Healthy cash flow is the lifeblood of any business. Without a steady stream of income covering expenses, even profitable companies can struggle to survive. That’s why learning how to improve cash flow is one of the most important skills business owners and managers can develop. Whether you’re running a small firm or managing a large organization, effective cash flow management ensures you can pay bills on time, invest in growth, and stay resilient during unexpected challenges.

In this guide, we’ll explore the top 10 strategies to create a positive cash flow that apply to businesses of all sizes, alongside with a number of tips and tricks for maintaining healthy cash flow.

Key takeaways

- Improving cash flow requires cash management strategy. From reducing overheads to optimizing invoicing, businesses need a structured approach to stay liquid.

- Tools accelerate results. Specialized solutions like BigTime help companies forecast finances, monitor budgets, and optimize business cash flow in real time.

- Sustainable improvements require consistency. Regular monitoring, reviews, and adjustments are key to long-term financial stability.

What is cash flow? Definition

Cash flow is the movement of money into and out of a business within a specific period. In simple terms, it shows how much cash your company generates versus how much it spends. Unlike profit, which can include non-cash items, cash flow focuses solely on liquidity — the actual cash available to run daily operations, cover expenses, and invest in growth.

Strong positive cash flow means your company has enough resources to pay bills, fund new projects, and handle unexpected costs. Weak or negative cash flow, on the other hand, can quickly lead to delayed payments, dropping project margins, lost opportunities, and even bankruptcy if not addressed. That’s why understanding and mastering how to improve company cash flow is crucial for both short-term survival and long-term growth.

10 ways and strategies to improve cash flow

Improving cash flow isn’t about making one big change — it’s about adopting multiple strategies that work together to strengthen your financial position. Below are ten practical approaches that can help any company, regardless of size or industry.

Improve financial management

Even businesses with strong revenue can face cash flow challenges. Overheads such as oversized office rent, unused software subscriptions, travel costs, high utility bills and a variety of unexpected expenses can quietly drain profitability and leave less cash on hand for daily operations.

The first step is to audit your costs. Look for unnecessary spending you can eliminate or reduce to gain better control of cash outflows. Adding regular budget reviews helps you spot these issues early and adjust before they grow into major cash flow problems.

Another important step is to automate financial processes, such as:

- Manual invoicing,

- Expense entry,

- Payroll,

- Financial reporting.

While all of those processes contribute to a steady cash flow, they are time-consuming and prone to errors. Automation ensures invoices go out on time, expenses are categorized accurately, and reports are generated in seconds.

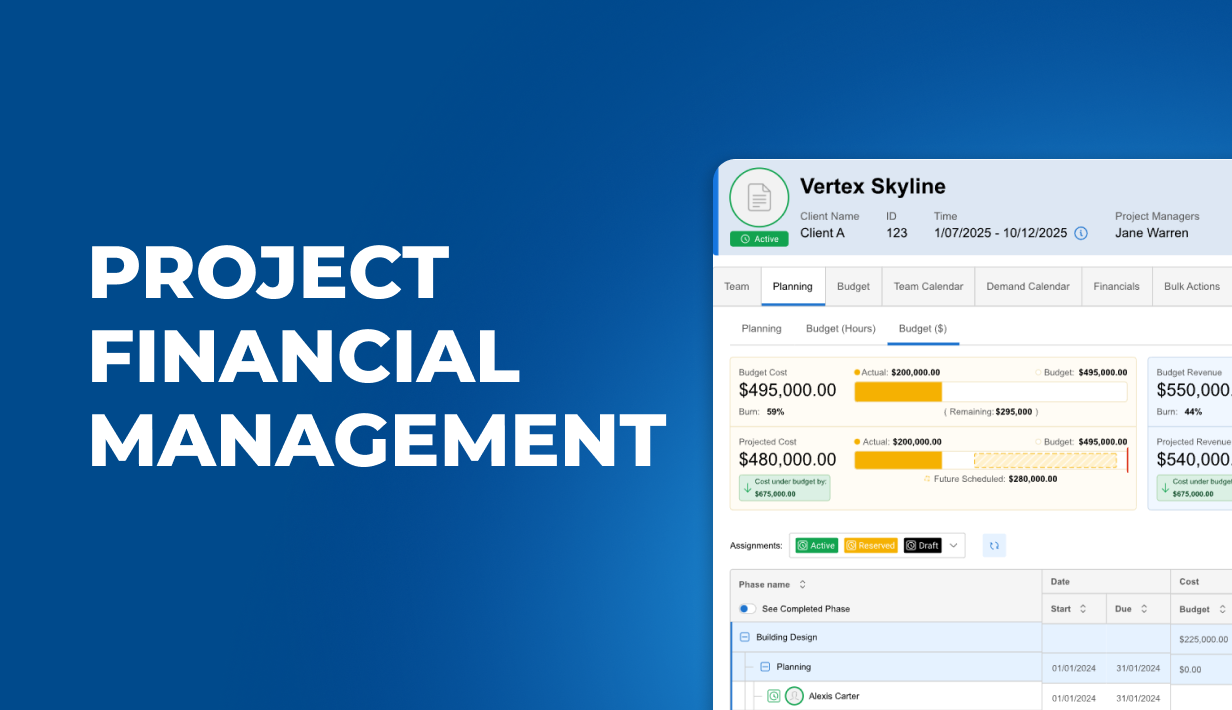

Naturally, monitoring company’s financial health is difficult with just simple spreadsheets at hand. Tools like BigTime connect project data with financials, giving managers a clear view of both costs and profitability.

