It’s no secret that 2023 is being broadcast as the year of economic uncertainty. Regardless of how much change we will see in the macroeconomic environment, businesses have one untapped tool in their tool belt — the ability to get paid faster through integrated payments.

Set up your professional services firm for success with a built-in payment integration.

In times of uncertainty, why leave your hard-earned receivables to chance?

CFOs get this, as according to a study by PYMNTS.com, 94% of companies are planning to invest in digital technologies for at least one area of payments and finance. The backdrop of what could be a challenging environment in 2023 has amplified the value a business can achieve with a modern payment process.

Businesses want to improve the way they manage cash flow and they want to get paid faster. Why not start with cash coming in the door as a digital payment and not in the physical door as a paper check? Without timely cash in the bank, business owners cannot invest in the growth of their organization like hiring new employees, developing existing employees, and using technology to drive efficient growth.

BigTime Software is committed to helping professional services organizations keep their business strong, resilient, and adaptive, no matter the challenge ahead.

Keep reading to learn about 3 reasons why now is the time to prioritize a seamless integrated payments experience!

1. Your customers expect it.

Multiple payment options

Today’s B2B buyers, who are predominantly millennials now, want a consumer-like payment experience, which means digital choice. What we experience in our personal lives as bill-paying consumers is now the expectation in business transactions. We have become accustomed to selecting from various payment options — credit card, debit card, ACH, Apple Pay, Google Pay, and more. Not only do traditional payment methods like checks compound cash flow issues, 41% of businesses identify a lack of payment options as the biggest complaint from their customers.

Secure & simple payment links

Offer customers the most useful checkout method — a payment link. Gone are the days where a business or consumer making a payment would have to go through extra hoops like navigating to another platform or banking website. A payment process that enables customers to pay directly from an electronic invoice makes it easy for your customer to pay and much more likely to pay before the invoice due date. In fact, according to a new report, 91% of invoices sent through BigTime are paid on time.

Customers now have added flexibility with scheduled payments from BigTime where they can select a future date within your invoice terms — letting your customers take action immediately so they don’t forget to pay.

Online customer portal

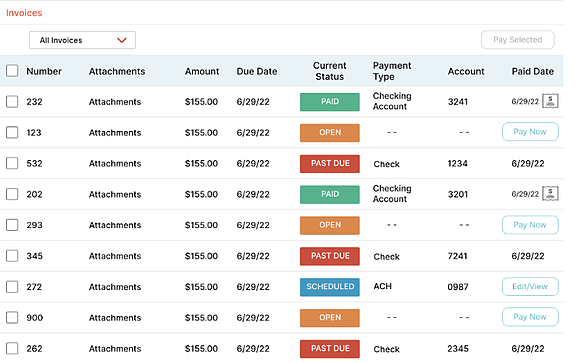

How about giving your customers one place to see all invoices paid and all invoices outstanding? One place where customers can pay one invoice or multiple invoices at a time? Self-service is becoming increasingly popular and is now available in the payments world with a customer portal.

With self-service, customers can enjoy 24/7 access and visibility to all invoicing-related information. At the same time, your business gets time back, and has another tool to speed up cash flow. Learn more tips on how to improve client experience with easy payments.

2. Your finance and accounting teams will be more productive.

I had a conversation last month with a BigTime customer about why they are looking to improve their accounts receivable process. Today, they get paid in one of three ways:

- Direct bank transfers (client paying has to initiate)

- Credit cards (multiple processors to manage)

- Checks (another lost or delayed payment)

On the surface, you would think this is a great experience as the business is offering multiple payment options. However, each payment results in a different accounts receivable process where a manual matching exercise has to occur between the invoice, payment, and accounting software.

When you are sending 50 or more invoices a month, as the BigTime customer said,

This time waste is all too common in the world of business payments where unnecessary A/R headaches are created and much-needed cash flow is unusable.

So, how can you help your finance and accounting team?

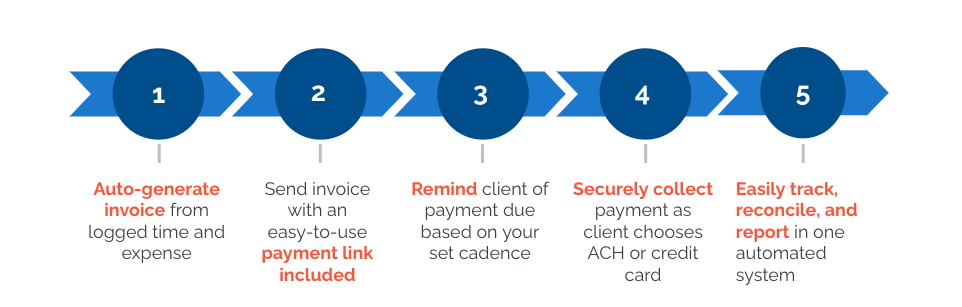

With a fully online and integrated experience! Check out the graphic below and our recent blog, How to Improve Invoicing and Get Paid Faster in 2023, for how this process should work with an operating platform/PSA software like BigTime.

