Last update: July 18, 2025

What was that invoice for and where did that other bill come from? Unfortunately, for numerous professional services companies, these questions are asked way too often. Fortunately, there is one way to prevent this situation from happening — it’s called cost allocation

In this article, you’ll find:

- The definition of cost allocation

- Types of costs in cost allocation process

- A real-life examples of cost allocation

- Battle-tested cost allocation methods you could use in your business.

What Is Cost Allocation? Definition

Cost allocation is the process of matching the cost objects with the departments or operations that generate them. It is mostly used for calculating the financial performance of a company or its parts, such as teams or projects, and determining where given cost objects came from.

For example, in a typical services company, costs can be allocated to non-production departments (i.e. marketing, sales, administration), as well as projects and teams.

What is cost allocation used for?

What’s the point of calculating all of these things?

While cost allocation is very helpful when it’s time to sum up employee performance, results of particular project managers, or finances that may interest stakeholders, there are other perks.

On a daily basis, cost allocation can also help you:

- Ensure budgets are on track — both the budget of the entire company, as well as the finances of particular departments or projects.

- Identify the aspects of operations that generate excessive costs and act on that information.

- Check whether the company is spending money on the right endeavors.

In other words, cost allocation is the process of identifying the sources of the company’s costs and evaluating their importance.

Types of Costs in Cost Allocation

Cost allocation involves all the people and assets in the organization. Therefore, it includes dozens of different types of costs that project managers and executives need to take into consideration while managing project budgets and other finances.

Let’s take a look at the types of costs in cost allocation.

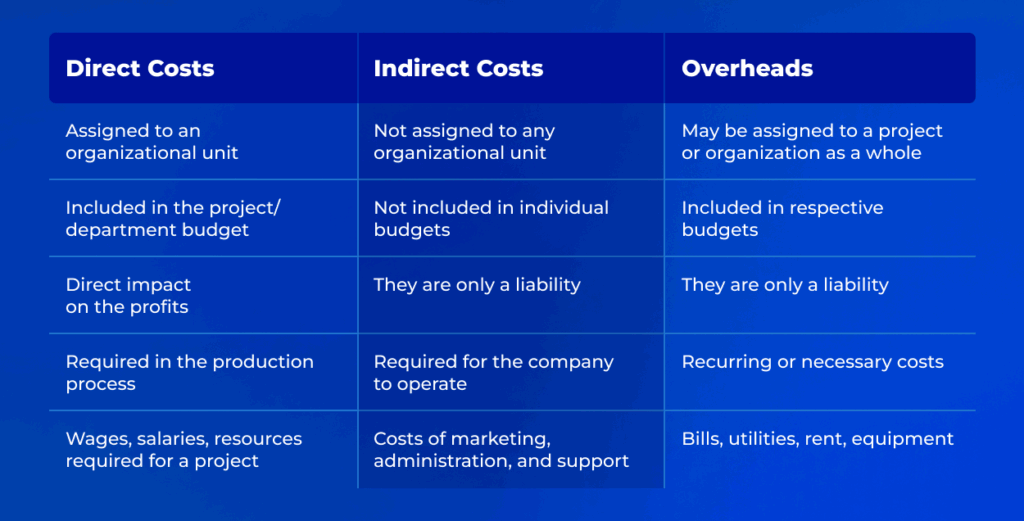

Direct Costs

Direct costs in cost allocation are fixed and variable costs that have already been attributed to certain departments, projects, or teams, and there are no doubts as to their origin. These costs contribute to the profit billable operations are supposed to generate as they are required in the production processes.

For example, in a service company, direct costs are usually included in the project budget, or even a project timeline in general. Examples of costs in this category usually include wages and salaries, but they may also include other resources required for the project or product, such as production costs or manufacturing costs. Therefore, allocating this type of cost is a piece of cake, as they are generated directly by the department, services, or other cost objects they are related to.

Indirect Costs

The definition of indirect costs in cost allocation is a bit more complicated, especially for endeavors closely related to professional services. These costs are not associated with any organizational unit in particular; they are simply the operating costs needed to keep the company running and growing.