Forecast pipeline

A reliable project forecast is one of the most powerful strategies to improve cash inflows. By predicting when money will come in and when it will go out, businesses can prepare for both growth opportunities and potential shortfalls.

Importantly, effective forecasts should always cover both positive and negative scenarios accounting for various cash flow fluctuations. For example, plan for what happens if a client pays late or a project gets delayed, but also account for what to do if a major deal closes earlier than expected. This dual perspective allows you to stay flexible and make decisions with confidence.

Improve utilization

Utilization rates describe how effectively a business uses its available resources, particularly employee time and skills. In professional services and project-based businesses, utilization is often measured as the percentage of billable hours compared to total available hours. Low utilization means you’re paying for resources — whether staff, tools, or equipment — that aren’t generating revenue.

Improving utilization directly supports better cash flow. When underused resources are put to work, revenue increases without the need for additional costs. For example, if employees are spending too much time on non-billable administrative tasks, your business loses potential income. Shifting that time toward client projects immediately boosts billable work and strengthens cash inflows.

Make data-driven decisions

No two companies are alike. Therefore, each business should rely on its own actual and historical data when making financial decisions.

Data-driven decision-making ensures strategies are based on facts, not assumptions. By analyzing past business performance, companies can identify trends such as recurring late payments, seasonal demand shifts, or projects that consistently exceed budgets. This insight makes it easier to allocate resources wisely, reduce financial risks, and strengthen cash flow in the long run.

To achieve this level of clarity, financial tools play a critical role. Platforms like BigTime, which is one of the best expense report tools, integrate project, time, and cost data, providing managers with real-time dashboards and detailed reports. With these insights, leaders can evaluate profitability across projects and make confident decisions that directly increase cash flow.

Lower the costs of supplies and subscriptions

Many companies overspend on supplies, vendor services, or software subscriptions they rarely use. In others, improper inventory management leads to excessive spending. These costs may seem small individually, but together they can significantly reduce profitability and restrict available cash.

To strengthen cash flow, start by auditing your existing contracts and subscriptions. Cancel or downgrade services that are no longer essential, and ensure you aren’t paying for duplicate tools across departments.

Another effective tactic for improving net cash flow is negotiating favorable payment terms with suppliers. Conversely, you might secure discounts for paying early if your cash position allows it. Both approaches give you greater flexibility in managing liquidity while maintaining strong vendor relationships.

Keep an eye on invoicing

Late or inconsistent invoicing is one of the most common reasons your cash flow statement suffers. Even if projects are profitable, delays in billing or client payments can create serious gaps between money earned and money available.

To improve cash flow, businesses should collect payments faster by tightening their invoicing process. Send invoices immediately after work is completed, set clear payment deadlines, and follow up promptly on overdue accounts. Offering incentives for early payments or implementing late fees can also encourage clients to settle balances on time.

But how to do that in the first place? Integrating invoicing with project tracking tools ensures greater accuracy and speed. Platforms like BigTime automate invoice creation directly from logged hours and expenses, reducing delays and errors, shortening the gap between project completion and cash in hand.

Use electronic payments

Relying solely on traditional payment methods like checks can significantly slow down cash flow. Physical payments often involve mailing delays, processing times, and bank holds, all of which leave your business waiting longer to access the money it has already earned.

Switching to electronic payments is one of the simplest ways to collect payments faster. Options like credit cards, ACH transfers, or online payment portals allow clients to settle invoices quickly and securely. When paired with invoicing automation, electronic payments streamline the entire billing cycle.

Review and update budgets

Project budgets are never static — they need to evolve as projects and business conditions change. Without regular updates, businesses risk running operations on outdated assumptions, which can quickly lead to cash flow shortages.

One of the biggest threats to financial stability is scope creep. When projects expand beyond their original plan without proper budget adjustments, costs spiral out of control while revenue stays the same. This gap directly impacts cash flow, leaving companies scrambling to cover unexpected expenses.

Ultimately, strong project cost management is the cornerstone of project profitability. Tools like BigTime simplify this process by connecting budget data with real-time project updates, giving leaders the visibility they need to make quick adjustments and maintain healthy cash flow.

Use savings accounts with high interest rates

Another way to create a strong cash flow is by making your money work for you, even when it isn’t immediately needed. By moving surplus funds into high-interest savings accounts, you can generate additional income without extra effort. For businesses managing tight margins, the extra income from interest can help offset operational costs and create a small but steady boost to cash flow using just some idle cash.

