based firms.

BigTime

BigTime is built specifically for professional services firms and offers a unified platform for budgeting, invoicing, time tracking, and financial reporting. With real-time insights into project and firm-wide finances, BigTime enables teams to act on accurate, actionable data.

Why BigTime Financial Management Software Stands Out

Track Budgets in Real Time Across Projects and Clients

BigTime provides project-specific budgeting tools that update dynamically as time and expenses are logged. Teams can monitor spending, compare actuals to estimates, and adjust allocations instantly, reducing cost overruns and improving financial control.

Automate Invoicing and Tie It Directly to Tracked Time and Expenses

By pulling in approved time entries and expenses, BigTime generates professional invoices that match the work completed, saving hours of manual work and ensuring accuracy. Flexible templates and billing rules allow firms to customize invoices based on contracts and client preferences.

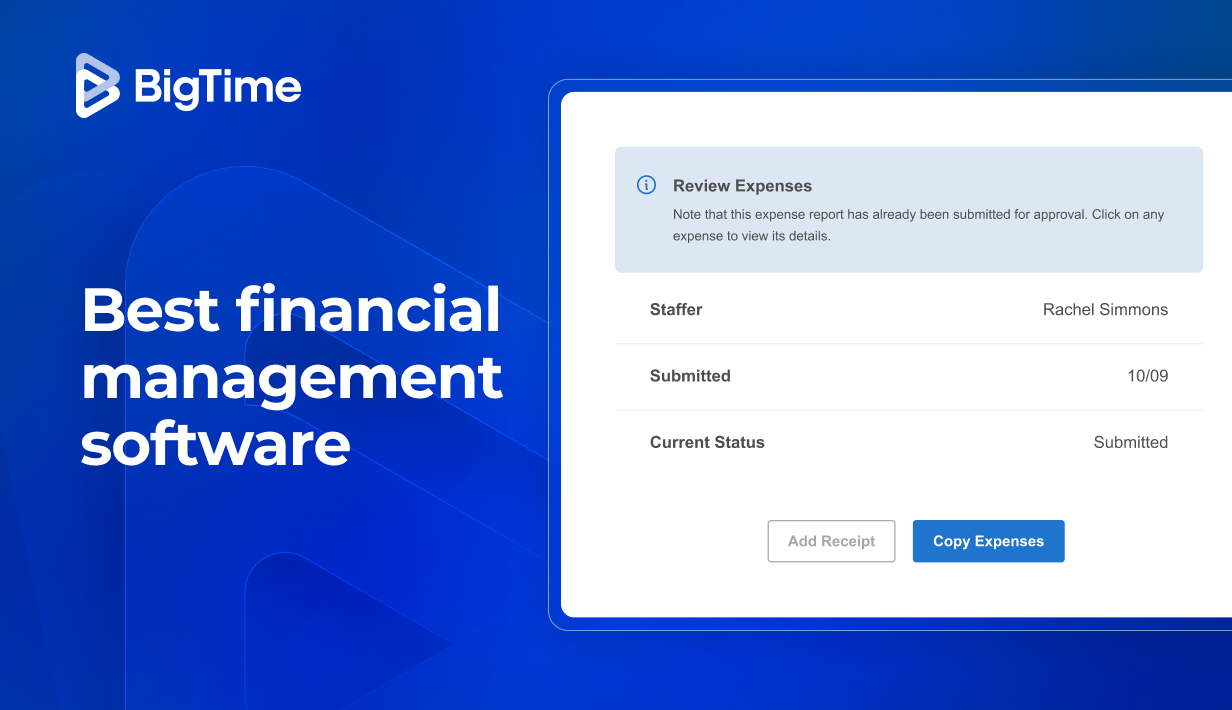

An example of project budget report in BigTime

Forecast Future Revenue with Predictive Insights

BigTime helps firms look ahead by analyzing pipeline activity, resource allocation, and historical data to forecast future income. This forecasting tool enables better planning around staffing, investments, and business growth.

Monitor Project Profitability with Customizable Reports

With drill-down dashboards and intuitive reporting features, BigTime empowers firms to analyze profitability by task, phase, team, or client. Real-time visibility into financial performance makes it easier to optimize costs and increase margins.

Integrate Seamlessly with QuickBooks, Sage Intacct, and Other Systems

BigTime’s robust integrations allow for two-way data syncing with leading accounting software. Whether you’re reconciling bank accounts or analyzing accounts payable, your data stays accurate and audit-ready.

Empower Finance Teams with Accurate, Audit-Ready Data

BigTime consolidates financial information in one place, reducing the risk of errors and improving compliance. From recurring bills to investment planning and tax preparation, the system ensures clean, transparent finance data across the organization.

Summary

BigTime is the right fit for professional services firms seeking control, clarity, and confidence in their finances. It streamlines routine tasks like tracking and invoicing while delivering the tools needed to analyze, forecast, and improve overall profitability.

Scoro

Overview

Scoro is a comprehensive business management platform that combines CRM, billing, reporting, and financial planning in one centralized solution.