Indirect costs usually include support staff wages and spendings made by the support staff that help the production department do its job. These include cost objects such as marketing and sales specialists, administrative employees, and any other support departments. Indirect costs also often include internal projects.

However, there is one more type of indirect cost in cost allocation that we need to consider — the overhead costs.

Overhead Costs

Overhead costs cover all the costs that need to be continually paid regardless of the company’s business performance. These are usually fixed costs incurred to keep the company or the project running, such as utilities, rent, or costs of basic equipment.

Overhead costs are usually divided into 2 categories:

- Project overheads, for example, equipment, subscriptions, and programs.

- Organizational overheads, such as utilities, bills, rent, etc.

- Cost of services needed to keep the company running, e.g. security expenses and business management.

Cost Allocation Example

Some organizations, particularly services companies, profit only from their projects, and they don’t need to allocate the costs for the entire business — they just need to share the costs between the profitable operations and departments, as well as other cost objects. Here’s what the process of identifying them looks like.

1. Define Which Costs You Want to Allocate

Begin by calculating the costs you want to allocate in the first place. For example, if you want to allocate the cost of utilities in your office, add them up to get a bigger picture.

For the sake of this cost allocation example, let’s assume that The Best Company is focused on allocating the costs of its support departments to the project for the month (also known as business overhead). The costs include:

- The costs of the marketing department: $40,000

- The costs of administration: $15,000

- The costs of the sales department: $45,000

Together, all these departments account for $100,000 of additional overhead expenses that need to be allocated.

2. Identify Cost Drivers

Depending on the type of business, you can divide the costs based on different factors, also known as cost drivers.

What Is a Cost Driver?

A cost driver is any factor, activity, or event that causes a change in the cost of an operation, process, or project. To put simply, it’s the root cause of why a cost occurs—it “drives” the cost.

The most cost drivers in professional services companies include:

- Billable hours tracked in the services

- Generated income

- Generated profit

For this example, we’ll use the first of these indicators — billable hours. This method is considered the simplest way of allocating costs proportionally.

The Best Company has 2 projects — Project A and Project B.

To complete all the activities planned in Project A for the month, the project managers and their team members will need 1,800 hours. For Project B, the number of hours needed is 1,200. Both projects combined require 3,000 hours to complete. Therefore, Project A accounts for 60% of all billable hours in the company, while Project B includes 40% of them. These are the proportions we’re going to use in this cost allocation method.

3. Allocate the Costs Proportionally

If Project A includes 60% of all billable hours while Project B accounts for 40% of them, we can now use the numbers to determine the distribution of costs between them. Let’s focus on identifying how they should each contribute to costs.

According to the examples above, the total amount of costs to be shared among billable operations is $100,000. Project B requires more hours, therefore it should account for a larger chunk of the costs — exactly 60% of them. As a result, $60,000 of the costs are allocated to the project.

Project B, meanwhile, requires 40% of all the billable hours. Therefore, it should pay 40% of the costs — $40,000.

Cost Allocation Methods

At this point, you may ask yourself, “but how to accurately allocate costs?” Fortunately, the answer to this question is not as complicated as it may seem — here are common cost allocation methods you can use for assigning costs to its sources.

Direct Cost Allocation

Direct cost allocation is a cost allocation methodology that ties expenses directly to a specific project or task — think employee wages for project-dedicated staff, contractor fees, or materials bought specifically for a job.

By tracing costs directly to where they’re incurred, you get an accurate, transparent picture of a project’s true expenses without any guesswork or complex formulas. Still, while this cost allocation method is the most straightforward, it also might not be enough for anything else than a simple project.

Indirect (Overhead Costs) Allocation

Indirect cost allocation method covers expenses that benefit multiple projects but can’t be traced to just one, like rent, utilities, or administrative support. Instead of leaving these costs out, you spread them fairly using consistent rules, such as dividing by labor hours or headcount, so you capture the full cost of doing business and price your work appropriately.

Activity Based Costing

Activity-Based Costing goes a step further by linking overhead costs to the specific activities that generate them. Rather than applying broad percentages, ABC assigns costs based on actual drivers like purchase orders processed or service tickets handled, giving you a clearer, more precise view of which parts of your project or workflow are truly consuming resources.