3. Integrated payments improves cash flow by reducing late or missed payments.

With a new year comes newfound energy and a drive to capture growth opportunities waiting to be seized. Whatever 2023 brings us, access to cash flow will be critical in bringing growth opportunities to fruition.

- More than 40% of businesses said that they lose 4% to 5% of revenue each month due to inefficiencies with their payments process.

- Checks are painfully manual and time-consuming, not to mention take a very long time to convert to cash — especially when they get lost or stolen.

- Late payments are a major obstacle to growth and must be combatted if your organization wants to unlock more cash.

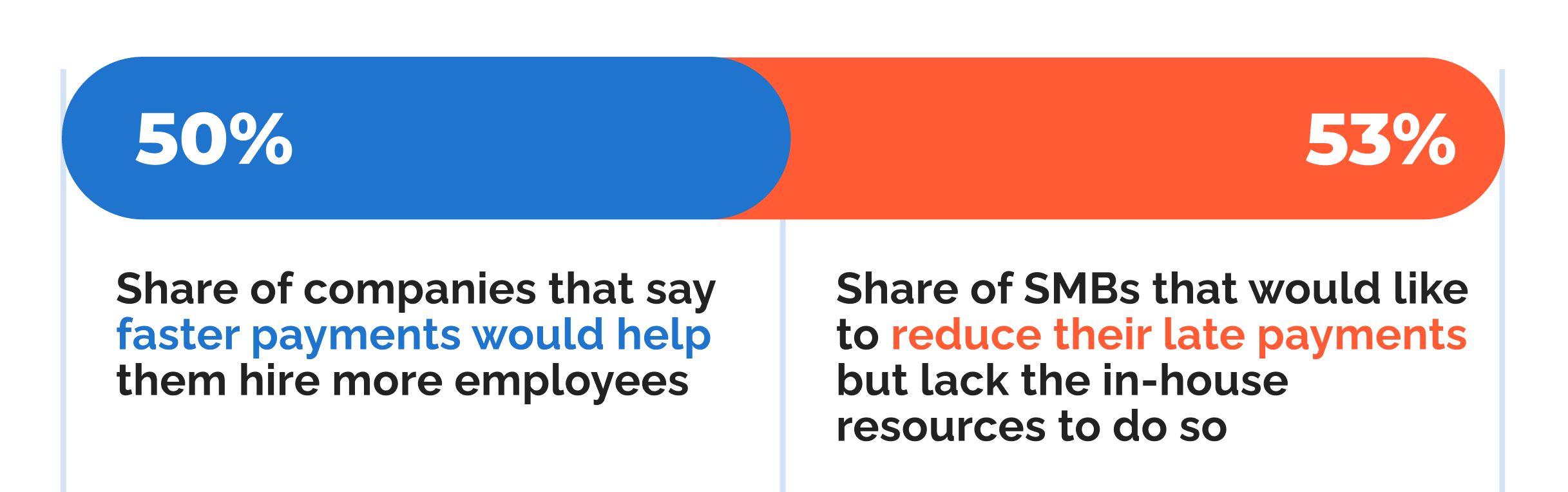

How big of a problem are late payments? PYMNTS.com shared the below stats highlighting how small and midsize businesses feel trapped in knowing they have an issue but acknowledging they don’t have the resources to solve it.

How can you mitigate the damage being done by late payments?

We talked earlier about offering multiple payment options, delivering invoices with payment links, and sharing access to an online customer portal.

Another great tool would be automated invoice reminders. While some customers pay on time without needing to be reminded, others might appreciate emailed reminders. Payment software from BigTime gives your business the option to specify which customers receive up to six automated invoice reminders. Automated reminders tell customers that you are on top of your collections and increase the likelihood you will be paid sooner.

Your finance and accounting team will also thank you as they no longer have to follow up with emails and phone calls or sort through sticky notes and Excel spreadsheets. Time back for other higher priorities!

In summary, integrated payments matters!

There are very few areas within a business that has as big of an impact on cash flow as payments. It is also an area that requires little change with the right payment partner. Payments modernization will be a critical space over the next 12 months as forward-thinking professional services organizations look to unlock cash flow quicker and gain access to much-needed data transparency.

Frequently Asked Questions About Integrated Payments

What is an integrated payment?

More than just credit card processing, integrated online payments work to streamline your internal operations by communicating directly with other software critical to your business. Integrated payments eliminates the need for the accounting and finance team to manually monitor, track, and report on the collection of all payments.

What are the benefits of integrated payments?

Some of the benefits of implementing integrated payments at your firm include:

- Providing a personalized payment experience for your clients

- The ability to get paid quicker

- Real-time insight into important metrics

- Easy tax preparation

What is payment processing software?

Payment processing software like BigTime allows your team to quickly send invoices based on your project data, with a convenient payment link for your clients.