Key Features

- All-in-one dashboard: Users can monitor financial performance, project progress, and KPIs from a unified dashboard, helping teams stay aligned.

- Billing automation: Scoro supports monthly bills, quote-to-cash workflows, and customizable invoice templates.

- Advanced financial reporting: With visual reports and exportable dashboards, finance teams can dig into revenue, costs, and profitability over time.

Summary

Scoro excels at consolidating business operations but may be too complicated for smaller customers. Its broad suite of features is powerful but comes with a steeper learning curve and higher cost.

Accelo

Overview

Accelo offers client work management software with integrated CRM, project management, and financial tools.

Key Features

- Client-based financial management: Manage finances in the context of client relationships, with workflows that connect sales, delivery, and billing.

- Invoicing integration: Automatically generate invoices from approved timesheets and track payments in real time.

- Task-based time tracking: Capture time at the task level to ensure accurate project accounting and analysis.

Summary

Accelo is suitable for firms focused on managing client relationships alongside financials. However, it lacks the customization and in-depth reporting needed for more complex profitability analysis.

Productive.io

Overview

Productive.io is designed for digital agencies looking to align project tracking with financial performance.

Key Features

- Visual dashboards: Easily monitor budgets, profitability, and resource allocation through sleek, intuitive dashboards.

- Project-based financial planning: Track project budgets, planned vs. actual revenue, and forecast revenue.

- Limited accounting integrations: While strong on planning, the platform doesn’t offer robust connections to traditional financial tools.

Summary

Productive.io is a strong contender for agencies that prioritize visualization and simplicity but may fall short for firms needing deep accounting capabilities.

Avaza

Overview

Avaza is a lightweight platform offering time tracking, invoicing, and task management in one cloud-based solution.

Key Features

- Simplified invoicing: Easily generate invoices from timesheets and expenses, with support for multiple currencies and tax formats.

- Time and expense management: Mobile apps and web tools make it easy to track hours and expenses from anywhere.

- Basic reporting: Generate standard financial summaries with limited customization.

Summary

Avaza is a solid option for small businesses or freelancers, but it lacks the advanced forecasting, reporting, and customization that growing firms often require.

Kantata

Overview

Formerly Mavenlink, Kantata is designed for enterprise-level professional services organizations looking for strategic financial insight.

Key Features

- Scenario modeling: Build and compare financial scenarios based on different project assumptions or staffing models.

- Advanced forecasting tools: Forecast financial performance using pipeline and utilization metrics.

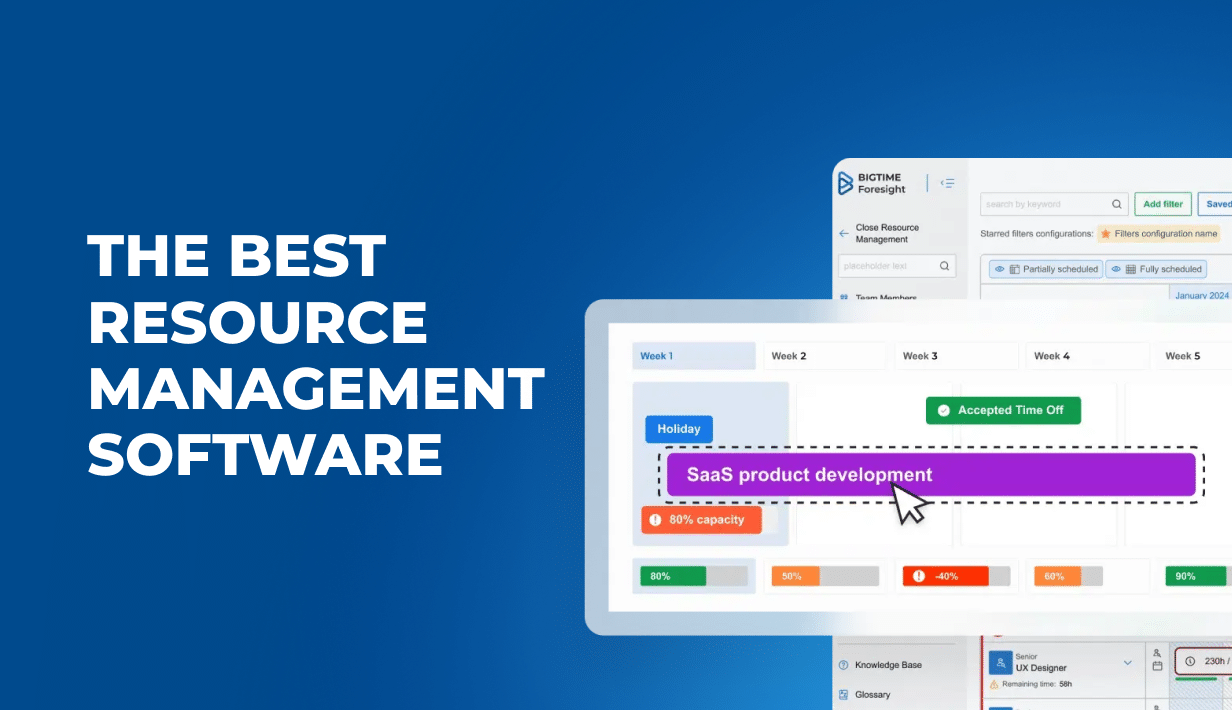

- Resource management: Align team planning with financial objectives for smarter staffing decisions.