Top-Down Allocation

Top-down allocation starts with a total budget, whether it’s for a program, department, or entire project portfolio, and breaks it down into projects or tasks using percentages or strategic priorities. It’s a fast, practical way to set spending limits early on, ensuring teams work within big-picture funding goals even if it sacrifices some level of precision.

Parametric Cost Allocation

Parametric cost allocation uses formulas or models based on historical data and financial reporting to quickly estimate true cost of an action or a product—like dollars per square footage in construction or cost per line of code in software projects. It’s especially useful for early budgeting and comparing similar projects, offering speed and consistency without needing every detail defined at the start.

Equitable (Fair Share) Cost Allocation

Equitable allocation spreads shared costs evenly or according to agreed rules among multiple departments or projects, keeping things simple and transparent when multiple initiatives use common resources. Whether you’re dividing meeting room fees or training costs equally, this approach promotes fairness and predictability in managing shared expenses, distributing costs evenly across the company.

Benefits of Cost Allocation

While cost allocation is a burden, it’s also a huge business advantage.

With cost allocation, you can:

- Determine whether your projects are profitable and make informed decisions based on their margins

- Learn what part each project plays in covering the organizational costs.

- Check whether the company’s rates are high enough to cover all the costs and generate profits.

- Determine whether indirect costs are eating up the majority of the company’s profits.

- Identify the actual cost of services you provide to your customers.

- Find out which departments are spending more or less money, and what they use it for.

- Assign any lost spending to the people, teams, or departments responsible for them.

- Calculate the real profitability of your business as a whole and make better business decisions.