While this strategy won’t solve larger financial issues on its own, it complements other cash flow improvements by maximizing the value of every dollar your business holds.

Raise prices

One of the most direct ways to improve cash flow is to raise prices. Increasing rates on products or services can immediately boost revenue without adding extra work, resources, or other financial obligations.

However, while raising prices might improve overall financial health of your company, it comes with risks. Customers may resist higher rates or switch to competitors if they don’t see added value. To mitigate these risks, businesses should communicate price changes clearly, emphasizing improvements in quality, service, or overall customer experience. Another approach is to introduce tiered pricing or bundled packages, giving clients options while protecting your profitability.

Still, some customers migth not be happy with rising numbers on their invoices. To ensure that their discontent is not reflected in the churn rates and, consequently, your net income, offer early payment discounts or lower prices for customers with verified credit checks to increase the added value of your services.

How to improve cash flow in small business?

For small businesses, cash flow management is often the difference between stability and survival. Limited resources mean there’s less room for error, so even small delays in payments or unexpected expenses can cause major financial strain. In addition to the strategies we’ve already covered, there are several approaches that work particularly well for smaller companies.

- Negotiate with suppliers: Small businesses can often gain breathing room by securing extended payment schedules, terms, or discounts for early payments. This flexibility helps keep cash available longer and reduces short-term pressure.

- Encourage upfront payments: Offering small incentives for customers who pay before work is completed can significantly improve liquidity and mitigate potential risks.

- Build a cash reserve: Even a modest emergency fund can make a big difference for small firms. Setting aside a percentage of each payment into a reserve account provides a safety net against late client payments or seasonal slowdowns.

- Use cloud-based tools for efficiency: Instead of relying on manual spreadsheets, small businesses should use affordable, digital tools to automate invoicing, track expenses, and monitor financial performance. This reduces errors and ensures faster access to cash.

By adopting these additional steps, small businesses can create greater financial resilience and ensure cash flow supports—not hinders—their growth.

Effective cash flow management starts with the right tools

While strategies like cost-cutting, forecasting, and faster invoicing are essential, they can only take you so far without the right systems in pla.,ce. Cash flow management is most effective when supported by specialized tools that bring financial, project, and resource data together in one place.

One of the best tools for this purpose is BigTime. Designed for professional services and project-based companies, BigTime goes beyond simple accounting software by linking project performance directly to financial outcomes. With BigTime, you can:

- Forecast cash flow accurately by combining project pipeline, budgets, and expenses into real-time projections.

- Automate invoicing and payments to reduce delays, improve accuracy, and collect money faster.

- Track utilization rates and ensure employees are working on the most profitable tasks.

- Gain actionable insights through detailed financial reports and dashboards, helping managers spot risks early.

- Control budgets with precision by monitoring scope changes and expenses as projects evolve.

Unlike spreadsheets or disconnected systems, BigTime unifies financial management with day-to-day operations. This integration gives managers a clear line of sight from project planning to cash flow outcomes, making it easier to protect profitability and scale with confidence.

👉 Book a demo or start a free trial today to see how BigTime can transform your approach to cash flow management and ensure business success ever

FAQ

What is cash flow?

Cash flow is the movement of money into and out of a business over a specific period. It shows how much cash is available to cover expenses, invest in growth, and handle unexpected costs. Unlike profit, cash flow focuses only on liquidity — the actual cash your company can use.

What is cash flow management?

Cash flow management is the process of monitoring, analyzing, and optimizing the inflows and outflows of money in a business. It ensures that a company has enough cash on hand to meet obligations, invest strategically, and remain financially stable.

What are the five rules of cash flow?

The five rules of cash flow are as follows:

- Spend less than you earn – Always keep expenses below income to maintain positive cash flow.

- Collect payments quickly – Shorten the time between delivering services and receiving payments.

- Plan for the future – Forecast cash flow to anticipate both opportunities and risks.

- Control debt wisely – Avoid excessive borrowing and ensure repayment schedules don’t strain liquidity.

- Build a buffer – Maintain a cash reserve to handle emergencies and seasonal fluctuations.

What are the types of cash flow?

The three main types of cash flow are:

- Operating cash flow – Money generated from core business activities, such as sales and services.

- Investing cash flow – Cash spent on or earned from investments, such as equipment purchases or asset sales.

- Financing cash flow – Cash received from or paid to investors, lenders, or shareholders, such as loans or dividends.

Why is it important to improve cash flow?

Improving cash flow ensures your business can pay bills on time, reinvest in growth, and remain resilient during downturns. Strong cash flow also improves financial flexibility, enabling businesses to seize new opportunities without relying on external funding.

How can cash flow be improved?

Cash flow can be improved by combining strategies like cost control, faster invoicing, electronic payments, regular budget reviews, and better resource utilization. Using specialized tools such as BigTime makes the process easier by connecting financial and operational data, providing real-time insights for smarter decision-making.