Summary

Kantata offers powerful forecasting and planning tools, but its complexity and pricing may limit accessibility for smaller firms.

Paymo

Overview

Paymo caters to freelancers and small firms with simple project tracking and invoicing features.

Key Features

- Invoicing and payment tracking: Send invoices and monitor payments with reminders and recurring options.

- Time tracking with task management: Capture hours worked on tasks and convert them into billable time.

- Expense logging: Add and categorize expenses per project or task.

Summary

Paymo is easy to use and ideal for solo professionals, but it lacks the advanced analytics and customizable reports needed by larger firms.

Discover How BigTime Can Improve Your Financial Management

BigTime gives professional services firms the tools they need to take control of project budgets, optimize resource allocation, and automate routine financial tasks. Whether you’re monitoring cash flow, forecasting future revenue, or streamlining invoicing, BigTime helps you stay ahead with real-time data and intuitive financial reporting.

Frequently Asked Questions

What financial management software should professional services firm choose?

BigTime stands out as the top financial management software for professional services firms, thanks to its ability to track time, manage expenses, automate invoicing, and monitor profitability across projects. It’s tailored for services-based businesses, such as consulting, engineering, IT services, and accounting, that need full control over budgeting, bills, and financial data.

Can I forecast budgets in BigTime?

Absolutely. BigTime includes powerful forecasting tools that help you anticipate future revenue, monthly or quarterly spending, and resource needs. By analyzing project data, past income, and scheduled work, finance teams can confidently act on insights and build flexible, scenario-based budgets to stay ahead.

How does BigTime support project-based profitability tracking?

BigTime empowers users to track profitability at the project, client, or team level. With real-time dashboards, firms can monitor financial metrics like revenue, expenses, billable utilization, and profit margins, helping them make more informed financial decisions that improve overall return on investments and savings over time.

Is BigTime compatible with QuickBooks and other accounting platforms?

Yes. BigTime integrates seamlessly with QuickBooks (Online and Desktop), Sage Intacct, Xero, and other leading accounting platforms. These integrations ensure that all transactions, accounts, and reports stay in sync, reducing data entry errors and giving firms an accurate, audit-ready financial foundation.

Can BigTime automate billing processes?

Definitely. BigTime automates the entire billing cycle, from tracking time and expenses to generating and sending invoices. You can configure billing rules by project, client, or billing type (fixed fee, milestone, or hourly), making it easy to reduce delays, save time, and manage cash flow efficiently.

What types of financial reports does BigTime offer?

BigTime offers a wide array of customizable reports, including revenue by client, project profitability, time and expense summaries, and forecasting analysis. Dashboards provide visual snapshots of spending, income, accounts, and net worth, ideal for both high-level executives and day-to-day finance users.

How customizable are BigTime’s financial dashboards?

BigTime’s dashboards are highly configurable, allowing firms to tailor widgets and reports to highlight the metrics that matter most, like recurring bills, project budgets, savings goals, or income trends. These intuitive dashboards empower users to manage finances proactively, without needing to export data to other tools.

Can I manage both time and expenses in BigTime?

Yes, time tracking and expense management are core features of BigTime. Users can track time from any device, submit receipts on the go, categorize expenses by project or client, and ensure all billable items are captured and included in invoices. It’s ideal for mobile teams who need visibility across transactions and spending.

What makes BigTime ideal for services-based firms?

BigTime is purpose-built for professional services firms that manage multiple client projects and rely on billable time. It combines budgeting, invoicing, time tracking, forecasting, and financial reporting into one app, giving users everything they need to monitor spending, investments, savings, and financial performance in real time.

Does BigTime work on mobile?

Yes. BigTime offers a robust mobile experience so users can track time, log expenses, review financial data, and approve timesheets and bills directly from their mobile phones. This flexibility makes it easier for remote teams to stay on top of project finances and spending wherever they are.

Can BigTime help with taxes and financial compliance?

Yes. BigTime’s reporting tools and integrations help prepare audit-ready reports, track income and expenses accurately, and support financial compliance for tax season. With integrations to accounting tools like QuickBooks and Sage Intacct, your tax-related data stays organized, centralized, and accurate.

How does BigTime finance software help customers manage finances and save money?

BigTime’s finance software is designed to give customers complete visibility into their finances, from budgeting and forecasting to tracking expenses and paying invoices. With transparent pricing plans and powerful automation, the program helps firms save time and reduce manual errors in their financial workflows. By streamlining how customers manage projects, track billable hours, and generate invoices, BigTime ensures they’re paying attention to the metrics that matter most, ultimately helping them save money, improve margins, and grow smarter