Create Cost Allocation Plan in Seconds with the Right Tools

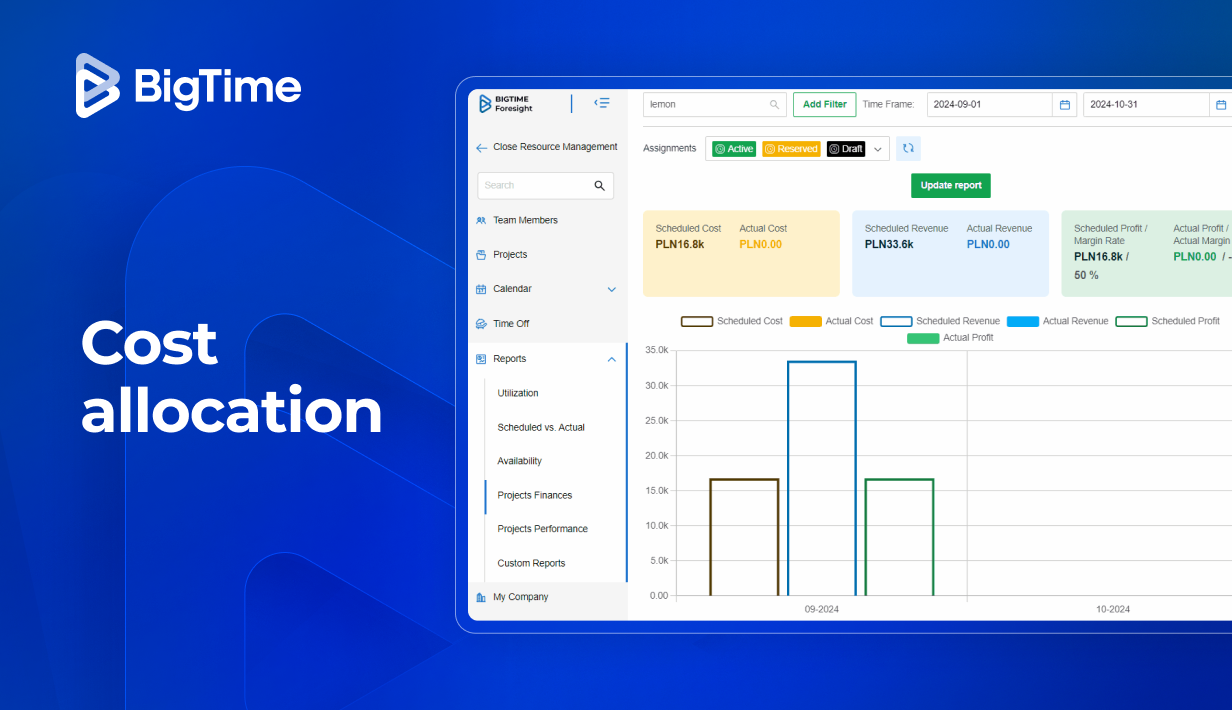

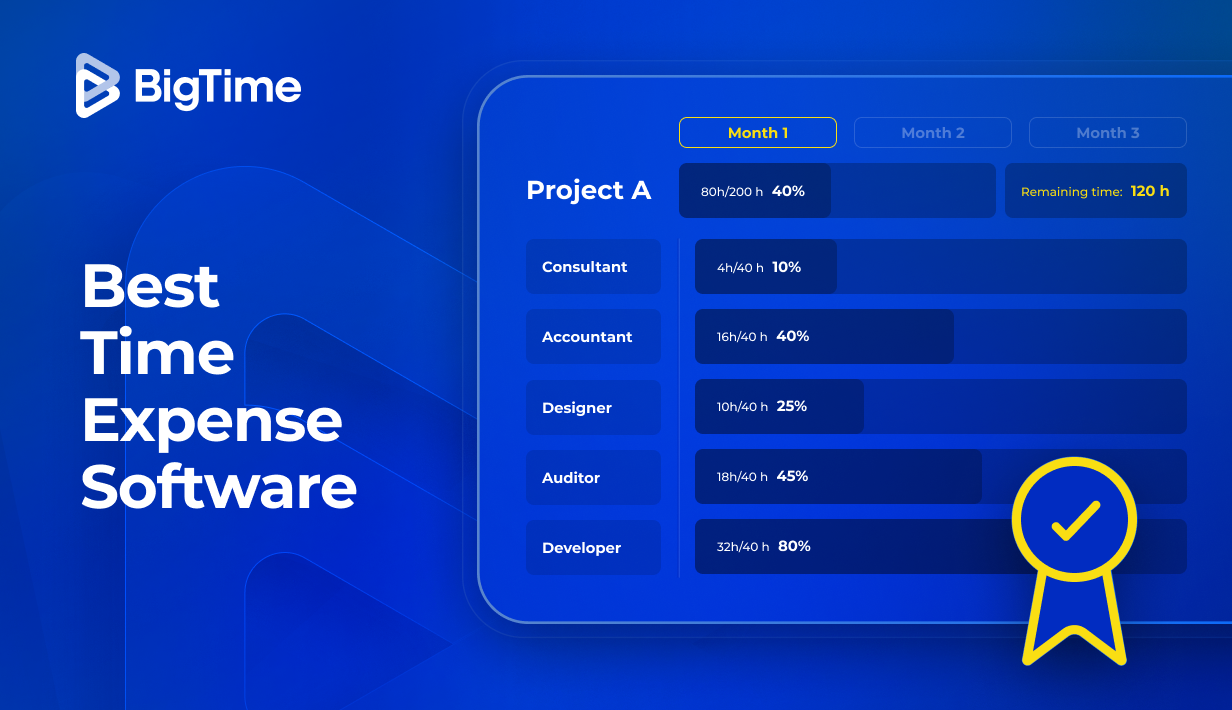

We get it – sometimes it’s hard to assign a specific cost object to its source. In spreadsheets, this task might prove to be even more difficult. Fortunately, with the right cost allocation system, that can quickly change. BigTime is one of such tools.

In BigTime, you can:

- Allocate costs of work to every single employee with hourly rates.

- Monitor the costs of work in the real time – your reports will be altered each time a new time log is added.

- Create comprehensive project budgets and modify them whenever you need.

- Monitor both project and company overheads in seconds.

- Create comprehensive financial reports to monitor every minute worked, and every penny spent.

Want to see more of BigTime’s capabilities? Book a demo and see what else we can do for you!